by Rachel Vilsack

September 2013

Several programs exist to measure jobs in Minnesota, and each defines jobs and employment in its own way. However, not everyone who is working is counted in these programs or at a level of industrial or occupational detail that allows us to show changes in hiring trends that may be of interest to job seekers and employment counselors. For some job seekers opportunities at temporary staffing agencies or contract work have become an increasingly viable route for getting them back to work. Self-employment may be a natural extension of the professional skill set and expertise of job seekers in career transition or for students being trained in occupational fields where self-employment or contract work is high.

So, how does labor market data count jobs in staffing agencies, contract work, and self-employment?

State labor market data collections include many sources for counting jobs:

First, the Current Employment Statistics (CES) is a monthly survey of nonfarm businesses for estimating state and Metropolitan Statistics Area (MSA) industry employment, hours, and earnings. The CES program is a federal-state cooperative program between the U.S. Bureau of Labor Statistics and state agencies. This program is the largest survey of its kind, based on a sample of 400,000 businesses nationwide and 5,900 businesses in Minnesota. Jobs excluded from CES include:

Second, the Quarterly Census of Employment and Wages (QCEW) is a count of all establishments and employment covered under the state's Unemployment Insurance (UI) Program. It's estimated that the UI program covers about 97 percent of Minnesota's wage and salaried employment. Workers and jobs excluded from the QCEW include, but are not limited to:

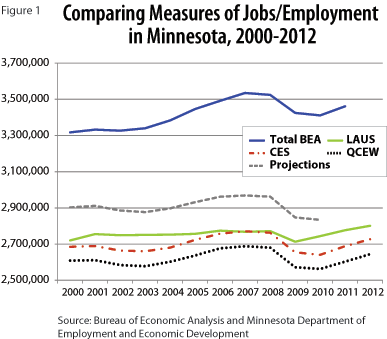

Other programs in the Labor Market Information (LMI) Office further measure Minnesota jobs and employment such as the Local Area Unemployment Statistics (LAUS) program and the 10-year employment projections. Each defines jobs and employment differently, yielding a range of estimates as evident in Figure 1. While the job and employment figures in these LMI programs follow a similar trend line, the difference in job and employment estimates among programs can vary by nearly 300,000 between the highest and lowest estimates.

One national estimate of jobs from the Bureau of Economic Analysis (BEA)'s annual State Personal Income and Employment series makes adjustments to account for employment and wages not covered by state Unemployment Insurance (UI) programs. Therefore, the BEA estimates of total employment are nearly 33 percent higher than the QCEW job estimates in 2011.

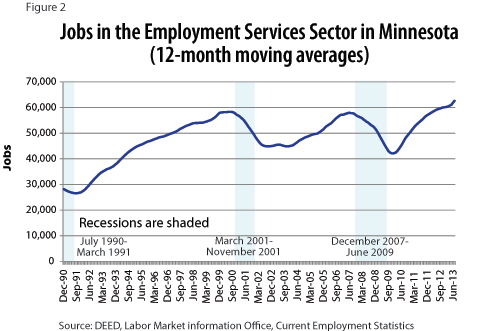

The Employment Services sector (NAICS 5613), which includes employment placement and temporary staffing agencies, is often a leading indicator of economic trends.1 Firms experiencing downturns in business demand prior to a recession may lay off temp workers before cutting permanent staff. As business conditions improve, temp agency employment should increase as firms slowly ramp up production without adding to permanent payroll. While this industry's employment level does not necessarily predict a recession or its recovery, the industry has shown itself to rise and fall with the larger labor market (Figure 2).

Rapid growth in employment staffing agencies has been driven by structural changes in the economy. Part of the growth is from the current business climate, but the concept of "just-in-time labor" allows firms to use labor when it is needed without paying for the compensation costs associated with full-time workers. People who work for temporary agencies are counted in both CES estimates and QCEW counts of jobs. In both programs jobs reported by larger employment service firms are usually reported to the correct industry, but smaller firms' data is all too frequently captured under the larger Employment Services sector. So the data do not confirm if the rise of temp jobs is necessarily related to an increase in work in a specific industry.

