by Jerry Brown

May 2013

Minnesota experienced moderate job growth in 2012 compared to 2011 with newly benchmarked data showing an annual increase of 1.4 percent and numeric growth of 38,868 jobs for the year. This is a reduction from the 47,374 jobs added in 2011.

As was to be expected in the second year of a recovery from a sharp downturn, employment growth was widely distributed. Table 1 presents the rate of growth for all supersectors and major rollups. Of these, only the Information supersector showed an annual decline in 2012 with a loss of 153. The Government sector was weaker than the apparent growth of 1,160 jobs for the year. This figure was inflated by the state government layoff which reduced the average employment in 2011, thereby increasing the apparent growth in 2012. Adjusting for this one-month layoff produces an average loss of more than 600 in 2012 rather than a gain. The other supersectors showed mainly modest rates of growth although Professional and Business Services, Construction, and Mining and Logging all showed gains of 2.0 percent or higher. Table 1 also presents the U.S. rates of growth for the supersectors and shows that the U.S. as a whole outperformed Minnesota in terms of its rate of job growth in 2012, posting a gain of 1.7 percent. The U.S. outperformed Minnesota in seven of 11 supersectors including the key areas of Professional and Business Services, Educational and Health Services, Trade, Transportation, and Utilities, and Leisure and Hospitality. Minnesota saw a faster increase in Construction employment but is recovering from a larger than average Construction downturn. In the end, nearly all of the job gains made between 1995 and 2005 in Construction were lost in the recession, and it is not surprising the state shows somewhat higher than average growth in recovering from this very low level.

| Employment Growth by Supersector 2011 and 2012 | ||||||

|---|---|---|---|---|---|---|

| Year-to-Year Change 2011 to 2012 | ||||||

| Minnesota | United States | |||||

| Industry Title | 2012 Average | 2011-2012 Average | 2010-2012 Average | Numeric | Percent | Percent |

| Total Nonfarm | 2,727,514 | 2,688,646 | 2,641,272 | 38,868 | 1.4 | 1.7 |

| Total Private | 2,315,737 | 2,278,029 | 2,224,741 | 37,708 | 1.7 | 2.2 |

| Goods-Producing | 407,130 | 398,991 | 386,265 | 8,139 | 2.0 | 2.0 |

| Service-Providing | 2,320,383 | 2,289,655 | 2,255,008 | 30,728 | 1.3 | 1.7 |

| Private Service-Providing | 1,908,607 | 1,879,038 | 1,838,476 | 29,569 | 1.6 | 2.2 |

| Mining and Logging | 7,037 | 6,605 | 5,972 | 432 | 6.5 | 8.0 |

| Construction | 94,739 | 91,776 | 87,614 | 2,963 | 3.2 | 2.0 |

| Manufacturing | 305,354 | 300,610 | 292,679 | 4,744 | 1.6 | 1.6 |

| Trade, Transportation, and Utilities | 503,226 | 497,127 | 490,062 | 6,099 | 1.2 | 1.8 |

| Information | 53,683 | 53,836 | 54,104 | (153) | -0.3 | 0.1 |

| Financial Activities | 177,082 | 174,209 | 172,598 | 2,873 | 1.6 | 1.2 |

| Professional and Business Services | 336,258 | 329,646 | 314,044 | 6,612 | 2.0 | 3.5 |

| Educational and Health Services | 478,038 | 469,401 | 458,391 | 8,637 | 1.8 | 2.2 |

| Leisure and Hospitality | 244,256 | 239,687 | 235,197 | 4,569 | 1.9 | 2.9 |

| Other Services | 116,063 | 115,133 | 114,082 | 930 | 0.8 | 1.4 |

| Government | 411,777 | 410,617 | 416,531 | 1,160 | 0.3 | -0.8 |

| Source: Minnesota Current Employment Statistics: | ||||||

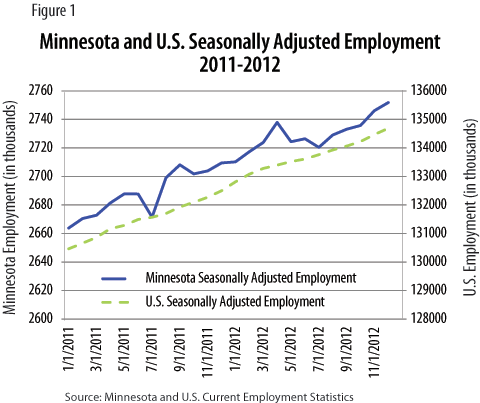

Figure 1 provides a graphical representation of seasonally adjusted employment growth by month for 2011 and 2012. The figure shows that employment has been on a consistently upward trend with two major exceptions: in July 2011 with the State Government layoff and in the April and May period in 2012 where a sharp April increase was followed by a sharp loss in May. These two movements largely counteracted each other and did not change the underlying upward trend.

