by Tim O'Neill

June 2023

A lot has happened in the Seven-County Twin Cities Metro Area's labor market in recent years. Like the state and the nation, the region witnessed a severe unemployment spike during the Pandemic Recession in the spring months of 2020, along with reduced hiring demand. Throughout the following year the region's labor market steadily recovered, reaching historical lows for unemployment and historical highs for job vacancies. This article will analyze how the Metro Area's labor market continues to trend in 2022 and the beginning of 2023, and more specifically, will focus upon labor force conditions, industry trends, and hiring demand.

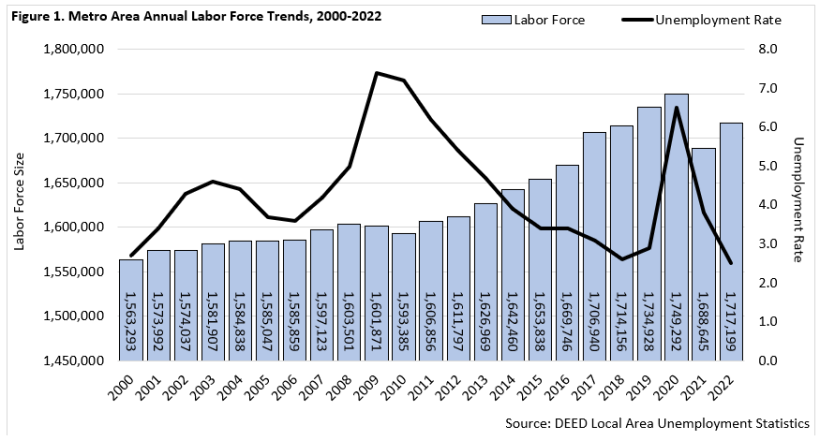

When analyzing labor market conditions, one of the very first indicators that comes to mind is unemployment. The number of unemployed, and the subsequent unemployment rate, can quickly reveal the relative health of a local labor market. This data comes from DEED's Local Area Unemployment Statistics (LAUS). The Metro Area's annual unemployment rate for 2022 dropped down to 2.5%. This was the lowest annual rate for the region since 1999 and represented approximately 42,600 unemployed persons. This was down from 3.8% (63,400 unemployed persons) in 2021 and down from 6.5% (113,000 unemployed persons) in 2020 (Figure 1).

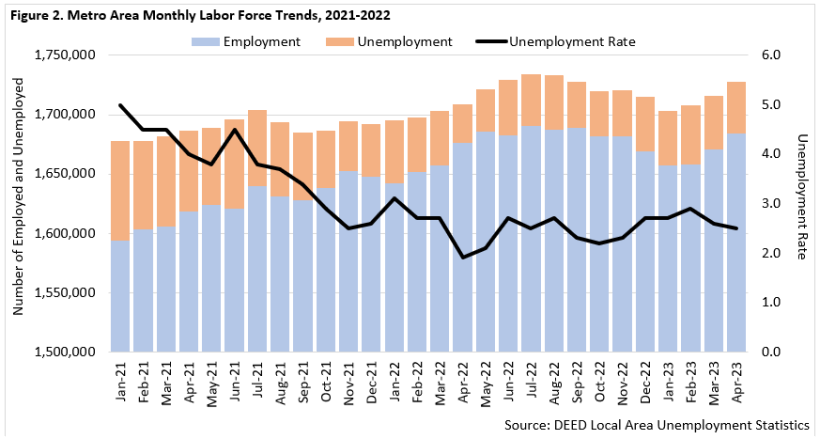

On a monthly basis, the region's unemployment rate spiked to 11.9% (204,100 unemployed persons) in May 2020, before steadily declining to an historical low of 1.9% (32,500 unemployed persons) in April 2022. Over the past year of available data, between April 2022 and April 2023, the region's unemployment rate has hovered between 2.1% and 2.7%. So, while there have been slight increases in the region's unemployment rate through the beginning of 2023, unemployment is still very low (Figure 2). In fact, as of April 2023, the region's total number of unemployed was about 8,400 persons less than pre-pandemic levels in February 2020. It should be noted that the Metro Area's annual unemployment of 2.5% in 2022 was slightly below Minnesota's rate of 2.7% and well below the national rate of 3.6%.