Annual counts of job openings in employment service and temporary staffing agency seem to support this analysis. MinnesotaWorks.net, the state's no-fee job bank for employers and job seekers, showed a large number of posted jobs openings (109,740) in employment placement agencies, executive search services, and temporary help services sectors.2 In fact 42.4 percent of all jobs posted on MinnesotaWorks.net were in the Employer Services sector (NAICS 5613). By comparison, Minnesota employers posted 45,470 employer service-related openings in 2010, during the early days of the recession's recovery. The Employment Services sector accounted for 35.5 percent of all posted openings.3

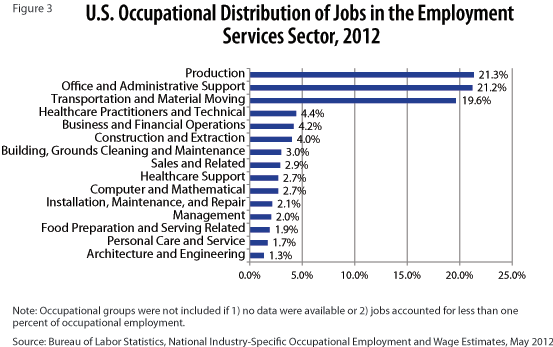

Figure 3 shows the national occupational distribution of jobs in the Employment Services sector in 2012. While jobs in this sector also include the administrative, business, financial, human resource, and managerial positions in staffing and temporary help agencies, the high concentration of production and of transportation and material moving occupations suggests the kinds of workers that are being placed by staffing firms.

A closer look at the detailed occupations employed in the Employment Services sector reveals the following top 10 professions with the highest concentration:

With over-the-year jobs in the Employment Services sector growing at 13.5 percent in July, compared to the 2.4 percent private sector job growth in Minnesota, it's clear that job seekers are finding opportunities in this industry.

While the definition of jobs varies slightly between the data sets, they do not include the self-employed or contract workers who are not viewed as an employee of the firm. One of the best sources of data is the U.S. Census Bureau's Nonemployer Statistics program. A nonemployer business is one that has no paid employees, has annual business receipts of $1,000 or more ($1 or more in the Construction industry), and is subject to federal income taxes. The source of this data is primarily from the annual or quarterly business income tax returns filed with the Internal Revenue Service (IRS) and maintained in the Census Bureau's Business Register. Independent contractors receiving a 1099 tax form that must be filed with the Internal Revenue Services (IRS) are included in these calculations.

According to the U.S. Census Bureau "most nonemployers are self-employed individuals operating very small unincorporated businesses, which may or may not be the owner's principal source of income." These firms are excluded from most other business statistics, like QCEW which tracks wage and salaried jobs and employers who pay Unemployment Insurance taxes. Adding nonemployers into the count of QCEW business establishments and jobs would reveal that nonemployers account for 70.2 percent of all businesses in Minnesota and about 13.0 percent of total jobs, if each self-employed individual counts as one job in the total number of jobs data from the U.S. Census Bureau.4

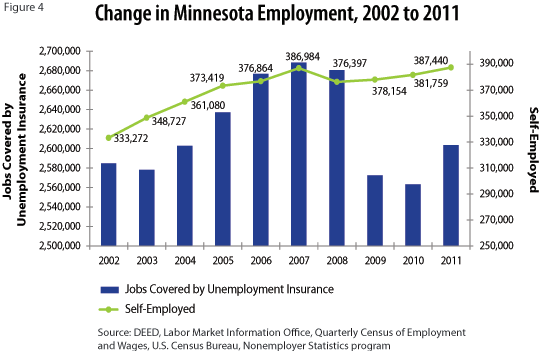

With Nonemployer Statistics dating back to 2002, we can measure changes in the number of nonemployer firms against the jobs tracked by the QCEW program and covered by unemployment insurance. Figure 4 shows the changes in Minnesota employment between 2002 and 2011. The state suffered noticeable employment declines during the Great Recession, which officially began in December 2007. While covered jobs declined less than one half of one percent between 2007 and 2008, all the 2007 gains in self-employment businesses disappeared in 2008.

