by Jerry Brown, Oriane Casale, Amanda Rohrer and Dave Senf

June 2013

Minnesota's recovery from the recession has been slow but steady, with that trend expected to continue through the remainder of the year.

Minnesota's job market has rebounded faster than the country as a whole since the Great Recession, but the pace of job growth in the state has been moderate and uneven by historical standards. Unemployment has also dropped faster here than nationally, but under-employment has only recently started to decline. Despite headwinds from a cut in federal spending, many positive indicators remain, including an improving housing market, rising wages, low unemployment insurance claims and rising job vacancies. They indicate state job growth in 2013 will follow recent patterns, staying slightly ahead of the national pace.

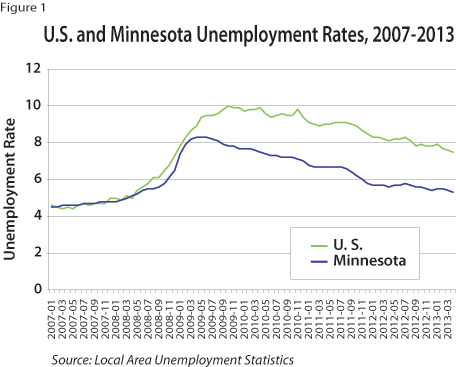

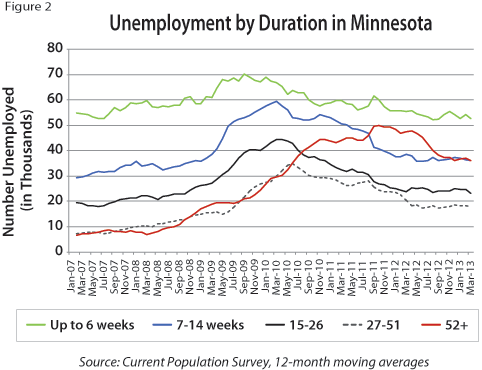

Minnesota unemployment rates outperformed the U.S. during and after the recession, peaking earlier and ticking reliably downward for the past three years (see Figure 1). Despite this optimistic picture, other measures of labor force health until very recently have indicated a hidden but continuing struggle. For example, the share of the unemployed who had been out of work for a year or more continued to rise until late 2011 and didn't begin to taper off until mid-2012 (see Figure 2).

This suggests two trends: First, fewer people were becoming unemployed. Second, people who had been unemployed for a shorter time were more desirable to employers, who had their pick of the labor force. Although the long-term unemployed are not back to their pre-recessionary levels, their rapidly decreasing numbers might indicate that employers are more willing to tap talent despite employment gaps. A tightening market for labor will undoubtedly benefit these workers.

Not all of the no-longer-unemployed find jobs. Some leave the labor force. While Minnesota and the country as a whole are seeing declines in labor force participation, the small sample sizes in Minnesota make it difficult to determine how many departing workers are retiring and how many simply became discouraged and quit looking for work.

Demographics suggest the trend is largely driven by retirements. It's uncertain, however, how many workers are retiring from jobs and how many are retiring from job searches as they become eligible for Medicare or Social Security. Regardless, the tightening labor market benefits workers. Even those who leave the labor force reluctantly might have better luck re-entering it in the near future.

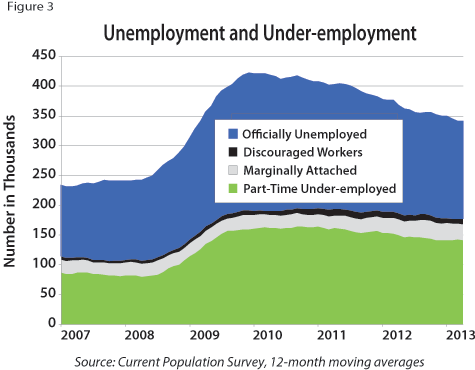

Another point of optimism is in the measures of under-employment. While unemployment is fairly narrowly defined as people who are available and actively seeking work, not everyone who is looking for work falls neatly into this category. They are tracked in separate measures. Discouraged workers have given up active job searches because they believe nothing is available to them. Like discouraged workers, marginally attached workers want a job and have looked for work in the past year, but for a variety of reasons were not actively looking during the four weeks prior to being surveyed. Part-time under-employed workers want full-time work but cannot find it.

