by Nick Dobbins and Oriane Casale

June 2024

You can read a fully accessible version of the June issue of Trends here.

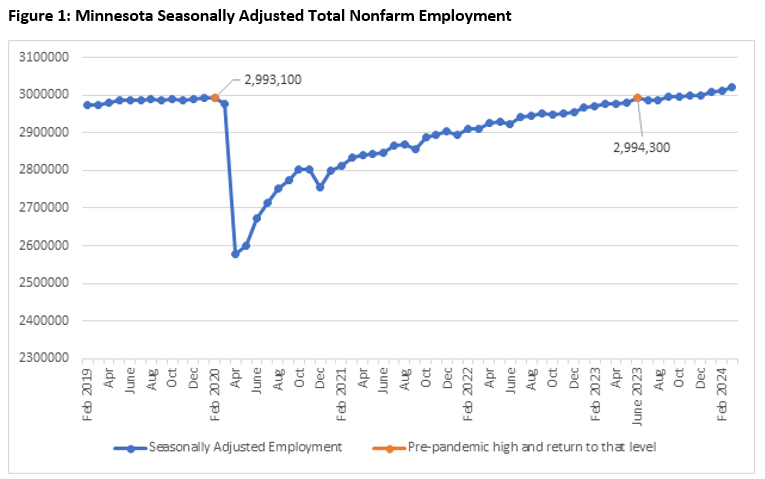

Payrolls continued to stabilize over the past year following several years with much greater than normal change. Nonfarm employment ultimately returned to pre-pandemic levels in June of 2023 following sharp losses in the spring of 2020 and three years of recovery. As Figure 1 shows, the shape of the recession and recovery was unbalanced, with a sharp decline followed by a long recovery with gradually slowing growth.

Following a short dip below pre-pandemic levels in July and August, employment returned to greater than 2,993,100, its pre-pandemic level, in September 2023 and has widened the gap since then. In November 2023, the state topped three million jobs for the first time and has remained above that benchmark from that point forward. In April 2024, the most recent month included in this analysis, preliminary employment was at 3,023,900 jobs (see Figure 1).

While employment returned to pre-pandemic levels in 2023, the recovery was not consistent across industry groups. As Table 1 shows, some supersectors, such as Construction and Education & Health Services, have experienced strong growth over pre-pandemic levels, while others have not fully recovered in the intervening years. As of April 2024, five of eleven published supersectors had employment below pre-pandemic levels, including Mining & Logging, Information, Professional & Business Services, and Leisure & Hospitality. However, two of those supersectors, Mining & Logging and Professional & Business Services, previously reached their pre-pandemic employment levels before declining again.

| Table 1: Seasonally Adjusted Minnesota Employment | |||||

|---|---|---|---|---|---|

| Industry | February 2020 | April 2020 | April 2024 | Percent Change Feb 2020 to April 2020 | Percent Change Feb 2020 to April 2024 |

| Total Nonfarm | 2,993,100 | 2,578,600 | 3,023,900 | -13.8% | +1.0% |

| Total Private | 2,565,800 | 2,181,700 | 2,587,500 | -15.0% | +0.8% |

| Goods-Producing | 457,600 | 426,100 | 467,100 | -6.9% | +2.1% |

| Mining & Logging | 6,700 | 6,400 | 6,600 | -4.5% | -1.5% |

| Mining, Logging, & Construction | 135,200 | 124,300 | 141,600 | -8.1% | +4.7% |

| Construction | 128,500 | 117,900 | 135,000 | -8.2% | +5.1% |

| Manufacturing | 322,400 | 301,800 | 325,500 | -6.4% | +1.0% |

| Service-Providing | 2,535,500 | 2,152,500 | 2,556,800 | -15.1% | +0.8% |

| Private Service Providing | 2,108,200 | 1,755,600 | 2,120,400 | -16.7% | +0.6% |

| Trade, Transportation & Utilities | 530,000 | 463,600 | 536,700 | -12.5% | +1.3% |

| Information | 46,100 | 42,300 | 42,500 | -8.2% | -7.8% |

| Financial Activities | 195,400 | 191,100 | 187,000 | -2.2% | -4.3% |

| Professional & Business Services | 382,600 | 345,500 | 379,700 | -9.7% | -0.8% |

| Education & Health Services | 562,100 | 506,900 | 584,700 | -9.8% | +4.0% |

| Leisure & Hospitality | 277,000 | 128,100 | 273,900 | -53.8% | -1.1% |

| Other Services | 115,000 | 78,100 | 115,900 | -32.1% | +0.8% |

| Government | 427,300 | 396,900 | 436,400 | -7.1% | +2.1% |

Source: Current Employment Statistics (CES)

