by Jerry Brown

January 2013

Monthly analysis is based on seasonally adjusted employment data.

Yearly analysis is based on unadjusted employment data.*

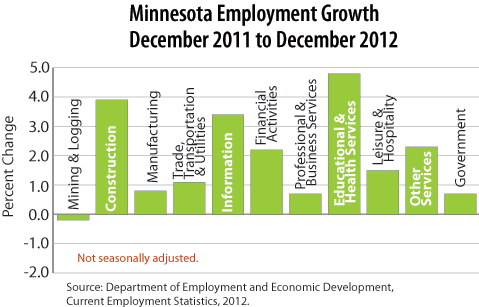

Monthly employment increased by 9,100 in December. November estimates experienced an upward revision to post an even larger gain of 12,300. This was the third gain in the last four months with a net increase of 27,600 since August. Monthly growth was well distributed with eight of 11 supersectors showing monthly gains against two losses and one supersector with no change. The largest gain was in trade, transportation, and utilities with an increase of 3,900. Other large gains were posted in professional and business services, up 2,500, educational and health services, up 1,800, and also in manufacturing and in information, both up 1,400. The only large decline came in construction with a loss of 3,500. Turning to over-the-year comparisons, the state showed an increase of 1.9 percent, substantially higher than the rate of growth for the nation as a whole. Ten of 11 supersectors showed annual gains, with only mining and logging posting a negligible loss. Educational and health services was by far the most important area of job growth posting a gain of 22,700, equal to a gain of 4.8 percent. Trade, transportation, and utilities added 5,600. Three supersectors showed gains over 3,000: financial activities, construction, and leisure and hospitality. Manufacturing, professional and business services, other services, and government showed gains ranging from 2,400 to 2,900.

There was no change in mining and logging employment over the past month. Compared to last year there is also only the most negligible loss of less than 50.

Construction experienced a loss of 3,500 in December to erase all of the jobs gained in the previous three months. This rather swift turnaround makes it difficult to evaluate whether construction is showing a clear upward trend or has yet to turn the corner to more consistent employment growth. On the positive side, housing permits have improved substantially in 2012, home prices have been increasing, and the volume of houses for sale has dropped much closer to a normal level. Overall the housing recovery should be fueling at least some consistent employment growth. Despite the large monthly loss, the supersector showed an annual gain of nearly 3,300 with growth occurring in both specialty trade contractors and construction of buildings.

Manufacturing employment increased for the third consecutive month, up 1,400 in December equal to the combined growth for October and November. All of the monthly gain came in durable goods manufacturing which added 1,500 jobs. Most industries in durable goods showed at least minor improvement over the past month. Two areas showed strong monthly results including fabricated metal product manufacturing and miscellaneous manufacturing. Over the last year the supersector showed a gain of 2,500 jobs with all of the annual gain coming from durable goods manufacturing where 4,700 jobs were added. The largest gain among more detailed industries was fabricated metal manufacturing with a gain of 3,300. One positive note is that the Minnesota Business Conditions Index moved above the break-even point of 50 up to 57.2 after being below the break-even point for the previous five months. All of the components of the index were above 50, indicating conditions are in place to support economic growth.

Employment in trade, transportation, and utilities increased for a third consecutive month in December. December's gain of 3,900 was largely from a gain of 3,200 in retail trade. Retail trade, after experiencing a decline over the first half of 2012, has added 6,400 jobs in the second half of the year. After this growth, seasonally adjusted employment levels are at their highest levels since early 2009. Compared to last year, employment showed an increase of 1.1 percent with gains in each of the three major component industry groupings. Wholesale trade added 2,000 jobs largely in nondurable goods wholesaling. Retail trade showed a gain of 0.8 percent, a rate of growth in line with the modest improvements in retail trade sales compared to last year. Transportation, warehousing, and utilities posted a gain 1,200 jobs.

Seasonally adjusted estimates showed an increase of 1,400 in the information supersector. This increase reversed a loss of 1,100 in November and continues an eight-month period where the indicated monthly change has alternated between employment increases and losses. The December gain is not apparent in the two more detailed industries, meaning that monthly growth is apparently coming from outside traditional publishing and telecommunication industries. On an annual basis information added 1,800 jobs with all of this increase coming outside of traditional publishing and telecommunications.