Minnesota was in the middle of the pack in terms of employment growth compared to other states, sharing a ranking of 22nd with six other states. North Dakota showed by far the highest rate of job growth, boosted by an expanding oil mining sector. Nine states showed growth of 2.0 percent or greater. During the heart of the last expansion in 2005 and 2006, 19 states showed annual growth of 2.0 percent or higher. Twelve states showed growth of less than 1.0 percent.

Looking at over-the-year rates of growth by quarter showed that employment growth compared to the previous year was strongest in the first quarter of the year at 1.8 percent, but gradually tailed off to a level of 1.2 percent in the fourth quarter. This indicates that job growth was not accelerating at the same rate as the year progressed compared to 2011. This occurrence is in line with measures of gross national product growth for the U.S. Annualized real GDP for 2011 was 0.1 percent in first quarter, 2.5 percent in second quarter, 1.3 percent in third quarter, and 4.1 percent in fourth quarter. For 2012 growth was 2.0 percent in first quarter, 1.3 percent in second quarter, 3.1 percent in third quarter, and 0.1 percent in fourth quarter. Since economic growth was back-loaded in 2011 and front-loaded in 2012, the gradual reduction in the over-the-year rate of growth for the year is a logical result. Table 2 presents growth by quarter for all supersectors. Overall 2012 posted a 2.2 percent gain in gross domestic product, a bit higher than the 1.8 percent gain of 2011 but still a rather pedestrian showing for an economy exiting a deep recession. In the three years of recovery GDP growth has yet to exceed 3.0 percent, a mark commonly hit following a recessionary period. This further drives home the point that while in recovery, we are improving only very gradually rather than experiencing a sharp return to past trends. Productivity posted another weak period with growth of only 0.7 percent at nonfarm businesses after increasing only 0.6 percent in 2011. Income growth was again stagnant with disposable personal income growing only 1.5 percent after controlling for inflation, a slight increase from 1.3 percent growth in 2011 but well below the income growth common in previous expansions. With about 70 percent of the economy based on consumer spending, slower growth in real personal consumption expenditures, 1.8 percent compared with 2.5 percent, was indicative of the mediocre nature of the economic growth experienced in 2012.