Along with unemployment, it's also very important to study labor force trends. The labor force includes all persons 16 years of age and older, living within a specified geographic area, who are either employed or unemployed. Labor force data is a count of persons, not jobs. As an annual average in 2022, the Metro Area had a labor force size of 1,717,199 workers. This was up by over 28,500 persons (+1.7%) from 2021, but is still down from 2020 by about 32,100 persons (-1.8%).

On a monthly basis, there has also been considerable fluctuation with the Metro Area's labor force size. The labor force increased by nearly 56,500 persons (+3.4%) between January 2021 and July 2022, before declining by about 31,000 workers (-1.8%) between July 2022 and January 2023. More recently, the region's labor force has increased by about 24,200 persons (+1.4%) between January 2023 and April 2023 (Figure 2).

As an annual average in 2022, the Seven-County Metro Area had 91,945 establishments supplying 1,726,710 covered jobs. This is according to DEED's Quarterly Census of Employment and Wages (QCEW) program. Total annual payroll for the region equaled $132.6 billion, with the average annual industry wage equal to $76,804. The Metro Area has 60.5% of the state's total employment, and 66.7% of the state's total payroll.

Health Care & Social Assistance is the Metro Area's largest-employing industry sector with 278,895 covered jobs at 13,204 establishments. Manufacturing is the second largest-employing industry with 174,170 covered jobs at 4,046 establishments. Retail Trade rounds out as the Metro Area's third largest-employing industry with 153,774 covered jobs at 8,199 establishments. Altogether, those three industries account for over one-third (35.1%) of the Metro Area's total employment. Other large-employing industry sectors with over 100,000 jobs in the region include: Educational Services; Professional, Scientific & Technical Services; Accommodation & Food Services; and Finance & Insurance (Table 1).

Management of Companies is the major industry sector with the highest average annual wage in the Metro Area, at $147,836. Other industries with significantly higher average annual wages include: Finance & Insurance ($136,396); Utilities ($130,988); Mining ($119,496); Professional, Scientific & Technical Services ($118,508); Information ($108,732); and Wholesale Trade ($103,844). The industries with lower average annual wages include Accommodation & Food Services ($27,872); Retail Trade ($40,508); Agriculture ($43,784); and Other Services ($47,320).

| Table 1. Seven-County Metro Area Industry Statistics, Annual 2022 Sorted by Number of Jobs | |||||

|---|---|---|---|---|---|

| Industry | Number of Establishments | Number of Jobs | Share of MN Jobs | Total Payroll ($1,000s) | Avg. Annual Wage |

| Total, All Industries | 91,945 | 1,726,710 | 100.0% | $132,592,927 | $76,804 |

| Health Care & Social Assistance | 13,204 | 278,895 | 16.2% | $17,408,008 | $62,348 |

| Manufacturing | 4,046 | 174,170 | 10.1% | $15,163,383 | $87,048 |

| Retail Trade | 8,199 | 153,774 | 8.9% | $6,230,182 | $40,508 |

| Educational Services | 2,383 | 131,161 | 7.6% | $8,256,499 | $62,868 |

| Professional, Scientific, & Technical Services | 11,989 | 126,722 | 7.3% | $15,020,411 | $118,508 |

| Accommodation & Food Services | 6,374 | 126,600 | 7.3% | $3,539,304 | $27,872 |

| Finance & Insurance | 5,059 | 106,236 | 6.2% | $14,505,693 | $136,396 |

| Administrative Support & Waste Management Services | 4,594 | 93,057 | 5.4% | $4,879,797 | $52,364 |

| Construction | 7,068 | 78,250 | 4.5% | $6,800,682 | $86,840 |

| Wholesale Trade | 5,220 | 78,051 | 4.5% | $8,104,797 | $103,844 |

| Transportation & Warehousing | 2,163 | 76,682 | 4.4% | $5,220,120 | $68,016 |

| Management of Companies | 979 | 76,265 | 4.4% | $11,265,960 | $147,836 |

| Public Administration | 806 | 71,805 | 4.2% | $5,499,751 | $76,492 |

| Other Services | 11,148 | 53,436 | 3.1% | $2,532,354 | $47,320 |

| Arts, Entertainment, & Recreation | 1,850 | 32,854 | 1.9% | $1,786,051 | $54,548 |