Employment increased by 600 over the past month in financial activities industries. This gain erased a loss of 500 that was posted over the previous two months. The monthly increase was centered in credit intermediation and insurance carriers, which outweighed losses posted in real estate rental and leasing. Seasonally adjusted employment now exceeds its prerecession high point. Compared to December 2012 supersector employment increased 2.2 percent, equal to about 3,800. Every industry breakout showed over-the-year increases including 1,300 in credit intermediation, 1,000 in insurance carriers, and 400 in real estate and rental and leasing.

Professional and business services employment increased by 2,500 in December. There was a gain of 1,900 in professional, scientific and technical services after a gain of 100 in November. This growth was still insufficient to erase the losses posted in September and October. Architectural, engineering, and related was a strong performer. The remainder of the monthly growth came from administrative and support services. While the monthly gain reversed some recent losses, comparing current data to one year ago shows a gain of 0.7 percent which is the lowest rate of over-the-year growth since March 2010 and much weaker than in recent months. Employment services was up only 100 jobs. This lack of growth is worth watching as this industry is among the first to show the effects of change in economic growth. Professional, scientific, and technical services was still a source of strong growth adding 6,000 jobs over the past 12 months. Management of companies showed a loss of 1,000.

Strong gains in health care and social assistance outweighed losses in educational services to allow a net increase of 1,800 jobs. This is the sixth consecutive month of growth. Educational services showed a loss of 1,300 as colleges showed particular weakness for the month. This could simply be related to the timing of layoffs at the end of the fall term. Health care and social assistance added 3,100 jobs easily erasing educational losses. The continued growth trend in the supersector reflected a strong 4.8 percent rate of annual growth. All the major components showed strong annual growth, particularly ambulatory health care with an annual gain of 6.8 percent.

Following November's strong gains, the leisure and hospitality supersector added a pedestrian 800 jobs in December. All of the job growth was in accommodation and food services with the addition of 1,400 jobs for the month, and with growth particularly centered in limited service restaurants. After a very strong November showing, art, entertainment and recreation posted a loss of 600. On an annual basis leisure and hospitality showed a gain of 1.5 percent with even stronger growth after November's positive turn. This level of growth is substantially below the national rate of 2.6 percent. All components showed annual growth but limited service restaurants and arts, entertainment, and recreation contributed most of the job growth over the past year.

Other services lost 700 jobs over the past month, the first monthly loss for the supersector since August 2012. Repair and maintenance was the locus of most of the monthly decline. Compared to one year ago, the supersector showed a gain of 2,700, with religious, grantmaking, civic, professional, and similar organizations providing nearly all of this growth.

Estimates showed government employment up 900 jobs for the month, with all of the growth coming in state government employment, where 2,500 jobs were added. Local government lost 1,500 jobs. Additions in state government were centered in state government education. It is probable that much of the monthly gain is from the timing of layoffs after the fall semester; therefore, we are likely to see some counteracting losses in January and/or February. Compared to last December, government employment was up 2,900. State government was up 2,000, with state government education accounting for 1,400 of these new jobs. Local government was up 1,300 with nearly all gains in education as well.

| Minnesota Seasonally Adjusted Nonagricultural Wage and Salary Employment

(In Thousands) |

|||

|---|---|---|---|

| December 2012 | November 2012 | October 2012 | |

| Total Nonfarm | 2,735.2 | 2,726.1 | 2,713.8 |

| Goods-Producing | 404.4 | 406.5 | 404.1 |

| Mining and Logging | 6.6 | 6.6 | 6.7 |

| Construction | 92.8 | 96.3 | 95.0 |

| Manufacturing | 305.0 | 303.6 | 302.4 |

| Service-Providing | 2,330.8 | 2,319.6 | 2,309.7 |

| Trade, Transportation, and Utilities | 503.2 | 499.3 | 495.2 |

| Information | 54.1 | 52.7 | 53.8 |

| Financial Activities | 178.0 | 177.4 | 177.8 |

| Professional and Business Services | 339.7 | 337.2 | 337.3 |

| Educational and Health Services | 494.5 | 492.7 | 488.9 |

| Leisure and Hospitality | 231.8 | 231.0 | 228.0 |

| Other Services | 118.4 | 119.1 | 117.8 |

| Government | 411.1 | 410.2 | 410.9 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2012. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.