by Amanda Rohrer

September 2013

Monthly analysis is based on seasonally adjusted employment data.

Yearly analysis is based on unadjusted employment data. *

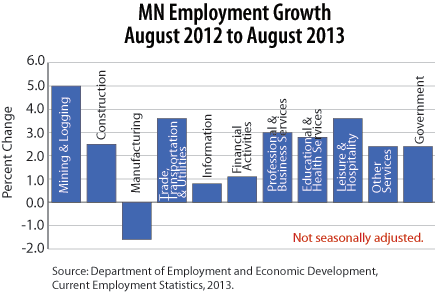

Employment increased by 12,200 in August 2013, and the July 2013 change was revised downward from an increase of 4,300 to an increase of only 2,700. Over-the-year, overall employment increased 63,100 before the seasonal adjustment for a 2.3 percent increase. Although the percent change was similar in Private and in Government employment, Goods Producing declines counterbalanced the effects of healthy gains in most Private Service Providing industries. Government employment increased 1,900 for a 0.5 percent increase, and again this month most of the gains were in Local Government. Goods Producing industries employment fell 2,300 (0.6 percent), driven by losses in Manufacturing (down 3,400 or 1.1 percent). In Service-Providing industries performance was mixed, but only Information and Professional and Business Services saw declines. The two industries driving the upswing were Trade, Transportation, and Utilities and Educational and Health Services, mostly from the education side. August was the first month where employment regained the pre-recession peak from February 2008 of 2,780,900.

Employment in Mining and Logging was flat (0.0 percent and 0 numerically). In fact, employment has been largely flat -- or showed only very small gains -- for the past year and a half, so this is on trend. Hiring in Mining has slowed as new mines reach capacity and slowly rising water levels limit shipping. Logging has suffered along with the printing and paper industry in northern Minnesota.

Construction employment increased 1,100 for a monthly increase of 1.1 percent. Construction permits and starts have been performing well recently, and the good weather helped. Moderate gains in the seasonally adjusted data are a likely response to these factors.

Employment in Manufacturing declined 3,400 (1.1 percent) over the month. After bottoming in January 2010, Manufacturing employment appeared to have been on a growth trajectory. That slowed last year, and only two months this year have seen any gains. While August saw the most substantial monthly loss of the year, combined with the moderate losses of recent months employment is back down to 2011 levels. The bulk of the loss came from Durable Goods manufacturing: Employment fell 2,800 (1.4 percent). But the monthly change doesn't seem to reflect a larger trend in the strength of Manufacturing component industries.

With an increase of 6,000 (1.2 percent), Trade, Transportation, and Utilities employment saw its largest post-recession one-month gain and achieved a new high of 518,700. Retail Trade and Transportation, Warehousing, and Utilities were the subsectors that drove the increases, gaining 3,600 (1.3 percent) and 1,500 (1.6 percent) respectively. While Transportation, Warehousing, and Utilities has been gaining as steadily as the supersector, Retail Trade's trend has been much more sporadic and is frequently reversed by poor months.

Employment in Information decreased 900 (1.6 percent). August was another loss where, year to date, there have been equal monthly losses and gains. The industry has stronger and weaker periods but no clear post-recessionary trend.

Financial Activities employment increased 100 (0.1 percent) over the month and 2,000 (1.1 percent) over the year. The two component industries, Finance and Insurance (up 400, 0.3 percent) and Real Estate and Rental and Leasing (down 300, 0.8 percent) had opposite effects on the total, resulting in the nearly flat total employment change. Real Estate and Rental and Leasing has been seeing balanced gains and losses over the last year. Given reports of the strength of the housing market, August's loss is unexpected.

Employment in Professional and Business Services declined 1,100 (0.3 percent) over the month. Despite frequent poor performance in the industry, which has nearly as many declining months as gaining, employment is up 10,200 (3.0 percent) over the year.

Employment in Educational and Health Services increased 5,500 (1.1 percent). Educational and Health Services is one industry where there have been consistent gains. The last two months were exceptions to that, but August's strong growth has put the industry at a new high, despite a downward revision to the July numbers. In the Educational Services component industry employment increased 4,200 (6.9 percent). The largest part of the Educational and Health Services gain came from Private Education in August. Over the last several years, however, Private Education has been on only a slight and inconsistent growth pattern. August's gain nearly reverses the losses of June and July, but keeps employment in the range that has been normal for the last few years. Health Care and Social Assistance was up 1,300 (0.3 percent), another increase in an industry for which growth has been steady and reliable.

In August, employment in Leisure and Hospitality increased 700 (0.3 percent). Gains were driven by strong growth in Arts, Entertainment, and Recreation (up 1,000, 2.6 percent). In this sub-industry, August's gain neatly reverses July's loss of the same amount. Overall, this is a moderate drop-off from the post-recession peak last winter, although this month it significantly outperformed the other component industry of Leisure and Hospitality, Accommodation, and Food Services. Typically the reverse is true. It is likely an anomaly.

Other Services has seen increases since the recession, but only very slight ones and very inconsistently, with largely alternating gains and losses. August's gain of 2,300 (2.0 percent) was the most substantial single-month change for the industry in the seasonally adjusted series and follows another unusually large change in July.

Employment in Local Government increased 1,200 (0.4 percent). In August, Local Government employment saw slight gains. Following July's unusual gains and speculation about the effects of recent legislation this raises questions. In the unadjusted series the two-month change from June to August is about normal, so it's possible the legislation mostly spurred permanent hires earlier than usual because it eliminated uncertainty. Overall, Government employment increased 1,900 (0.5 percent) for August.

| Seasonally Adjusted Nonfarm Employment (in thousands) | |||

|---|---|---|---|

| Industry | August 2013 | July 2013 | June 2013 |

| Total Nonagricultural | 2,786.0 | 2,773.8 | 2,771.1 |

| Goods-Producing | 404.4 | 406.7 | 409.8 |

| Mining and Logging | 7.4 | 7.4 | 7.4 |

| Construction | 97.6 | 96.5 | 97.9 |

| Manufacturing | 299.4 | 302.8 | 304.5 |

| Service-Providing | 2,381.6 | 2,367.1 | 2,361.3 |

| Trade, Transportation, and Utilities | 518.7 | 512.7 | 512.1 |

| Information | 54.5 | 55.4 | 54.2 |

| Financial Activities | 179.6 | 179.5 | 177.4 |

| Professional and Business Services | 350.0 | 351.1 | 351.9 |

| Educational and Health Services | 489.8 | 484.3 | 487.7 |

| Leisure and Hospitality | 250.9 | 250.2 | 249.4 |

| Other Services | 120.0 | 117.7 | 116.4 |

| Government | 418.1 | 416.2 | 412.2 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2013 | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.