by Brent Pearson and Cameron Macht

September 2013

While it doesn't enjoy the same workforce and economic development focus that the larger Health Care and Manufacturing industries do, Retail Trade is a popular employment option because it offers flexible work conditions, a variety of challenges, has regular vacancies, and accommodates many kinds of skills.

In 2012 there were 173,371 covered jobs across all industries in the 23-county Southwest Minnesota planning region according to data from DEED's Quarterly Census of Employment and Wages program. Of those, 20,095 jobs were in Retail Trade, making it the third largest employing industry in the region, behind Health Care and Manufacturing. Retail Trade provides about 11.6 percent of total employment in Southwest Minnesota, which was 1.0 percent more concentrated than in the state of Minnesota as a whole (see Table 1).

| Table 1: Industry Employment Statistics, 2012 Annual Data | |||||

|---|---|---|---|---|---|

| Region | Industry Title | Number of Firms | Number of Jobs | Total Payroll | Average Annual Wages |

| Southwest Minnesota Planning Region | Total, All Industries | 12,268 | 173,371 | $6,061,511,826 | $34,963 |

| Retail Trade | 1,644 | 20,095 | $412,616,472 | $20,533 | |

| Region 6W - Upper MN Valley | Total, All Industries | 1,605 | 17,929 | $589,705,642 | $32,891 |

| Retail Trade | 207 | 1,807 | $33,361,938 | $18,463 | |

| Region 8 - Southwest | Total, All Industries | 4,040 | 53,677 | $1,789,507,898 | $33,338 |

| Retail Trade | 545 | 6,063 | $124,585,987 | $20,549 | |

| Region 9 - South Central | Total, All Industries | 6,624 | 101,765 | $3,682,298,286 | $36,184 |

| Retail Trade | 893 | 12,226 | $254,668,547 | $20,830 | |

| State of Minnesota | Total, All Industries | 167,213 | 2,644,930 | $130,515,059,105 | $49,345 |

| Retail Trade | 19,212 | 283,243 | $7,178,127,835 | $25,343 | |

| Source: DEED Quarterly Census of Employment and Wages (QCEW) program | |||||

The largest number and highest concentration of retail jobs and total jobs in the planning region are in South Central Minnesota (Region 9), which encompasses Blue Earth, Brown, Faribault, Le Sueur, Martin, Nicollet, Sibley, Waseca, and Watonwan counties, as well as the Mankato-North Mankato metropolitan area. In 2012 Region 9 had 893 Retail Trade establishments providing 12,226 jobs and accounting for 12 percent of total jobs.

Retailers in Southwest Minnesota (Region 8), which includes Cottonwood, Jackson, Lincoln, Lyon, Murray, Nobles, Pipestone, Redwood, and Rock counties, offered 6,063 jobs at 545 establishments in 2012 or 11.3 percent of total jobs. The Upper Minnesota Valley (Region 6W) had the smallest concentration and count of Retail Trade employment with 1,807 jobs at 207 establishments, but it still supplied at least one in every 10 jobs in the five-county - Big Stone, Chippewa, Lac qui Parle, Swift, and Yellow Medicine - region.

With its large number and consistent availability of jobs, Retail Trade's impact on the workforce of Southwest Minnesota cannot be overstated. In addition to current demand, employment in Retail remained relatively stable over the past five years, despite the recession. While industries like Manufacturing, Construction, and Administrative Support and Waste Management Services declined around 10 percent from 2008 to 2009, Retail Trade cut just 2.6 percent of jobs. Although retail sales were affected by swooning consumer confidence, employment did not appear to drop as drastically.

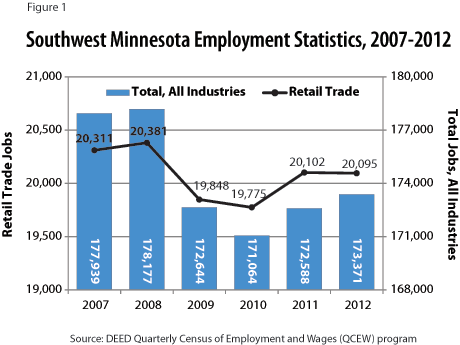

This vital sector has also rebounded at a greater rate than employment across all industries. There are now three full years of recovery-level employment data through 2012, with Retail Trade regaining 98.9 percent of its pre-recession mark in employment. In comparison, the Southwest Minnesota planning region economy is at 97.4 percent of its pre-recession employment level. Jobs in Retail Trade have grown 1.6 percent from 2010 to 2012 compared to a 1.3 percent increase in the total of all industries (see Figure 1).

