by Jerry Brown

May 2013

Monthly analysis is based on seasonally adjusted employment data.

Yearly analysis is based on unadjusted employment data.*

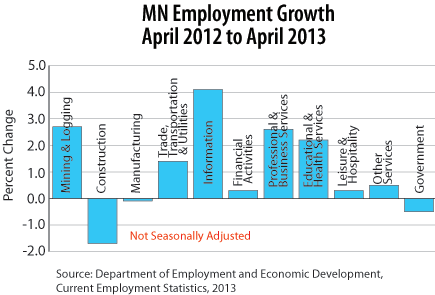

Minnesota employment estimates showed a one-month decline of 11,400 in April, the second consecutive monthly employment loss and the fourth in the last 12 months. Losses were distributed broadly with eight of the 11 supersectors posting declines. More than half the total loss came in Trade, Transportation, and Utilities which fell by 5,700. Other large losses occurred in Government (-2,000), Leisure and Hospitality (-1,900), and Manufacturing (-1,100). There were no large monthly increases but gains of 600 in each of Educational and Health Services and Information. Two consecutive months of losses have significantly lowered the year-over-year rate of change from 2.2 percent in February to 1.0 percent in April. Eight supersectors showed annual growth. The largest gain was in Educational and Health Services which increased 10,500. Large gains were also present in Professional and Business Services, up 8,600, Trade, Transportation, and Utilities, up 6,800, and Information, up 2,200. Slow spring hiring in Construction moved annual employment change back into negative territory, down 1,500, over the past 12 months. Government was down 2,100.

There was no change in employment in Mining and Logging for the month. The supersector showed a gain of 200 compared to one year ago.

Construction employment was down 100 over the last month as seasonal growth was off a bit. It is surprising that the loss was not larger given the record snowfalls and unseasonably cold temperatures. Hiring in Heavy and Civil Engineering Construction was well off for the month with an unadjusted monthly increase of 14.6 percent, about half the usual gain. Counterbalancing this was fairly good performance in Specialty Trade Contractors. Over the past year the supersector showed a loss of 1,500, turning negative for the first time since December 2012 and largely caused by a difference in the seasonal pattern of one year ago compared to this year. For January to March, Census Bureau estimates showed an increase of 14.9 percent in terms of units permitted for construction in Minnesota. Unlike last year, most of this increase has been in single family construction with permits for individual structures up 31.2 percent over the first three months of 2013.

Employment fell for a third consecutive month in Manufacturing, down 1,100 in April and 2,500 over the past three-month period. All of the loss was in Durable Goods Manufacturing. Fabricated Metal Manufacturing was among the weakest performing industries. Over the past 12 months the supersector was down 200 jobs. This was the first instance of year-over-year job loss since the middle of 2010. Durable Goods still showed annual growth of 400 jobs, but was weakened by a loss of more than 700 in Computer and Electronic Product Manufacturing. Nondurable Goods Manufacturing was down 600 jobs, with a substantial loss in Paper Manufacturing and in Printing and Related Support Activities where the closure of one paper plant and reductions at others have hurt employment in the past year. The recent losses came despite fairly positive reports associated with Creighton University's Minnesota Business Conditions Index which has been above growth neutral for five months and stood at 55.7 in April. This indicates expectations for solid but unspectacular growth in the next few months.

Losses in all three major industry components contributed to the extremely large decline of 5,700 in Trade, Transportation, and Utilities (TTU). Transportation, Warehousing, and Utilities was particularly weak, falling 2,800, with notable losses in Trucking and Warehousing and in Delivery Service industries. Wholesale Trade was also down sharply with both Durable and Nondurable Wholesalers posting very weak job growth. This continued a four-month growth-loss cycle with substantial ups and downs but that on net has produced an additional 400 jobs over the four months. Retail fell for a second consecutive month, down 800 in April and 2,300 the past two months. A large part of the monthly loss in Retail was in Building Material and Garden Equipment and Supply, negatively impacted by April's extremely cold and snowy weather. Over the past 12 months TTU added 6,800 jobs with a rather even distribution of growth in the three major component industries. Jobs increased 1.5 percent in Wholesale Trade, 1.4 percent in Retail Trade, and 1.1 percent in Transportation, Warehousing, and Utilities. The delay of spring hiring was evident in over-the-year losses in Building Material and Garden Equipment and Supplies dealers and in Department Stores.

