by Nick Dobbins

March 2019

Monthly analysis is based on seasonally adjusted employment data. Yearly analysis is based on unadjusted employment data.*

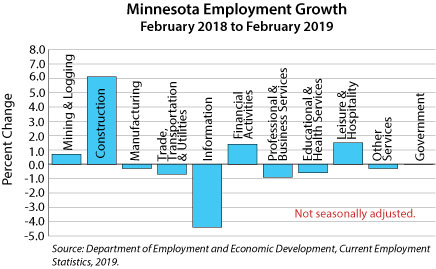

Employment in Minnesota was off by 8,800 (0.3 percent) in February on a seasonally adjusted basis. The losses came entirely from the private sector, which shed 9,200 jobs (0.4 percent) while the public sector added 400 (0.1 percent). Goods producers lost 5,500 jobs (1.2 percent), and service providers lost 3,300 (0.1 percent). Annually the state lost 1,364 jobs (0 percent). It was the first over-the-year job loss since July of 2010 and continued a trend of shrinking over-the-year job growth that has been progressing since last summer. Service providers drove the losses, off by 6,598 (0.3 percent), as goods producers added 5,234 jobs (1.2 percent). Private sector employers lost 1,181 jobs (0 percent), and public sector employers lost 183 (0 percent).

Mining and Logging employment was down by 100 (1.5 percent) in February, ending the consecutive-growth streak at two months. Over the year Mining and Logging employers added 44 jobs (0.7 percent). It was the second consecutive month of over-the-year job growth in the supersector, following three months of over-the-year job losses in the fourth quarter of 2018.

The Construction supersector lost 3,800 jobs (3 percent) in February. The sharp seasonally-adjusted decline may be in part caused by the significant snowfall the state received over the course of the month. Prior to January's 100 jobs decline, the supersector had shown positive over-the-month growth in every month since May of 2018. Annually Construction employers added 6,246 jobs (6.1 percent). This was the largest proportional and actual over-the-year job growth of any supersector in the state. While Specialty Trade Contractors led the way with 5,446 new jobs (8.1 percent), Building Construction (up 741 or 3 percent) and Heavy and Civil Engineering Construction (up 59, 0.6 percent) also contributed to the growth.

Employment in Minnesota's Manufacturing supersector was off by 1,600 (0.8 percent) in February. The losses came entirely from Durable Goods Manufacturing (down 0.8 percent) as employment in Non-Durable Goods Manufacturing remained at 117,200. Annually the supersector lost 1,056 jobs (0.3 percent). This was a notable change from January's 0.4 percent over-the-year job growth and represents the first time the supersector has shed jobs on an annual basis since January of 2017. Both Durable Goods (down 334, 0.2 percent) and Non-Durable Goods (down 722, 0.6 percent) lost jobs on the year.

Employment in Trade, Transportation, and Utilities was down by 3,300 (0.6 percent) in February. Retail Trade lost 2,100 jobs (0.7 percent), and Transportation, Warehousing, and Utilities lost 1,100 (1 percent). Wholesale Trade added 200 jobs (0.2 percent). On an annual basis the supersector lost 3,472 jobs (0.7 percent). Transportation, Warehousing, and Utilities led the decline, shedding 3,776 jobs (3.5 percent), with most of those losses coming in the larger Transportation and Warehousing component (down 3,652, 3.8 percent). Retail Trade employers lost 495 jobs (0.2 percent), and Wholesale Trade added 799 (0.6 percent).

The Information supersector lost 100 jobs (0.2 percent) in February on a seasonally adjusted basis. The supersector lost jobs in three consecutive months and nine of the last 12. Annually the supersector lost 2,202 jobs (4.4 percent). It was the largest proportional decline for any supersector in the state. Information employers have lost jobs in every month since June of 2017.