DEED's most recent Job Vacancy Survey results provide another sign of Retail's recovery in Southwest Minnesota. Retail job vacancies in the second quarter of 2013 were the highest reported since the second quarter of 2004, and were the third highest count since the recession started in 2007. However, Retail Trade has a strong seasonal component, meaning that the fourth quarter job vacancy survey is often a better indicator of retail hiring patterns.

Vacancies are almost always higher during the fourth quarter, as many retail establishments add temporary help to accommodate an increase in business during the holiday rush, typically from October through December, relying on a flexible workforce that often works variable part-time hours for low wages. In the remaining months these retailers are staffed by more permanent, but often still part-time, workers with slightly higher wages.

During the recession Retail's dependence on part-time employment increased, seasonal employment decreased, fourth quarter vacancies dropped significantly, and wage offers hovered around minimum wage. When the recovery started in 2010, hiring activity returned to normal. From the second quarter of 2009 to the second quarter of 2010 retail job vacancies increased by 450 percent, while fourth quarter 2009 to fourth quarter 2010 vacancies increased nearly 800 percent. Likewise, vacancies were up more than 200 percent in 2011 and 2012 compared to 2009 (see Table 2).

| Table 2: Southwest Minnesota Planning Region Job Vacancy Survey Results, 2007-2013 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Q2 2007 | Q4 2007 | Q2 2008 | Q4 2008 | Q2 2009 | Q4 2009 | Q2 2010 | Q4 2010 | Q2 2011 | Q4 2011 | Q2 2012 | Q4 2012 | Q2 2013 | ||

| Total, All Industries | Total Vacancies | 4,104 | 4,556 | 3,232 | 2,998 | 2,087 | 2,265 | 2,791 | 3,120 | 4,260 | 3,506 | 4,345 | 3,638 | 4,734 |

| Percent Part-Time | 36% | 53% | 37% | 35% | 46% | 50% | 48% | 46% | 41% | 45% | 39% | 43% | 39% | |

| Percent Seasonal | 17% | 27% | 14% | 8% | 30% | 8% | 21% | 11% | 24% | 14% | 24% | 13% | 22% | |

| Median Wage Offer | $9.14 | $10.00 | $9.73 | $11.00 | $10.00 | $10.00 | $10.00 | $9.54 | $11.45 | $10.84 | $11.78 | $11.40 | $11.00 | |

| Offers Health Care | 58% | 53% | 71% | 59% | 48% | 58% | 46% | 57% | 39% | 55% | 48% | 57% | 53% | |

| Retail Trade | Total Vacancies | 181 | 673 | 185 | 249 | 109 | 105 | 498 | 810 | 238 | 441 | 305 | 376 | 659 |

| Percent Part-Time | 68% | 80% | 81% | 83% | 82% | 57% | 76% | 71% | 77% | 76% | 77% | 52% | 76% | |

| Percent Seasonal | 2% | 48% | 0% | 19% | 2% | 45% | 5% | 11% | 30% | 37% | 7% | 30% | 20% | |

| Median Wage Offer | $7.00 | $8.00 | $8.00 | $7.50 | $8.00 | $7.25 | $7.96 | $7.94 | $7.96 | $7.92 | $9.13 | $9.16 | $8.97 | |

| Offers Health Care | 98% | 44% | 47% | 13% | 18% | 74% | 37% | 41% | 32% | 27% | 53% | 65% | 28% | |

| Source: DEED Job Vacancy Survey | ||||||||||||||

Because Retail jobs are in constant demand throughout the region, they can be great for workers looking for flexible work schedules, fast-paced work environments, easy to learn job skills through short-term on-the-job training, and opportunities for advancement or job mobility. However, jobseekers might not find opportunities in the industry quite as great if they desire full-time hours, higher wages, or benefits like health care insurance.