Employment growth totaled 600 over the past month with the supersector posting a sixth month of job growth in the last seven. There were no evident gains in either traditional Publishing or in Telecommunications. Compared to April 2012 the supersector was up 2,200 with nearly all of the gains taking place during the past seven months.

Employment at Insurance Related Companies was a major reason for an April job loss of 700 in Finance and Insurance, and helped produce a loss of 400 in the Financial Activities supersector. Real Estate and Rental and Leasing added 300 jobs to mark a fourth month of growth in the last six months. On an annual basis, employment increased by 700 jobs with nearly all of the gain coming from Real Estate. Insurance Carriers, which had produced solid results during most of the recovery, posted its first annual employment loss since March 2010. Credit Intermediation still showed some vigor, but other areas of Finance are in the doldrums.

There was a small decline of 500 in Professional and Business Services as slight losses occurred in Management of Companies and in Administrative and Support Services. Professional and Technical Services continued to trend upward, adding 3,500 jobs during the past six months. Administrative and Support is showing results all over the map. Employment has fallen in nine of 12 months in the last year, but two sizeable monthly gains outweighed these losses. The supersector added 8,600 jobs compared to last year. More than half of the increases came in Professional, Scientific, and Technical Services, but there were also sizeable annual gains in Administrative and Support and in Management of Companies. Despite some recent weak results, annual growth in Employment Services stood at 6.4 percent in April.

Educational and Health Services added 600 jobs in April. Private Education added 400, while Health and Social Welfare added 200. The gain in Private Education came from outside Primary, Secondary, and College Education which experienced very average monthly employment change. Over the past year employment was up 10,500 jobs with all of the gain in Health Care and Social Assistance. Ambulatory Health Care added 6,100 jobs. There has been a slowing of job growth in Health Care and Social Assistance but no evidence that the upward trend is coming to an end.

The Leisure and Hospitality supersector posted a second consecutive month of decline in April, down 1,900 jobs. A net 3,300 jobs were lost the past two months but did not erase the large gains made over the winter. Since September 2012, the supersector has added a net 4,100 jobs despite the recent losses. All of the current month's decline came in Arts, Entertainment, and Recreation which fell by 2,200 jobs and has seen nearly all of the gains made during the winter disappear the past two months. There is hope for a partial turnaround in May as the poor weather would have impacted seasonal hiring in April, and there is likely to be some additional hiring in May because of this. Over-the-year growth has fallen by 1 percent since January to 0.3 percent in April, mainly caused by poorer results in Arts, Entertainment, and Recreation and in Accommodation.

Other Services employment fell for a third consecutive month, down 900 in April and 1,300 over the past three months. Over the past year the supersector showed a gain of 600 largely from increases last fall and winter.

Employment in Government fell for a third consecutive month, down 2,000 jobs with nearly all of the loss coming from Local Government employment. A substantial volume of seasonal hiring in non-educational Local Government that usually occurs in April was missing. Some losses may be regained in May and June as the seasonal build-up continues. The educational portions of Government performed close to expectations. Compared to April 2012, Government employment was down 2,100 jobs with most of the losses coming from Federal and State Government payrolls.

| Seasonally Adjusted Nonfarm Employment (in thousands) | |||

|---|---|---|---|

| Industry | April 2013 | March 2013 | February 2013 |

| Total Nonfarm | 2,760.6 | 2,772.0 | 2,775.3 |

| Goods-Producing | 410.4 | 411.6 | 410.6 |

| Mining and Logging | 7.3 | 7.3 | 7.3 |

| Construction | 97.7 | 97.8 | 96.5 |

| Manufacturing | 305.4 | 306.5 | 306.8 |

| Service-Providing | 2,350.2 | 2,360.4 | 2,364.7 |

| Trade, Transportation, and Utilities | 511.1 | 516.8 | 516.0 |

| Information | 55.5 | 54.9 | 54.7 |

| Financial Activities | 178.2 | 178.6 | 179.3 |

| Professional and Business Services | 345.7 | 346.2 | 345.1 |

| Educational and Health Services | 486.2 | 485.6 | 487.9 |

| Leisure and Hospitality | 247.8 | 249.7 | 251.1 |

| Other Services | 115.6 | 116.5 | 116.7 |

| Government | 410.1 | 412.1 | 413.9 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2013 | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.