| Information | 1,993 | 31,305 | 1.8% | $3,404,533 | $108,732 |

| Real Estate & Rental & Leasing | 4,420 | 26,855 | 1.6% | $1,903,648 | $70,876 |

| Utilities | 110 | 6,494 | 0.4% | $848,033 | $130,988 |

| Agriculture | 303 | 3,491 | 0.2% | $152,587 | $43,784 |

| Mining | 39 | 606 | 0.0% | $71,134 | $119,496 |

| Source: DEED Quarterly Census of Employment and Wages (QCEW) | |||||

DEED's QCEW tool allows users to zoom in on more detailed industry levels. Those 20 major industry sectors are at the 2-digit North American Industry Classification System (NAICS) level. At the 3-digit level, the largest-employing industries in the Metro Area in 2022 include: Educational Services (131,161 jobs); Professional, Scientific, & Technical Services (126,722 jobs); Food Services & Drinking Places (113,697 jobs); Administrative & Support Services (89,005 jobs); Ambulatory Health Care Services (88,855 jobs); Management of Companies (76,265 jobs); Social Assistance (76,086 jobs); Hospitals (63,987 jobs); Merchant Wholesalers, Durable Goods (52,426 jobs); and Specialty Trade Contractors (50,549).

These finer levels of industry analysis provide for a more complete understanding of what makes the Metro Area unique, using Location Quotients. For example, prominent 3-digit NAICS industries with especially high levels of employment concentration in the Metro Area include: Management of Companies; Securities, Commodity Contracts, & Other Financial Investments & Related Activities; Insurance Carriers & Related Activities; Computer & Electronic Product Manufacturing; Miscellaneous Manufacturing; Professional, Scientific, & Technical Services; Real Estate; Personal & Laundry Services; Administrative & Support Services; and Social Assistance. All these detailed industries have at least 70% of their respective statewide employment located within the Metro Area.

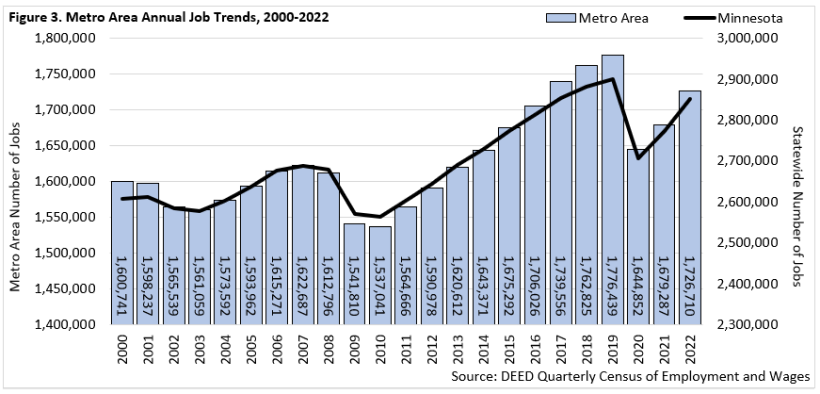

Of course, users of the QCEW tool can also analyze industry trends over time. For example, the Metro Area lost nearly 131,600 jobs between annual 2019 and 2020. This 7.4% loss of employment was slightly more severe than the comparable statewide loss of 6.8%. Between annual averages for 2020 and 2022, the Metro Area has regained over 81,800 jobs, growing by 5.0%. This was slightly less than the respective statewide gain of 5.3% during that period. In other words, as an annual average for 2022, the Metro Area was about 49,700 jobs below its pre-pandemic level of employment in 2019 (Figure 3).