One supersector, Financial Activities, largely escaped the immediate impacts of the lockdown, losing only 2.2% of employment when the state was off by 13.8%, presumably due to the nature of much of the work done in that industry and the ability to transition to remote work. However, since April of 2020 employment in Financial Activities was off by 2.1%, making it the only supersector to lose jobs since the low point of pandemic employment.

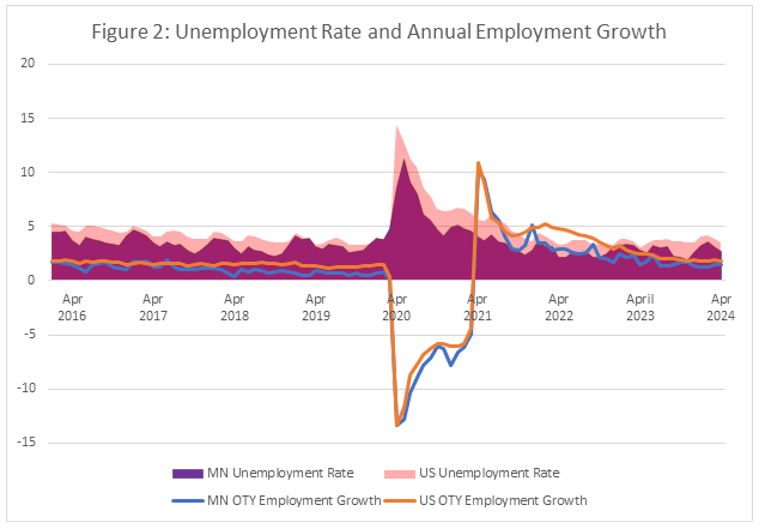

As total nonfarm payroll employment approached and surpassed pre-pandemic levels, growth at the state and national level has continued to flatten. As Figure 2 shows, growth appears to have settled into a more consistent baseline.

Minnesota's annual employment growth fell behind the nation in the summer of 20201, and has stayed there consistently since then, though the gap has closed over the past year. For most of 2022, U.S. growth ran more than a full percentage point higher than statewide growth, but that gap shrunk to less than a percentage point for most of 2023. April 2024 national annual growth was at 1.8%, while Minnesota's growth was 1.5%. The persistent gap between the two may be due in part to Minnesota's labor market reaching a stable long-term employment level sooner than the nation. The state's unemployment rate has been lower than the national level for the entirety of the recovery period. These labor market pressures will be discussed in more depth later.

With total employment now above pre-pandemic levels, and new labor market trends beginning to appear, the utility of analyzing the market through the lens of recovery from the recent recession will likely continue to decrease.