| Minnesota Year-over-Year Growth by Quarter | ||||

|---|---|---|---|---|

| 2012 Quarterly Annual Growth Rates | ||||

| Industry Title | 1st Qtr. | 2nd Qtr. | 3rd Qtr. | 4th Qtr. |

| Total Nonfarm | 1.8 | 1.5 | 1.3 | 1.2 |

| Total Private | 2.2 | 1.8 | 1.2 | 1.4 |

| Goods-Producing | 2.9 | 2.8 | 1.6 | 0.9 |

| Service-Providing | 1.6 | 1.3 | 1.3 | 1.3 |

| Private Service-Providing | 2.1 | 1.6 | 1.2 | 1.5 |

| Mining and Logging | 8.9 | 9.1 | 5.7 | 2.9 |

| Construction | 5.2 | 5.3 | 2.2 | 0.8 |

| Manufacturing | 2.2 | 1.9 | 1.3 | 0.8 |

| Trade, Transportation, and Utilities | 1.9 | 1.1 | 0.7 | 1.2 |

| Information | -0.7 | -0.4 | -1.0 | 0.9 |

| Financial Activities | 1.0 | 2.3 | 1.9 | 1.4 |

| Professional and Business Services | 3.1 | 2.5 | 1.4 | 1.1 |

| Educational and Health Services | 1.9 | 1.4 | 1.6 | 2.4 |

| Leisure and Hospitality | 3.5 | 1.9 | 1.3 | 1.0 |

| Other Services | 1.2 | 0.7 | 0.1 | 1.2 |

| Government | -0.7 | -0.2 | 1.9 | 0.3 |

| Source: Minnesota Current Employment Statistics | ||||

With continued job growth in 2012, the official rate of unemployment continued to drop although the rate of decline slowed from 2011. The rate of unemployment fell from 5.8 percent to 5.4 percent on a seasonally adjusted basis from December 2011 to December 2012. This drop of 0.4 of a percentage point was far short of the 1.2 percentage point drop from December 2010 to December 2011. This indicates that while job growth is not robust enough to return the state quickly to the sub 4 percent rate experienced in 2006, growth is adequate to move lower slowly, particularly with increasing numbers of retirees limiting workforce growth. As has been common for the past two decades, Minnesota showed unemployment substantially below the national rate. Using the annual average rate of unemployment, Minnesota ranked ninth at 5.6 percent compared to the national rate of 8.1 percent. The 10 states with the lowest unemployment rates were dominated by Midwestern states, six out of 10, along with two New England states and oil patch states Oklahoma and Wyoming. Nevada showed the worst unemployment at 11.1 percent with California and Rhode Island also showing unemployment rates above 10 percent.

Initial claims for unemployment showed only a small decline compared to 2011, down 1.4 percent for total initial claims. The raw number of claims for the year - 281,194 - was about 6,600 above the number filed in 2007 prior to the large increases caused by the recession. Historical data indicate that monthly seasonally adjusted claims levels of about 26,000 are the point at which consistent job growth begins. Initial claims in Minnesota have been at or below that approximate level since late 2010. During 2012 seasonally adjusted initial claims fell from 24,809 in January to 21,507 in August before rising again at the end of the year to about 23,000. This would indicate modest job growth. Very robust job growth would require this number to fall to around 17,000. At the end of 2012, about 55 percent of all initial claims were associated with job cuts expected to be permanent. This ratio reached 71 percent in the worst of the downturn. During economic expansion after the 2001 recession, permanent layoffs were about 45 percent of all initial claims.

Turning to a more detailed look at where job growth came from in 2012, Table 3 presents the 25 industry groups below the level of supersector with the highest rate of job growth for the year. Representatives in this group from eight of the 11 supersectors mark a year of fairly well distributed growth. Having three construction industries on the list was not particularly surprising given that the Construction supersector trailed only Mining and Logging in its rate of job growth. Specialty Trade Contractors, the largest component of Construction, posted a gain of 3.2 percent but all three major components showed strong growth as Heavy and Civil Engineering increased 4.7 percent and Construction of Buildings 2.4 percent. There is no longer a question whether Construction has bottomed out. It is clearly past its bottom and is now trending toward growth. This is an important factor going forward as thus far we have experienced a recovery without the usual burst of growth from Construction expansion. This lack of growth has been a contributing factor in the rather slow pace of recovery. Census data on new housing permits in Minnesota showed substantial improvement in 2012. Estimates showed that overall there were 15,409 permits issues in Minnesota for the year compared to 8,990 in 2011 to post an increase of 73.3 percent. This is the highest level of permitting since 2007. While this improvement is heartening, remember that 2012's permitting level was only about 38 percent of the 41,843 permits issued in 2004. Signs indicate continued improvement in housing in 2013. Housing inventories have been declining relative to sales as the volume of foreclosures declines. A result has been higher median prices for existing home sales. For the Twin Cities metro area the Case Schiller index showed an 11.9 percent annual increase in home prices in December 2012. Zillow reported that for Minnesota overall, there was an 8.4 percent annual increase in prices for December 2012. As inventories drop, there should be more demand for new houses, and as home prices rebound, family balance sheets should be under less stress, and confidence should improve. Improved values should help the market move toward a more normal balance as instances of negative equity decline, thereby releasing trapped homeowners more readily to upsize, downsize, or exit for employment purposes. Fannie Mae projects a 15.1 percent increase in new single family building in 2013 and a 10.5 percent increase in existing home sales for the U.S. as a whole.

| Minnesota Industries with the Highest Rates of Growth | ||

|---|---|---|

| 2011 to 2012 Growth | ||

| Industry Title | Numeric | Percent |

| Fabricated Metal Product Manufacturing | 2,252 | 5.8 |

| Employment Services | 3,062 | 5.4 |

| Heavy and Civil Engineering Construction | 610 | 4.7 |

| Machinery Manufacturing | 1,316 | 4.3 |

| Computer Systems Design and Related Services | 1,244 | 4.2 |

| Machine Shops, Turned Product, and Screw, Nut, and Bolt Manufacturing | 508 | 3.8 |