Analyzing annual employment trends between 2019 and 2022, Accommodation & Food Services and Retail Trade each are over 10,000 jobs below their pre-pandemic levels of employment. Other industries significantly below their pre-pandemic employment levels include: Finance & Insurance; Administrative & Support Services; Educational Services; Information; Other Services; and Arts, Entertainment, & Recreation. Meanwhile, Transportation & Warehousing and Construction are both more than 2,500 jobs above their pre-pandemic job counts. Other industries above their pre-pandemic levels of employment include Manufacturing; Wholesale Trade; Professional, Scientific, & Technical Services; Agriculture; Utilities; and Mining (Table 2).

| Table 2. Seven-County Metro Area Industry Trends, Annual 2019 – 2022 Sorted by Number of Jobs | |||||

|---|---|---|---|---|---|

| Industry | 2022 Number of Jobs | 2019 – 2022 Job Change | 2021 – 2022 Job Change | ||

| Numeric | Percent | Numeric | Percent | ||

| Total, All Industries | 1,726,710 | -49,729 | -2.8% | +47,423 | +2.8% |

| Health Care & Social Assistance | 278,895 | -52 | -0.0% | +1,833 | +0.7% |

| Manufacturing | 174,170 | +1,109 | +0.6% | +6,119 | +3.6% |

| Retail Trade | 153,774 | -11,044 | -6.7% | -1,144 | -0.7% |

| Educational Services | 131,161 | -3,995 | -3.0% | +2,897 | +2.3% |

| Professional, Scientific, & Technical Services | 126,722 | +749 | +0.6% | +4,131 | +3.4% |

| Accommodation & Food Services | 126,600 | -14,494 | -10.3% | +14,243 | +12.7% |

| Finance & Insurance | 106,236 | -8,840 | -7.7% | -5,669 | -5.1% |

| Administrative & Support Services | 93,057 | -4,228 | -4.3% | +3,291 | +3.7% |

| Construction | 78,250 | +2,537 | +3.4% | +2,307 | +3.0% |

| Wholesale Trade | 78,051 | +920 | +1.2% | +2,584 | +3.4% |

| Transportation & Warehousing | 76,682 | +2,885 | +3.9% | +6,054 | +8.6% |

| Management of Companies | 76,265 | -2,643 | -3.3% | -494 | -0.6% |

| Public Administration | 71,805 | -1,300 | -1.8% | +1,433 | +2.0% |

| Other Services | 53,436 | -3,909 | -6.8% | +2,511 | +4.9% |

| Arts, Entertainment, & Recreation | 32,854 | -3,673 | -10.1% | +5,542 | +20.3% |

| Information | 31,305 | -3,917 | -11.1% | +702 | +2.3% |

| Real Estate & Rental & Leasing | 26,855 | -593 | -2.2% | +591 | +2.3% |

| Utilities | 6,494 | +272 | +4.4% | +248 | +4.0% |

| Agriculture | 3,491 | +418 | +13.6% | +162 | +4.9% |

| Mining | 606 | +73 | +13.7% | +82 | +15.6% |

| Source: DEED Quarterly Census of Employment and Wages (QCEW) | |||||

Analyzing more recent trends, the Metro Area gained over 47,400 jobs between 2021 and 2022 on an annual average. This growth rate of 2.8% matched the statewide growth rate. During this period, 17 of 20 major industries in the Metro Area gained jobs, with growth led by Accommodation & Food Services (+14,243 jobs). Other industries gaining a significant number of jobs between 2021 and 2022 included Manufacturing (+6,119 jobs); Transportation & Warehousing (+6,054 jobs); Arts, Entertainment, & Recreation (+5,542 jobs); and Professional, Scientific, & Technical Services (+4,131 jobs). Three industries lost jobs during that period, including Finance & Insurance (-5,669 jobs); Retail Trade (-1,144 jobs); and Management of Companies (-494 jobs) (Table 2).