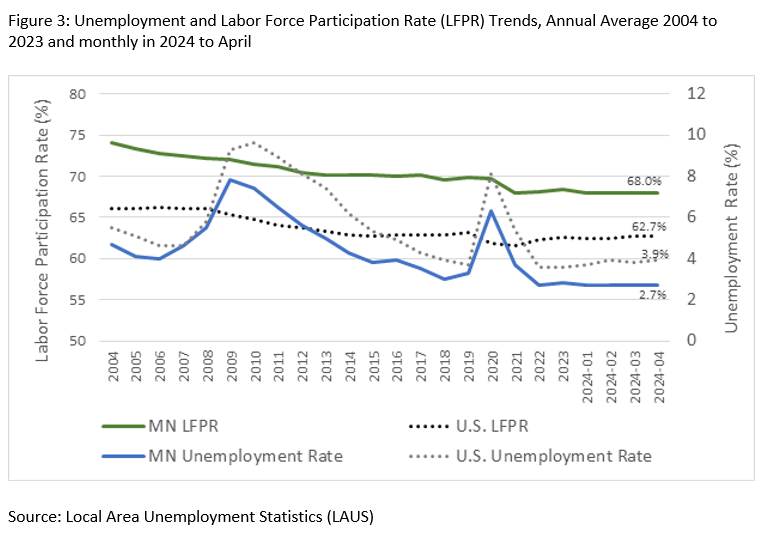

Minnesota's unemployment rate hovered between 2.7% and 3.0% over the last 12 months. To date, it has remained at 2.7% from November 2023 through April 2024 (subject to revision), indicating a very tight labor market that has, if anything, become tighter over the last 12-month period. Despite this, Minnesota does not have the lowest unemployment rate in the nation or the Midwest. At 2.7% in March 2024, Minnesota's rate ranked seventh lowest among states, tied with Kansas, coming in lower than our neighboring states of Iowa (2.9%) and Wisconsin (3.0%) but higher than North Dakota (2.0%), South Dakota (2.1%) and Nebraska (2.5%).

To put this in perspective, an unemployment rate below 3.5% indicates a tight labor market. Minnesota's unemployment rate has been below 3.5% since August 2021. This long-term tightness is causing hiring challenges for many employers and constraining job growth in certain industries in Minnesota.

Two forces are driving this long-term low unemployment rate. First, we have seen steady, if slowing, job growth coming out of the Pandemic Recession, as described above. Secondly, long-term demographic trends are leading to slowing population and labor force growth. Minnesota's labor market gained 23,500 people between 2022 and 2023 looking at annual average numbers, bringing us just 11,100 below the 2019 annual average size prior to the Pandemic Recession. The labor force size continued to tick up in 2024, to 3,101,383 in April, which is 470 people larger than the 2023 annual average size but still below 2019. Moreover, as Figure 1 illustrates, the labor force participation rate has stagnated at around 68% over the last 18 months. This very slow recent growth in the labor force, and long-term decline, which is not back to pre-pandemic levels, is resulting in falling numbers of unemployed.

Compared to our neighboring states, Minnesota has slower labor force growth than North and South Dakota and the U.S. overall, but we are ahead of Iowa, whose labor force also shrank between 2019 and 2023. Wisconsin's labor force is showing a similar trend to Minnesota's in that growth in the labor force from age 16 to 54 was almost entirely offset by declines in the labor force 55 and over, which pushed the labor force participation rate down.

In large part, the negative labor force growth is being driven by an aging population. As Anthony Schaffhauser explains in his article in the March 2024 issue of Trends, while Minnesota's labor force in the 16 to 54 age groups grew by 57,000 people, this was offset by a decline in the labor force for age groups 55 and over, even though Minnesota's population age 55 years and over grew 6.8% between 2019 and 2023. Overall, the labor force declined by 1,000 people over this period.

As people enter their retirement years, labor force participation drops dramatically. Schaffhauser's analysis demonstrates how the aging population, in which the Baby Boom generation is deep into their retirement years, is holding back labor force growth overall, resulting in declining labor force participation and long-term low unemployment despite slowing economic growth.

At the same time, the tight labor market is encouraging more teens to work than we've seen in recent history. The teen (age 16-19) labor force participation rate was 65.9% and the employment to population ratio was 62.3% in April 2024 (12-month average), both at record highs for April going back to 2002, the beginning of this data series. At the same time, the teen unemployment rate was 5.5% in April, down 1.4 points over the year, and at a record low for April.