Over the course of the last six years, during both the recession and the recovery, Retail Trade has maintained a higher reliance on part-time workers and seasonal hiring than the total of all industries. On average, about 42.5 percent of all job vacancies in the region were part-time compared to 73.9 percent of Retail vacancies.

Likewise, wage offers in Retail Trade were always lower than in other industries, settling between $7.00 and $8.00 per hour from 2007 to 2011, before climbing to $9.00 in 2012. As shown in Table 1, although Retail Trade accounts for 11.6 percent of total jobs, it provides just 6.8 percent of total payroll. Average annual wages were about $15,000 lower in Retail Trade than the total of all industries in Southwest Minnesota, at $20,533 versus $34,963 in 2012, respectively.

While wages are important, many jobseekers now consider benefit packages to be equally important in evaluating the net worth of a job. Table 2 shows that Retail Trade jobs are also less likely to offer health care benefits, though there have been exceptions to that rule over the last six years. Just over half (53.7%) of all job vacancies in the region during that time frame have offered health care benefits compared to 41.3 percent of Retail vacancies.

While this rebound in Retail employment is encouraging for jobseekers, is it sustainable? According to DEED's 2010 to 2020 employment projections, Southwest Minnesota is projected to gain about 21,500 jobs over the decade, a 10 percent increase. Retail Trade employment is expected to expand 7.6 percent from 2010 to 2020, a rise of just over 1,500 jobs.

Nine Retail subsectors are projected to exceed that overall rate of growth; ranging from a 62.6 percent increase in Other General Merchandise Stores to a 24.1 percent jump in Sporting Goods and Musical Instruments Stores to a 14.8 percent boost in Clothing Stores. Five other subsectors are also expected to grow between 1.5 and 8.5 percent over the next decade (see Table 3).

| Table 3: Southwest Minnesota Projected Retail Trade Employment Growth, 2010-2020 | ||||

|---|---|---|---|---|

| Industry | Estimated 2010 Employment | Projected 2020 Employment | Percent Change (2010-2020) | Numeric Change (2010-2020) |

| Total All Industries | 206,339 | 227,716 | +10.0% | +21,377 |

| Retail Trade | 19,812 | 21,316 | +7.6% | +1,504 |

| Other General Merchandise Stores | 1,691 | 2,750 | +62.6% | +1,059 |

| Furniture Stores | 254 | 320 | +26.0% | +66 |

| Sporting Goods/Music Instrument Stores | 439 | 545 | +24.1% | +106 |

| Beer, Wine, and Liquor Stores | 183 | 219 | +19.7% | +36 |

| Other Miscellaneous Store Retailers | 303 | 362 | +19.5% | +59 |

| Health and Personal Care Stores | 978 | 1,155 | +18.1% | +177 |

| Building Material and Supplies Dealers | 1,451 | 1,700 | +17.2% | +249 |

| Other Motor Vehicle Dealers | 144 | 166 | +15.3% | +22 |

| Clothing Stores | 745 | 855 | +14.8% | +110 |

| Auto Parts, Accessories, and Tire Stores | 692 | 750 | +8.4% | +58 |

| Home Furnishings Stores | 130 | 140 | +7.7% | +10 |

| Direct Selling Establishments | 323 | 346 | +7.1% | +23 |

| Automobile Dealers | 1,290 | 1,363 | +5.7% | +73 |

| Jewelry, Luggage, and Leather Stores | 125 | 127 | +1.6% | +2 |

| Grocery Stores | 4,282 | 4,260 | -0.5% | -22 |

| Gasoline Stations | 2,355 | 2,204 | -6.4% | -151 |

| Specialty Food Stores | 307 | 285 | -7.2% | -22 |

| Department Stores | 2,544 | 2,340 | -8.0% | -204 |

| Lawn and Garden Equip./Supplies Stores | 184 | 168 | -8.7% | -16 |

| Florists | 99 | 67 | -32.3% | -32 |

| Book, Periodical, and Music Stores | 119 | 43 | -63.9% | -76 |

| Source: DEED 2010-2020 Employment Outlook data tool | ||||

But like any industry, advances in technology and productivity could impact employment. The projections also show that many Retail Trade subsectors will likely lose jobs. Southwest Minnesota retailers are not immune to changes like online music downloads replacing the need for music stores, or online retailers such as Amazon cutting into the number of brick-and-mortar bookstores. Nor are rising gasoline prices likely to spare local gasoline stations from throttling back on employment to meet profit margins.