| Wholesale Electronic Markets and Agents and Brokers | 814 | 3.6 |

| State Government Excluding Education | 1,241 | 3.5 |

| Merchant Wholesalers, Durable Goods | 1,979 | 3.3 |

| Ambulatory Health Care Services | 4,185 | 3.3 |

| Specialty Trade Contractors | 1,857 | 3.2 |

| Miscellaneous Store Retailers | 470 | 3.0 |

| Offices of Physicians | 1,866 | 3.0 |

| Arts, Entertainment, and Recreation | 1,105 | 2.9 |

| Building Material and Garden Equipment and Supplies Dealers | 636 | 2.6 |

| Architectural, Engineering, and Related Services | 452 | 2.5 |

| Management of Companies and Enterprises | 1,858 | 2.5 |

| Construction of Buildings | 498 | 2.4 |

| Durable Goods | 4,604 | 2.4 |

| Motor Vehicle and Parts Dealers | 714 | 2.4 |

| Limited-Service Eating Places | 1,759 | 2.4 |

| Depository Credit Intermediation | 916 | 2.3 |

| Health Care and Social Assistance | 9,134 | 2.3 |

| Hospitals | 2,279 | 2.3 |

| Real Estate | 681 | 2.2 |

| Source: Minnesota Current Employment Statistics | ||

Professional and Business Services accounted for four of the fastest growing industries. The second fastest growth on the list was Employment Services with a gain of 5.4 percent, equal to 3,062 jobs. This was well below growth of 19 and 13.8 percent posted the previous two years for this industry. This slower growth is an expected development as the economic expansion matures and increased hiring of permanent workers takes place. Computer System and Design also posted a strong gain of 4.2 percent or about 1,200 new jobs. Management of Companies increased by 2.5 percent. That Minnesota lagged behind the U.S. in growth in Professional and Business Services is somewhat troubling as many of the jobs in these industries tend to be high paying and are in areas of the economy seeing dynamic growth.

Job growth in health care industries accounted for all of the gains in the Educational and Health Services supersector as Educational Services showed a loss of about 500 for the year. Four health care industry groupings showed up on the list of the 25 fastest growing industries. Ambulatory Health Services showed the most robust growth, adding 4,185 jobs with Offices of Physicians accounting for a great deal of this increase. Hospitals also showed good growth, up 2.3 percent for the year. Somewhat slower growth also occurred in Nursing and Residential Care and in Social Assistance industries with gains of 1.7 and 1.3 percent, respectively. There is every reason to believe that the long-term trend of job growth in health care will continue through 2013.

Of particular note was the large revision made in Leisure and Hospitality which initially was estimated to have produced very weak results throughout most of 2012. The revised data did not show this same weakness in the first part of 2012 with the revisions being particularly large in Arts, Entertainment, and Recreation which in the end showed an annual average increase of 2.9 percent to place it on our list of fast-growing industries. Limited Service Eating Places, which showed a gain of 2.4 percent, was also revised upward. Following the revision, the supersector actually posted solid though unspectacular growth that was about one percentage point below the national rate of growth. The large revision was caused by sample results that substantially underestimated growth in these industries. In particular, the sample showed a much larger seasonal decline in late 2011 and a smaller summer expansion than was present after benchmarking.

Although employment growth weakened at year end, Manufacturing nonetheless had four industries among those with the fastest rate of growth. Growth was focused in Durable Goods Manufacturing with a gain of 2.4 percent. Three component industries were on the fastest-growing list including Fabricated Metal Product Manufacturing, Machinery Manufacturing, and Machine Shops which were all in the top six fastest rates of growth for the year. The weakening of manufacturing job growth in the second half of the year was predicted by a decline in Creighton University's Minnesota Business Conditions Index which fell below growth neutral beginning in July and remained there until turning positive again with a strong gain in December to move it back above the neutral point. It has continued to indicate conditions of growth since that time, predicting that conditions are in place for modest growth in manufacturing industries in the first half of 2013. The health of the Manufacturing sector will be closely tied to gains in exports of goods which showed a reduced level of growth in the fourth quarter of 2012. Durable Goods industries are particularly impacted by export trends in terms of employment.

The data presented clearly point to a year of positive developments in the employment market for Minnesota. Growth in employment was solid but not particularly robust. The state saw similar improvement in its unemployment situation. For readers interested in additional detailed industry data not covered in this article, an Excel file that includes a presentation of job growth for the past two years for all industries and locations is available.