During the recession, these groups grew more rapidly than the traditionally defined unemployed. As the number of unemployed declined, under-employment levels remained elevated (see Figure 3). In recent months, the number of workers in all of these groups has finally started declining - another indication that the labor market is tightening and workers have more options.

While the unemployment rate has been declining for some time, the underlying data indicate a much slower recovery in the labor market. We're not yet back to pre-recessionary levels, but other measures are finally beginning to support a broad-based recovery in the labor market.

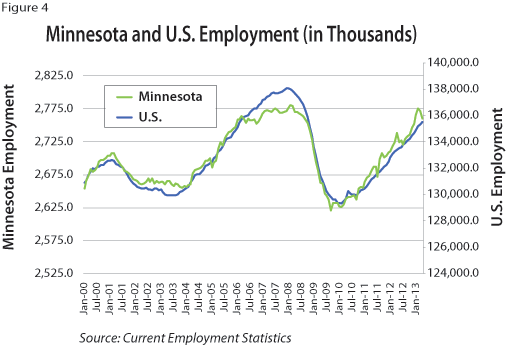

Employment growth had shown gradual improvement over the past several years. Figure 4 shows this upward trend in employment for both Minnesota and the U.S. While not as smooth, the upward trend in Minnesota has been slightly stronger than the rest of the country. As of February, employment was only 5,600 jobs short of the pre-recession peak employment of 2,789,900 in February 2008.

Two soft months in March and April have caused a bit of a reversal, however, with employment now 20,300 jobs short of the pre-recession peak.

After those two weak months, Minnesota's employment growth rate for the year fell to 1 percent, compared with a 1.6 percent growth rate for the U.S. The majority of the state's 22 major employment sectors were growing slower than the same sectors nationally as of April (see Table 1).

| Annual Employment Growth, April 2013, not seasonally adjusted data | ||

|---|---|---|

| Minnesota Percent | U.S. Percent | |

| Total Nonfarm | 1.0 | 1.6 |

| Total Private | 1.2 | 2.0 |

| Mining and Logging | 2.7 | 1.5 |

| Construction | -1.7 | 2.9 |

| Manufacturing | -0.1 | 0.7 |

| Trade, Transportation, and Utilities | 1.4 | 1.7 |

| Information | 4.1 | 0.4 |

| Financial Activities | 0.3 | 1.3 |

| Professional and Business Services | 2.6 | 3.4 |

| Educational and Health Services | 2.2 | 1.8 |

| Leisure and Hospitality | 0.3 | 2.7 |

| Other Services | 0.5 | 0.9 |

| Government | -0.5 | -0.4 |

| Source: Current Employment Statistics | ||

Timing is important when comparing the Minnesota and U.S. growth rates. February's annual job growth was 2.2 percent in Minnesota compared with 1.6 percent in the U.S., with no industries showing year-over-year declines in the state.

Minnesota typically trends closely with the U.S. as a whole but with more variance (see Figure 4). It is likely, therefore, that the sharp downturn of the past two months is only a short reversal. Some of the job losses in April were likely related to the late spring, with cold temperatures and heavy snowfall affecting several industries, most notably construction, leisure and hospitality, and retail businesses such as building materials and gardening equipment.

The current recovery has eclipsed the 2001 recession in terms of taking the longest time to regain peak employment, now at 38 months and counting. While federal spending cuts could slow job growth, other factors point to the modest growth that has been underway since February 2010. The Minnesota Business Conditions Index was well above growth neutral in April at 55.7, marking a fifth month in positive territory after a soft period last fall. This indicates conditions for positive growth in both manufacturing and the broader state economy in the coming months.

Another positive sign is the improving construction industry, thanks to the recovering housing market. One measure of this improvement is declining short sales and foreclosures in the Twin Cities. In April they represented 31.6 percent of all sales, down from 42.7 percent in April last year.