Financial Activities employment was up by 1,000 (0.5 percent) in February. All of the growth came from Finance and Insurance, where employment was up by 0.7 percent. Real Estate and Rental and Leasing employment was flat at 34,900. On an over-the-year basis the Financial Activities supersector added 2,542 jobs (1.4 percent). Finance and Insurance added 2,573 jobs (1.7 percent) with growth across multiple component sectors. Real Estate and Rental and Leasing lost 31 jobs (0.1 percent).

Employment in Professional and Business Services was up by 1,300 (0.3 percent) in February. All three component sectors added jobs on the month, with Administrative and Support and Waste Management and Remediation Services leading the way at 900 new jobs (0.7 percent growth). The other two component sectors, Professional, Scientific, and Technical Services and Management of Companies and Enterprises, added 200 jobs each (0.1 and 0.2 percent, respectively). Over the year the supersector lost 3,509 jobs (0.9 percent). Administrative and Support and Waste Management and Remediation Services was the biggest downward weight, shedding 5,011 jobs (3.9 percent) thanks to a dramatic decline of 11.9 percent (6,822 jobs) in the bellwether Employment Services sector. The other two component sectors added jobs on the year. Professional, Scientific, and Technical Services was up by 814 (0.5 percent), and Management of Companies and Enterprises was up 688 (0.9 percent).

The Educational and Health Services supersector lost 2,300 jobs (0.4 percent) in February, with job losses in each component sector. Educational Services lost 100 jobs (0.1 percent) while Health Care and Social Assistance lost 2,200 (0.5 percent). It was the fourth consecutive month that Health Care and Social Assistance lost jobs on a seasonally adjusted basis. Annually the supersector lost 3,385 jobs (0.6 percent). Educational Services lost 1,509 jobs (2.1 percent), and Health Care and Social Assistance lost 1,877 (0.4 percent). The lion's share of the losses in that component came from Nursing and Residential Care Facilities, where employment was off by 2,152 (2 percent).

Leisure and Hospitality employment was off by 800 (0.3 percent) in February. Accommodation and Food Services employers added 1,000 jobs (0.4 percent), but that growth was more than erased by the loss of 1,800 (3.6 percent) in Arts, Entertainment, and Recreation. Annually the supersector added 3,922 jobs (1.5 percent). Leisure and Hospitality added 2,069 (5 percent), and Accommodation and Food Services added 1,853 (0.9 percent).

The Other Services supersector added 200 jobs (0.2 percent) in February. It was the third consecutive month of over-the-month growth for the supersector. Annually Other Services employers lost 311 jobs (0.3 percent). Much of the loss came from Personal and Laundry Services (down 492 or 1.8 percent).

Government employers added 400 jobs (0.1 percent) in February. Federal employers led the growth adding 500 jobs (1.6 percent). Over the year Government employers lost 183 jobs (0 percent), with all three levels of government losing a small number of jobs. Federal employers had the most losses, down by 120, or 0.4 percent. State and Local employers each saw declines of less than 0.1 percent.

| Seasonally Adjusted Nonfarm Employment (in thousands) | |||

|---|---|---|---|

| Industry | Feb-19 | Jan-19 | Dec-18 |

| Total Nonfarm | 2,955.7 | 2,964.5 | 2,961.1 |

| Goods-Producing | 451.6 | 457.1 | 457.5 |

| Mining and Logging | 6.7 | 6.8 | 6.7 |

| Construction | 124.8 | 128.6 | 128.7 |

| Manufacturing | 320.1 | 321.7 | 322.1 |

| Service-Providing | 2,504.1 | 2,507.4 | 2,503.6 |

| Trade, Transportation, and Utilities | 535.1 | 538.1 | 537.1 |

| Information | 47.9 | 48.0 | 48.9 |

| Financial Activities | 186.0 | 185.0 | 183.7 |

| Professional and Business Services | 377.1 | 375.8 | 375.6 |

| Educational and Health Services | 539.6 | 541.9 | 544.0 |

| Leisure and Hospitality | 280.4 | 281.2 | 277.7 |

| Other Services | 112.7 | 112.5 | 112.1 |

| Government | 425.3 | 424.9 | 424.5 |

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.