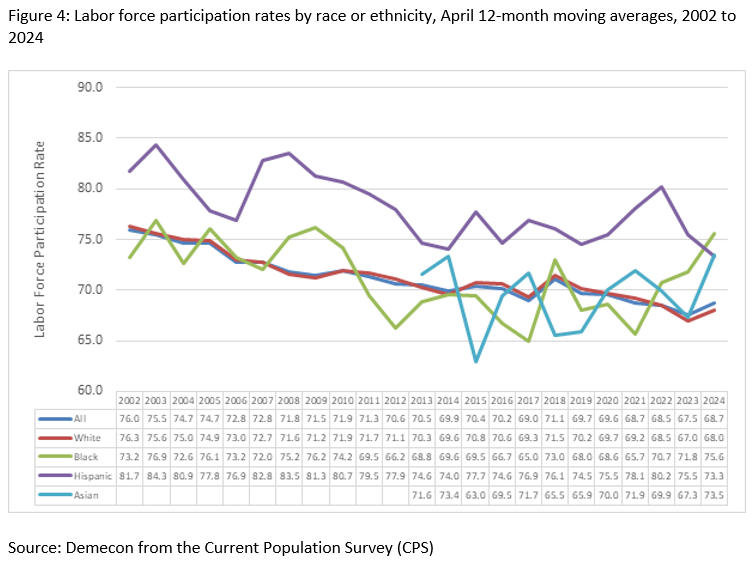

Breaking these numbers out by race is another demonstration of the role of age demographics in labor force trends. The labor force participation rate for white Minnesotans is now well below that of the other race groups. As Figure 4 shows, the labor force participation rate for white Minnesotans was 68.0% in April 2024 compared to 75.6% for Black, 73.5% for Asian and 73.3% for Hispanic Minnesotans (see Figure 4). These labor force participation rates are largely driven by the age of the population. Minnesota's white population is the oldest of these groups by a significant margin, with a median age of 42.8 compared to 28.6 for Black Minnesotans and 32.4 for Asian Minnesotans (American Community Survey, Table B01002A-E, 2022 1-year estimates). As a result, a much higher share of white workers is aging into retirement and leaving the labor market than other groups of workers.

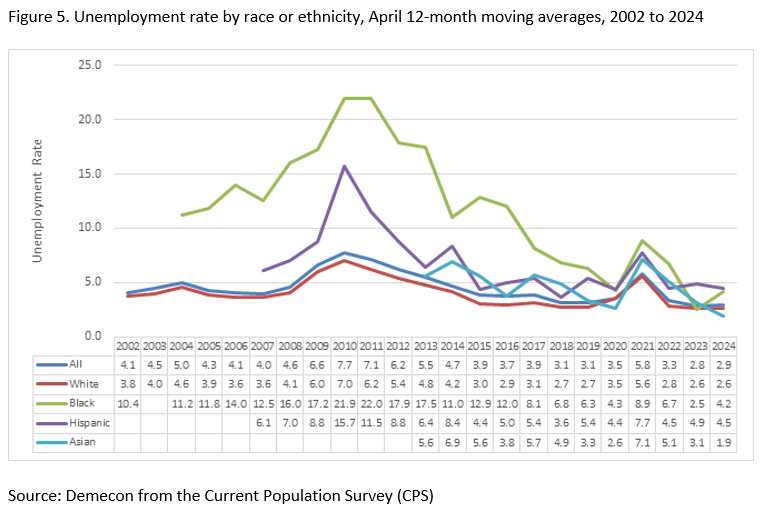

Unemployment rates remain higher for Black and Hispanic Minnesotans than for white or Asian Minnesotans, although rates have dropped dramatically, particularly for Black Minnesotans, over the past decade. Figure 5 shows that in Minnesota, the unemployment rate for Asian Minnesotans was 1.9%, white Minnesotans were at 2.6%, Black Minnesotans were at 4.2% and Hispanic Minnesotans were at 4.5%.

Labor force statistics also tell an interesting story when comparing male and female workers (the only two categories included in the CPS). In Minnesota, women's labor force participation ticked up 2.4 points over the year, reaching 65.9% in April 2024. In comparison, men's labor force participation remained level over the year at 71.5%. Women also saw an increase in their employment to population ratio, up 1.9% points to 64.1% in April 2024 compared to only 0.3 points for men at 69.3%, and an increase in their unemployment rate, up 0.7 points to 2.7% in April 2024 compared to a decline of 0.4 points for men at 3.1%. This shows a more dynamic labor market situation for women over the last year than for men.

In his article on labor force trends, Schaffhauser makes the case that this pattern is a hangover from the Pandemic Recession when more women dropped out of the labor force to care for children and others who were unable to attend school or care outside the home. These data provide evidence that women were still moving back into paid work during the last half of 2023 and first part of 2024.

Job vacancies in Minnesota, like employment, have slowed. The number of vacancies in 2023, at 139,059, is 24.7% lower than during second quarter 2022. Despite this sharp decline, 2023 has the fifth highest number of vacancies on record in Minnesota dating back to 2002. Moreover, the ratio of unemployed people to job vacancies, at 0.6, still shows a very tight labor market with almost twice as many openings as unemployed workers in Minnesota. The vacancy rate, at 5.1%, is also one of the highest on record.