Meanwhile, home prices continue to rise. Zillow data showed a year-over-year price increase of 9.2 percent statewide in March 2013 and an increase of 10.6 percent for the Twin Cites metro area. Additionally, census estimates of permitting for new housing units statewide were up about 15 percent in the first quarter, compared with a year earlier. Much of this improvement was in single-family dwellings, where permits were up more than 30 percent. Continued strength in manufacturing and the recovery in home construction will hopefully mitigate the impact of federal sequestration and the end of a temporary Social Security tax cut last January.

Health services continued to be the strongest area of job growth in Minnesota, adding 10,600 jobs year over year in April, a 2.2 percent growth rate. Most of the job gains in health care came in ambulatory health care (up 4.7 percent) and nursing and residential care facilities (up 2.7 percent). There is no reason to believe this industry will weaken in the coming year.

Professional and business services added 8,600 jobs, with all three major components showing annual employment increases in April, but with the most growth in professional, scientific, and technical services. Employment services, a bellwether industry for future job growth, improved somewhat in recent months, gaining 6.4 percent in April.

Other indicators are also positive. Initial claims for unemployment insurance benefits, while increasing a bit during the last two months, are still comfortably in a range that indicates modest job growth is likely. Weekly work hours were down a bit in April compared with a year earlier (from 33.9 to 33.3 hours). Average hourly wages, however, were up substantially over the year from $24.89 to $25.62.

With the state shaking off the effects of an unusually late spring, combined with a number of positive economic indicators, Minnesota likely will return to modest levels of job growth after a soft patch in March and April. Assuming that happens, the state should regain its pre-recessionary employment peak around September 2013.

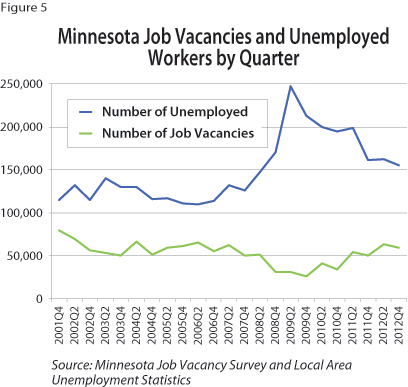

In another sign of an improving labor market, job vacancies increased to pre-recessionary levels during both the second and fourth quarters of 2012. Vacancies in the second quarter rose to 62,950, up 15.1 percent from the previous year. There were 58,860 vacancies in the fourth quarter, up 18 percent from the previous year.

There were 2.6 unemployed people for each vacancy in both the second and fourth quarters. This is the best ratio since the second and fourth quarters of 2007, overlapping the official start of the recession in December 2007. The ratio was as high as 8.2 job seekers per vacancy during fourth quarter 2009. The drop in this ratio since the peak of the recession was driven both by a decrease in the number of unemployed people and a strong increase in the number of job vacancies (see Figure 5). The 2012 ratio of 2.6 suggests that although the labor market remains challenging for job seekers, it continues to come back into alignment after the recession.

Minnesota's labor market recovery from the Great Recession has been slow and uneven, but progress is expected to continue through the rest of 2013. Moderate job growth and increasing job vacancies will continue to aid in the healing of the state's labor market. Improving labor market conditions have drawn discouraged and marginally attached workers back into the labor force, provided more hours for part-time workers, and helped boost wages as demand for workers has gradually climbed. Rising wages, in turn, will boost Minnesota's economy as larger paychecks stimulate consumer spending, feeding the self-reinforcing cycle of expanding economic activity.

Another year of 2 percent growth in gross domestic product for the U.S. will keep Minnesota's payroll employment growth hovering around 1.5 percent. The state's payroll employment will pass its pre-recessionary high sometime during the second half of 2013. This continued job growth will give the state its best three-year run since 1999 to 2001, adding to the steady but painfully slow improvement in Minnesota's labor market over the last four years. It will also help accelerate the recent headway made in Minnesota's unemployment picture, continuing to push both unemployment and under-employment down.