These productivity increases and changes in technology - such as self-service checkouts that allow employers to decrease the number of cashiers on staff - may impact the future workforce, perhaps significantly. Despite these advances, consumers still need to buy some things locally and there will still be a need for workers to assist them.

Analysis of the demographic profile of Retail Trade jobs in Southwest Minnesota can also help anticipate if there will be a need for more or fewer workers in the future. Data from DEED's Quarterly Workforce Indicators program provides detail on the age groups most likely to be working Retail, with notable changes over time.

In the second quarter of 2012 almost one-third (31.5%) of the Retail Trade workforce in Southwest Minnesota was under 25 years of age compared to just 16.2 percent across all industries collectively. In contrast, less than half (48.0%) of Retail workers were in the 25 to 54 year old age group compared to 61 percent of all workers. Finally, about one-fifth (20.5%) of workers in Retail Trade were 55 years and over, which was slightly lower than the 22.9 percent of workers in all industries (see Table 4).

| Table 4: Southwest Minnesota Workforce Demographics, Q2 2007-Q2 2012 | ||||||

|---|---|---|---|---|---|---|

| Retail Trade | Total, All Industries | |||||

| 2012 Workforce | 2012 Percent | 2007 Percent | 2012 Workforce | 2012 Percent | 2007 Percent | |

| 14-18 years | 2,309 | 9.9% | 13.7% | 6,590 | 3.6% | 4.9% |

| 19-21 years | 2,697 | 11.6% | 11.4% | 10,332 | 5.6% | 6.3% |

| 22-24 years | 2,340 | 10.0% | 9.8% | 12,813 | 7.0% | 7.3% |

| 25-34 years | 4,399 | 18.8% | 17.3% | 38,620 | 21.0% | 19.3% |

| 35-44 years | 2,870 | 12.3% | 14.4% | 32,855 | 17.9% | 19.6% |

| 45-54 years | 3,943 | 16.9% | 16.9% | 40,702 | 22.1% | 23.6% |

| 55-64 years | 3,275 | 14.0% | 10.7% | 32,266 | 17.5% | 14.3% |

| 65 years and over | 1,515 | 6.5% | 5.7% | 9,838 | 5.3% | 4.7% |

| Source: DEED Quarterly Workforce Indicators (QWI) program | ||||||

Often used as the source of a first job, the Retail Trade industry employed 35 percent of the region's 14 to 18 year old workers, 26 percent of 19 to 21 year old workers, and 18 percent of 22 to 24 year old workers, but only about 10 percent of the 25 to 64 year old workers. With the flexible hours and job training requirements, Retail Trade now also employs just over 15 percent of the region's oldest workers, 65 years and over.

Much like the jobs themselves, the demographic profile of the workers shifted during the recession. While workers under 25 years of age still make up the largest pool of workers in the industry, the percentage of younger workers declined significantly over the last six years, dropping from 34.9 percent of total workers in 2007 to 31.5 percent in 2012. Teenagers saw the biggest decline in employment during the recession as they were replaced by older workers (see Table 4).

Instead, the percentage of Retail Trade workers that were 55 years and over jumped from 16.4 percent in 2007 to 20.5 percent in 2012. Although the percentage of workers in the 25 to 54 year old age groups stayed essentially the same, the Retail Trade workforce aged faster than the total of all industries in the last six years, with fewer younger workers and more older workers.

Given the flexibility of the industry from higher amounts of part-time employment and seasonality, retailers have come to rely on two key age groups for workers - under 25 and over 55 years of age. Essentially, jobs in Retail Trade afford high school and college students, as well as older or retired workers looking for part-time work, an opportunity to participate in the labor force in a flexible work environment. During the recession and recovery, it also provided an alternative for people seeking to retain employment between jobs, after a layoff, immediately following college, or after retiring from a career. And though technology will change the job requirements, demand for the jobs will likely remain strong in the future.