By occupation, vacancies have dropped somewhat in some of the occupations most impacted by the Pandemic Recession, namely Food Prep & Serving, Sales & Related, Healthcare Support and Healthcare Practitioners & Technical occupations; but of the four, only Food Prep & Serving and Sales & Related are close to their pre-pandemic levels. Healthcare occupations are still seeing very high levels of job vacancies, with a job vacancy rate of 8.1% in Healthcare Practitioners & Technical and 7.0% in Healthcare Support, as is Community & Social Service, which is at an all-time high number of job vacancies in 2023 and a high job vacancy rate of 8.9%. The increase was in part driven by vacancies in Substance Abuse & Behavioral Disorders Counselors and Mental Health & Substance Abuse Social Workers, which are both at all-time high levels.

Legal occupations have seen an uptick in job vacancies over the past few years and are also now at an all-time high, although they still have a moderate job vacancy rate of 3.3%. The survey also tracked a high level of internships and apprenticeships in 2023. This is good news for young workers and may be a strategy that employers are using to improve their workforce pipelines by recruiting employees right out of high school and college and offering "earn while you learn" training and experience opportunities.

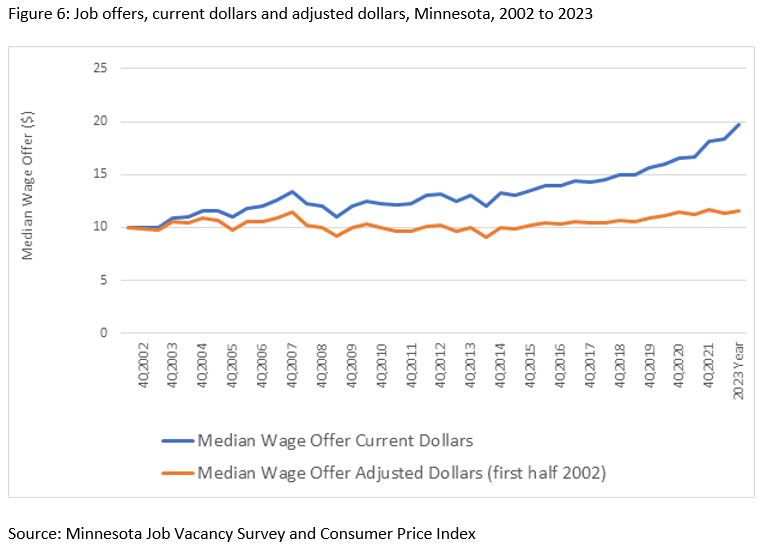

The median (50th percentile) wage offer for all job vacancies is $19.68 per hour in 2023. Figure 6 shows the median wage offers from 2002 to 2023 in current dollars as well as in inflation adjusted dollars. The 2023 median wage offer is easily the highest in the survey's history. Despite this, as the orange line in Figure 6 shows, wage offers have been just barely beating inflation over the 21-year data series and have been mostly flat over the last three years.

The total number of payroll jobs in Minnesota reached pre-pandemic levels in the summer of 2023 and has continued to grow, albeit at a slower pace than the previous two years. An aging workforce, especially among Minnesota's white population, which caused the total labor force to shrink by 8,066 people over the last 12 months through April 2024, is likely constraining job growth. On the positive side, labor force participation rates for Black, Asian, women and teen workers in Minnesota continued to grow this year. Overall, labor force participation dropped by six-tenths of a point over the last 12 months to 68.0% in April 2024 (12-month average). This further tightened the labor market, pushing the unemployment rate down to 2.7% in the last six months through April 2024.

The number of job vacancies, down in 2023 by almost 25% from second quarter 2022, also indicate a slight slowing in the job market. Despite this, the ratio of unemployed workers to job vacancies is still extremely low, at only 0.6, which means that some industries are continuing to experience hiring difficulties. Wage offers continued to grow but were essentially offset by inflation.

The picture over the last 12 months in Minnesota's labor market is in line with the Federal Reserve's goal to curb inflation with a "soft landing" with continued, albeit slowing, job growth and hiring, alongside continued low unemployment. This likely represents the new normal for Minnesota's job market for the foreseeable future.