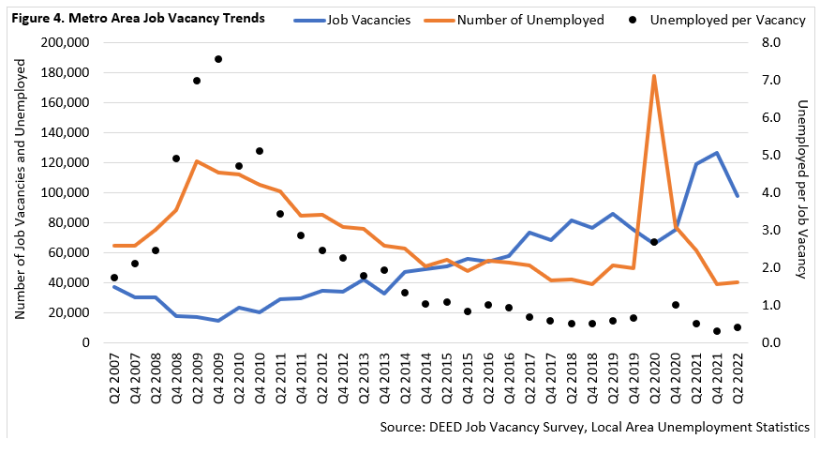

As the Metro Area's industry employment continues to recover those losses experienced during the Pandemic Recession, employers across the region are looking for workers to fill both new and replacement openings. According to DEED's Job Vacancy Survey (JVS), there were over 98,300 job vacancies in the Metro Area during 2022. This level of demand was down about 20%, or nearly 25,000 job vacancies, from job vacancy levels witnessed in 2021.

Despite this drop in hiring demand over-the-year, job vacancies reported in 2022 were still well above pre-COVID levels of hiring demand. In fact, the more than 98,300 job vacancies reported by Metro Area employers in 2022 were the third highest number of vacancies recorded since DEED's JVS data first became available in 2001. Job vacancies in the Metro Area steadily climbed from 34,500 vacancies in 2012 to 71,400 vacancies in 2017 to 80,800 vacancies in 2019. Job vacancies then dipped back to 70,800 vacancies in 2020 during the Pandemic Recession, before climbing to a record high 123,200 vacancies in 2021 (Figure 4).

Comparing job vacancies to the number of unemployed persons reveals the tightness of the labor market in the Metro Area. The region experienced steadily tightening labor market conditions throughout the 2010s, as unemployment declined from heights witnessed during the Great Recession and as job vacancies increased from recessionary lows in 2009. During 2018 and 2019, the Metro Area had between 82,000 and 86,000 job vacancies, with the number of unemployed people hovering between 42,000 and 50,000. As such, there were approximately 0.5 to 0.6 unemployed persons per job vacancy pre-COVID.

The ratio of unemployed per job vacancy climbed to 2.7-to-1 in 2020 with the onset of the Pandemic Recession as the number of unemployed spiked to nearly 180,000 persons. Unlike the Great Recession and its recovery, however, the number of job vacancies remained relatively high in 2020 and increased to historic levels in 2021. With unemployment dropping to historic lows, there were approximately 0.3 unemployed persons per job vacancy in the Metro Area in 2021. This increased slightly to 0.4 unemployed persons per job vacancy in 2022. So, while the number of job vacancies did decrease by about 20% between 2021 and 2022, the Metro Area continues to grapple with very tight labor market conditions.

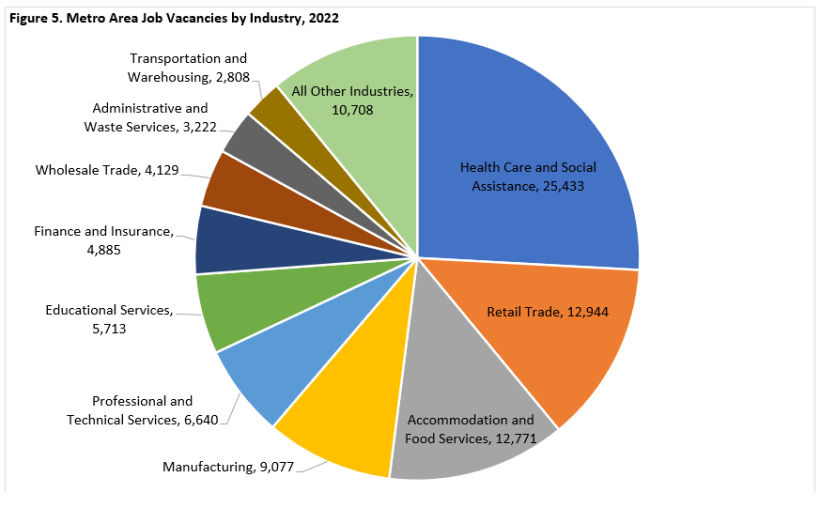

Health Care & Social Assistance led all industries in the Metro Area with over 25,400 job vacancies during 2022. In fact, this industry accounted for over one-quarter (25.9%) of the region's total job vacancies. Following Health Care & Social Assistance, both Retail Trade and Accommodation & Food Services had nearly 13,000 job vacancies. Altogether, these three industries accounted for over half (52.0%) of the Metro Area's total job vacancies (Figure 5). Other industries with a high share of job vacancies in the region included Manufacturing, Professional & Technical Services, Educational Services, Finance & Insurance, and Wholesale Trade.

