by Amanda Rohrer

August 2013

Monthly analysis is based on seasonally adjusted employment data.

Yearly analysis is based on unadjusted employment data.*

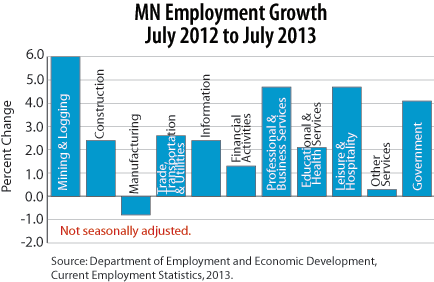

Employment increased by 4,300 in July 2013, and the June 2013 change was revised downward from an increase of 400 to a decrease of 1000. Private sector results were mixed with nearly all of the gains occurring in Government - specifically Local Government which added 3,800 jobs for a 1.3 percent increase. In the Private Sector most gains were in Service-Providing industries, while losses were in Goods-Producing. Construction fell 1.7 percent (1,700), and Manufacturing fell 0.5 percent (1,400). Information gained 2.0 percent (1,100), Financial Activities gained 1.3 percent (2,300), and Other Services gained 1.1 percent (1,300). The one significant decline in Services was in Educational and Health Services, which fell 0.5 percent (2,600) for the month. The industry weathered the recession well and has seen few seasonally adjusted declines overall, so this is unusual. Employment growth has alternated between positive and negative nearly every month of this year. Despite the inconsistency of growth, we're at a post-recession high and have only 5,500 jobs to go to regain February 2008's peak.

Employment was flat (0.0 percent and 0 numerically). Employment in Mining and Logging has been largely flat or seen only very small gains for the past year and a half, so this is on trend.

Construction losses of 1,700 (1.7 percent) seasonally adjusted were disappointing, considering reports of the industry's recovery. However, employment is up 10,300 since the recessionary trough in May 2010. Although subsectors are not seasonally adjusted, unadjusted data suggest that Residential Building Construction hiring is outperforming the typical July, while Heavy and Civil Engineering Construction and Specialty Trade Contractors are not.

Manufacturing employment declined 1,400 (0.5 percent) over the month. This is the fifth decline in the last six months. Durable Goods Manufacturing was up 500 (0.3 percent); Non-Durable Goods Manufacturing was down 1,900 (1.7 percent). There has been no consistent pattern in recent months indicating that neither of those subsectors is solely responsible for the overall direction of the industry.

With a decline of only 200 jobs Trade, Transportation, and Utilities saw 0.0 percentage change on a seasonally adjusted basis for July. Over the course of the year, most months have seen slight increases with only two exceptions this spring. The component industries have seen more disparate results in individual months, but their over-the-year increases of 1.9 percent (Wholesale Trade), 2.3 percent (Retail Trade), and 4.4 percent (Transportation, Warehousing, and Utilities) have been generally consistent with the overall annual increase of 2.6 percent.

June marked a significant gain of 1,100 (2.0 percent) after two months of declines and returns the seasonally adjusted total employment for the industry to its highest level since March 2009, tied with April 2013. This appears to be a return to growth after an anomalous couple of months. The over-the-year increase was 1,300 (2.4 percent).

Employment in Financial Activities increased 2,300 (1.3 percent) over the month. The over-the-year increase of 2,400 (1.3 percent) has been brought about by as many monthly losses as increases as employment growth has been inconsistent. Component industry Finance and Insurance employment increased 1,600 (1.2 percent) marking a post-recession high for the industry, but in the past year there have been as many falling months as increasing. In Real Estate and Rental and Leasing, employment increased 700 (1.8 percent). The industry has been seeing balanced gains and losses over the last year, with a net increase of 100 in employment. Given reports of the strength of the housing market, this is a little unexpected.

Professional and Business Services employment grew 100 over the month (0.0 percent). Over-the-month gains in Professional and Technical Services (up 1,300, 1.0 percent) and Management of Companies (up 100, 0.1 percent) were counterbalanced by a loss in Administrative and Support Services (down 1,300, 0.9 percent). Employment in the industry has been growing in fits and starts, but overall it is up 4.7 percent (16,200) over the year.

Employment in Educational Services declined 4,200 (6.5 percent). The loss was entirely from Private Education, which was counterbalanced a little by gains in Health Care and Social Assistance of 1,600 or 0.4 percent. The industry achieved its post-recession peak in July 2011 and has seen losses and spotty gains since.

In July, employment in Leisure and Hospitality increased 1,400 (0.6 percent). The industry has been performing well over the last year, with an increase of 4.7 percent (12,200). Accommodation and Food Services is responsible for most of the gains over the month, increasing 1.0 percent (2,200) while Arts, Entertainment, and Recreation fell 2.0 percent (800).

The employment increase of 1,300 (1.1 percent) in Other Services more than cancels out last month's decline in an industry that has remained fairly stable for the last few years. Despite the inching growth, the seasonally adjusted employment level of 117,700 is the highest it's been post-recession.

The gains in Local Government are much stronger than expected, increasing 3,800 (1.3 percent). It seems most likely that this can be credited to a substantial new state funding bill for early childhood education since in the unadjusted data this increase comes from an unusually small decline in Local Government Education, and it's seen in most individual units and is not driven by a single locality. Compared to Local Government's monthly change, the slight decline in Federal Government (down 300, 1.0 percent) and increase in State Government (up 500, 0.5 percent) were less significant.

| Seasonally Adjusted Nonfarm Employment (in thousands) | |||

|---|---|---|---|

| Industry | July 2013 | June 2013 | May 2013 |

| Total Nonfarm | 2,775.4 | 2,771.1 | 2,772.1 |

| Goods-Producing | 406.7 | 409.8 | 411.5 |

| Mining and Logging | 7.4 | 7.4 | 7.2 |

| Construction | 96.2 | 97.9 | 98.6 |

| Manufacturing | 303.1 | 304.5 | 305.7 |

| Service-Providing | 2,368.7 | 2,361.3 | 2,360.6 |

| Trade, Transportation, and Utilities | 511.9 | 512.1 | 509.5 |

| Information | 55.3 | 54.2 | 54.7 |

| Financial Activities | 179.7 | 177.4 | 178.5 |

| Professional and Business Services | 352.0 | 351.9 | 348.0 |

| Educational and Health Services | 485.1 | 487.7 | 488.2 |

| Leisure and Hospitality | 250.8 | 249.4 | 249.2 |

| Other Services | 117.7 | 116.4 | 117.0 |

| Government | 416.2 | 412.2 | 415.5 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2013. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.