Southeast Minnesota is a health care and agricultural powerhouse. The region is home to the renowned Mayo Clinic and some of the world's most recognized food companies and brands.

Southeast Minnesota is a health care and agricultural powerhouse. The region is home to the renowned Mayo Clinic and some of the world's most recognized food companies and brands.

Advanced manufacturing is especially strong here, with machinery, chemicals, and electronics among the top products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

11/25/2024 9:50:09 AM

Amanda O'Connell

Employee turnover represents one of the most significant challenges facing businesses today, impacting both operations and financial performance. When employees leave, companies must absorb substantial costs in recruitment, training and lost productivity. High turnover can disrupt team dynamics, reduce operational efficiency and result in loss of institutional knowledge. Annual average data from the 2022 Quarterly Workforce Indicators (QWI) program shows turnover patterns vary substantially across age groups, industries and wages in Southeast Minnesota

Age greatly influences employee turnover rates across Southeast Minnesota, showing clear patterns as workers progress through different life stages. While the overall regional turnover rate across all ages and industries was 8.1% in 2022, younger workers show much higher rates of turnover. Teenagers (ages 14-18) have the highest turnover rate at 23.1%, followed closely by young adults aged 19 to 21 at 19.7%. These high rates among young workers are likely due to school schedules and early career exploration This pattern of high turnover gradually decreases as workers move through their early careers, with those aged 22 to 24 exhibiting a 15.0% turnover rate, dropping to 9.1% for workers aged 25 to 34 years.

| Table 1. Turnover Rates by Age Group in Southeast Minnesota, 2022 | |

|---|---|

| Age | 2022 |

| 14-18 years | 23.1% |

| 19-21 years | 19.7% |

| 22-24 years | 15.0% |

| 25-34 years | 9.1% |

| 35-44 years | 6.5% |

| 45-54 years | 5.2% |

| 55-64 years | 5.0% |

| 65 years & over | 8.4% |

| Source: Quarterly Workforce Indicators | |

As employees enter their mid-careers, turnover rates drop well below the regional average to 6.5% for those aged 35 to 44 and reach their lowest levels among experienced workers aged 45 to 54 (5.2%) and 55 to 64 (5.0%). These lower rates likely reflect established careers, family commitments and the benefits of seniority. Interestingly, turnover increases slightly to 8.4% among workers aged 65 and older, primarily due to retirement transitions. These age-based patterns show how turnover naturally aligns with different life phases, from the exploration of early career years to the stability of established careers (see Table 1).

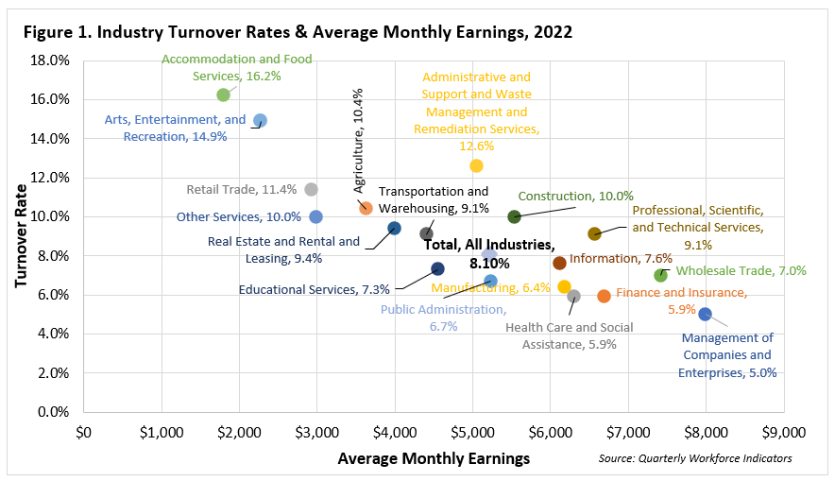

Age is not the only factor influencing turnover, as there is also a strong inverse relationship between industry turnover rates and average monthly earnings (see Figure 1). While approximately 8.1% of Southeast Minnesota's workforce separated from their employers in 2022, this rate varies significantly by industry. A clear group of high-wage, low-turnover industries emerge, led by Management of Companies & Enterprises ($7,997 average monthly earnings, 5.0% turnover), Finance & Insurance ($6,697, 5.9%), Health Care & Social Assistance ($6,309, 5.9%) and Manufacturing ($6,188, 6.4%). These sectors, all offering average monthly earnings above $6,000—which would equate to annual average earnings above $72,000—demonstrate remarkably low turnover rates well below the regional average of 8.1%. This suggests that higher wages and competitive compensation packages combined with likely career advancement opportunities contribute significantly to employee retention.

Conversely, industries with average monthly earnings below $3,000 consistently show turnover rates exceeding 10%. Accommodation & Food Services faces the greatest retention challenge with a 16.2% turnover rate and had the lowest average monthly earnings ($1,797), followed by Arts, Entertainment & Recreation ($2,276, 14.9%) and Retail Trade ($2,930, 11.4%). This pattern reinforces the strong relationship between compensation and workforce stability (see Figure 1).

However, several industries present interesting exceptions to these patterns. For example, despite offering high wages ($6,566), Professional, Scientific & Technical Services experiences a turnover rate of 9.1%, which suggests that factors beyond compensation also influence retention in this sector. Similarly, Administrative Support & Waste Management Services shows an unexpectedly high turnover (12.6%) despite mid-range wages ($5,050), while Construction maintains 10% turnover despite above-average compensation ($5,535). These outliers indicate that industry-specific factors such as work environment, job satisfaction, temporary and seasonal employment patterns, and career growth opportunities also play crucial roles in employee retention beyond wage considerations.

The analysis of Southeast Minnesota's employee turnover reveals a complex relationship between age, industry characteristics and wages in workforce retention. While turnover rates generally decline as workers age but increase with lower wages, exceptions across industries suggest that employee retention requires more than competitive compensation alone. Organizations must develop strategies that address both financial and non-financial factors to effectively reduce turnover.

For more information about turnover rates in Southeast Minnesota, contact Amanda O'Connell at amanda.oconnell@state.mn.us.