Trends over the 2007 to 2009 recession show a different picture. While the number of covered jobs fell by 4.3 percent between 2007 and 2009, the number of self-employed declined by almost half that rate (2.3 percent). Job growth rebounded between 2010 and 2011 for covered jobs (1.6 percent) and self-employment (1.5 percent) at nearly the same rate. The release of the 2012 Nonemployment Statistics in May 2014 will help to determine if the growth trends remain in tandem or if there has been further expansion in nonemployer businesses.

The largest industry for self-employment was professional, scientific, and technical services, accounting for 15.1 percent of all nonemployer establishments in Minnesota in 2011. This industry sector includes management and technical consulting, accounting, tax preparation, bookkeeping, and payroll services. Entry into these industries appears relatively easy, as the sector added more than 1,000 nonemployer businesses between 2010 and 2011 (Table 1).

| Nonemployer Statistics in Minnesota | ||||

|---|---|---|---|---|

| Firms | 2011 Percent of Firms | Receipts ($1,000) | 2010 to 2011 Change in Firms | |

| Total for All Sectors | 387,440 | 100.0% | 16,370,424 | 5,681 |

| Agriculture | 5,149 | 1.3% | 193,964 | 217 |

| Mining | 168 | 0.0% | 10,022 | -4 |

| Utilities | 342 | 0.1% | 26,255 | 2 |

| Construction | 41,860 | 10.8% | 2,200,671 | -325 |

| Manufacturing | 7,384 | 1.9% | 274,199 | 281 |

| Wholesale Trade | 6,731 | 1.7% | 498,791 | -60 |

| Retail Trade | 36,846 | 9.5% | 1,286,409 | 292 |

| Transportation and Warehousing | 19,272 | 5.0% | 1,407,419 | 552 |

| Information | 5,338 | 1.4% | 146,665 | 69 |

| Finance and Insurance | 13,884 | 3.6% | 915,583 | 63 |

| Real Estate and Rental and Leasing | 39,819 | 10.3% | 3,918,153 | -63 |

| Professional, Scientific, and Technical Services | 58,548 | 15.1% | 2,041,313 | 1,011 |

| Administrative and Support Services | 25,652 | 6.6% | 548,639 | 643 |

| Educational Services | 11,276 | 2.9% | 136,878 | 320 |

| Health Care and Social Assistance | 33,709 | 8.7% | 887,996 | -43 |

| Arts, Entertainment, and Recreation | 26,153 | 6.8% | 419,041 | 687 |

| Accommodation and Food Services | 3,987 | 1.0% | 188,785 | 95 |

| Other Services | 51,322 | 13.2% | 1,269,641 | 1,944 |

| Source: U.S. Census Bureau, Nonemployer Statistics program | ||||

Other services, which boasts the second largest number of nonemployer businesses in Minnesota and the sector that added the largest number of new net nonemployer businesses in 2011, includes:

While five industries saw a contraction in the number of net nonemployer businesses, construction had the largest number (325) between 2010 and 2011. Specialty trade contractors, like framers, roofers, finish carpenters, plumbers, and electricians, often make up a large number of nonemployer firms in this sector. Because the number of covered construction jobs decreased significantly during the recession, it's reasonable to assume that some workers transitioned into self-employment. By 2011 covered construction jobs increased by 3,440 on an annual average basis and some self-employed workers may have transitioned back into working as an employee for another company.

While the number of jobs for temporary, contract, and the self-employed are tracked in different ways and by various means, they represent an important component of the state's economy and a source of opportunities for job seekers.

1The Employment Services sector includes 1) employment placement agencies primarily engaged in listing employment vacancies and in referring or placing applicants for employment; 2) temporary help services primarily engaged in supplying workers to clients' businesses for limited periods of time to supplement the working force of the client; and 3) professional employer organizations primarily engaged in providing human resources and human resource management services to client businesses.

2MinnesotaWorks.net job postings counts are available for both employment services and temporary staffing firms. Openings in temp agencies outnumber employment service firms by a magnitude of 2.

3Minnesota's semi-annual Job Vacancy Survey excludes firms in the Employment Services sector from its sampling procedure.

4These percentages represent the sum of total covered jobs in 2011 from the Quarterly Census of Employment and Wages and the sum of nonemployers in 2011 from the U.S. Census Bureau Nonemployer Statistics program.