The Minneapolis-St. Paul metropolitan area is a national leader in finance, advanced manufacturing, agriculture and retailing.

The Minneapolis-St. Paul metropolitan area is a national leader in finance, advanced manufacturing, agriculture and retailing.

Medical devices, electronics and processed foods are strong suits recognized globally.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

1/13/2017 2:23:55 PM

Tim O'Neill

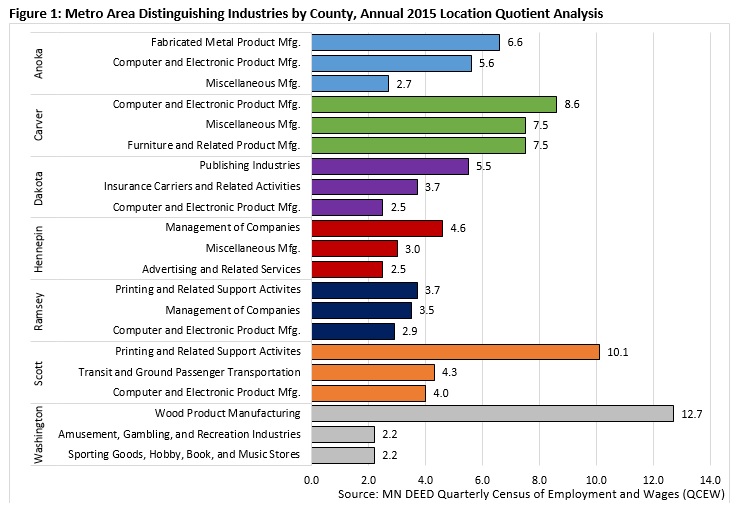

In recent months, the Metro Region Local Look has zoomed in on Dakota, Washington, and Anoka counties. To start 2017, we will highlight distinguishing industries throughout the metro region. To determine which industries are more highly concentrated, we will use location quotients (LQ), ratios which compare the share of employment in a particular industry locally to the share that same industry constitutes in the United States. We can see which industries have a stronger presence locally than they do nationwide.

As Figure 1 shows, each of the seven metro counties has unique industry concentrations, which reveal a lot about the types of businesses and jobs located in different parts of the Twin Cities. For example, in Scott County Printing and Related Support Activities is highly distinguishing. Employment in this industry is approximately ten times more concentrated than it is nationally (note that any location quotient at or above 1.2 is generally considered to be significant). With 1,425 jobs in the second quarter of 2016, employment within this sector made up nearly one-quarter of the county’s total manufacturing employment. Comparatively, Printing and Related Support Activities makes up just over eight percent of the metro’s total manufacturing employment. Clearly, printing is vital to Scott County’s economy.

Hennepin County is marked by a high concentration of employment in Management of Companies. With a LQ of 4.6, employment in this industry is almost five times more concentrated in the county than in the U.S. overall. With the large number of corporate headquarters and Fortune 500 companies in Hennepin County, this makes sense.

While location quotients can be a great tool for local economic analysis, especially for determining distinguishing industry sectors, they do not reveal the complete picture on their own. A closer look at Computer and Electronic Product Manufacturing highlights this reality. With the exception of Washington County, Computer and Electronic Product Manufacturing is highly concentrated across the whole metro region, ranging from an LQ of 2.3 in Hennepin County to 8.6 in Carver County.

While exceptionally concentrated in Carver County, Hennepin County still makes up the bulk of Computer and Electronic Product Manufacturing employment in the Twin Cities, with about 16,350 jobs, compared to just over 2,500 jobs in Carver County. Carver County’s share of employment is nearly four times higher, but Hennepin County has over six times as many jobs. This makes sense, considering the sheer size of Hennepin County’s total labor market.

Overall, location quotients can provide key insights into regional economies that other forms of labor market analysis cannot offer. The information garnered from such analysis can help local governments determine which industries to guide resources toward for regional growth, assist local colleges and schools with program development, help job counselors guide job seekers toward appropriate career pathways, or help legislators understand their jurisdictions.

As mentioned, the LQ analysis in this blog post used the national economy as a reference economy for determining distinguishing industries in the metro. Visit the Bureau of Labor Statistics to explore such analysis yourself.

Contact Tim O'Neill at 651-259-7401 or email timothy.oneill@state.mn.us.