It should be noted that the Metro Area accounted for over half (53.3%) of Minnesota's total job vacancies in 2022. Those industries with higher shares of job vacancies in the region included Real Estate, Rental, & Leasing (87.8% of the state's total job vacancies); Finance & Insurance (87.4%); Professional & Technical Services (85.5%); Management of Companies (78.6%); Wholesale Trade (72.3%); Administrative Support & Waste Management Services (66.8%); and Health Care & Social Assistance (56.2%).

As previously mentioned, the Metro Area did see a modest decrease in the number of job vacancies between 2021 and 2022. Accommodation & Food Services witnessed the largest decrease in job vacancies during that period, with a drop of just over 8,000 vacancies between 2021 and 2022. Other industries that experienced more significant drops in job vacancies during that period included Retail Trade (down 6,500 job vacancies), Other Services (down 4,700 job vacancies), and Transportation & Warehousing (down 2,400 job vacancies). Construction; Arts, Entertainment, & Recreation; and Health Care & Social Assistance each experienced drops of between 1,300 and 1,400 job vacancies between 2021 and 2022.

Those industries experiencing an increase in the number of job vacancies between 2021 and 2022 included Educational Services (up 1,100 job vacancies); Wholesale Trade (up 600 job vacancies); Finance & Insurance (up 400 job vacancies); Public Administration (up 400 job vacancies); Manufacturing (up 300 job vacancies); and Real Estate, Rental, & Leasing (up 100 job vacancies).

DEED's JVS data also reveals the occupational groups and specific occupations with the most hiring demand in the Metro Area. The major occupational groups with the most job vacancies in the region in 2022 included Food Preparation & Serving Related occupations, Sales & Related, and Healthcare Practitioners & Technical occupations. Each of these three occupational groups accounted for over 11,000 job vacancies, and altogether accounted for over one-third (35.4%) of the region's total job vacancies. Other occupational groups with a high number of job vacancies included Healthcare Support, Office & Administrative Support, Transportation & Material Moving, and Business & Financial Operations.

The specific occupations with the most job vacancies included Personal Care Aides, Registered Nurses, Retail Salespersons, First-Line Supervisors of Food Preparation & Serving Workers, Nursing Assistants, Fast Food & Counter Workers, Maids & Housekeeping Cleaners, Cashiers, First-Line Supervisors of Retail Sales Workers, and Software Developers. These ten occupations alone accounted for over one-quarter (27.2%) of the Metro Area's total job vacancies in 2022.

Beyond total job vacancy trends, industry specifics, and occupational data, DEED's JVS tool also reveals additional job vacancy characteristics. For the Metro Area's 98,330 job vacancies during 2022, the median wage offer was $19.96. Just over one-third (36%) of total vacancies were for part-time work, with 6% of total vacancies for temporary or seasonal work. By educational requirements, 34% of the region's total vacancies did not require any formal education, 29% required a high school diploma or equivalent, 7% required vocational training, 8% required an associate degree, 18% required a bachelor's degree, and 5% required an advanced degree. Just over half (54%) of total job vacancies required one or more years of work experience, while 39% of total job vacancies required a certificate or license. Between 2021 and 2022, the median wage offer for the total of all job vacancies increased by 7.5%.

The Metro Area continues to experience very tight labor market conditions. Unemployment has risen slightly through the beginning months of 2023 yet remains near historical lows. Hiring demand dipped between 2021 and 2022 but also remains near historical highs. Meanwhile, the labor force size and total industry employment continue to recover, although both remain below pre-pandemic levels. Analyzing these trends reveals a regional labor market in constant motion. This is especially so as the Metro Area continues to recover from the impacts of the Pandemic Recession, and as the labor market continues to witness rapidly shifting demographics and workplace dynamics.