by Dave Senf

July 2013

The U.S. economic recovery, which is now four years old, looks to be headed for another year of modest real GDP growth, with growth hovering around the 2 percent range. The nation's economy has averaged 2.1 percent growth over the last three years which by historical standards is subpar given the depth and length of the Great Recession. Growth will be curbed during the first half of the year as the federal sequester cuts take effect. But the long-awaited housing recovery will gain strength through the year offsetting the drag of federal austerity and helping to accelerate growth by the end of the year.

As of May the nation had regained 6.9 million of the 8.8 million private sector wage and salary jobs lost between 2008 and 2010. On the public side employment climbed from 2008 to 2010, partly from Census hiring, but is now down around half a million from early 2008 when total employment peaked. The net effect is that national wage and salary employment is 2.4 million below the peak reached in January 2008. About 72 percent of the Great Recession job loss had been recaptured as of May 2010.

Unemployment has been slow to improve as a result of the modest pace of the job rebound. May's 7.6 percent unemployment rate, while down from the 10.0 percent peak in October 2010, is still a long way from the 4.6 annual rates in 2006 and 2007. The slow downward drift in the unemployment rate is actually worse than it looks as a good share of the decline can be attributed to workers dropping out of the workforce. Labor force participation has dropped nearly 4 percentage points since 2007 as discouraged job seekers stopped looking for work or headed to school to upgrade their skills. The number of workers unemployed in May, 11.2 million, is more than 40 percent higher than in May 2007.

Fiscal austerity and weak global growth, especially in Europe, are expected to produce a third consecutive year of modest job growth for U.S. workers. Manufacturing, which had been a bright spot during the early stage of the recovery, is slowing as export growth tails off. Monthly job gains will average around 160,000, down slightly from the 170,000 average in 2012. Layoff rates have dropped to prerecession levels but hiring remains tepid. Hiring is expected to pick up in the second half of 2013 as consumer spending and the rebounding housing market emerge as sources of growth.

Household finances have gradually improved over the last four year as debt has been whittled down. Rising home values and the stock-market rally have also bolstered households' balance sheets. Consumer confidence recently climbed to a five-year high which suggests that households may begin to ramp up their spending even though income growth has been lackluster. Consumer spending will also benefit from housing-related purchases as the housing market gains momentum. The housing market revival will drive home-building activity up toward more nearly normal levels. Residential construction usually leads the economy out of downturns but until last year had been a drag on growth.

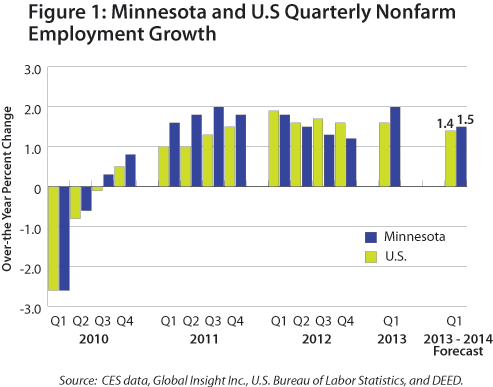

Minnesota's job recovery is further along than the national recovery as of May. The state has reclaimed 93 percent of the 160,000 jobs lost in 2008-09 compared to the 72 percent recaptured nationally. Minnesota's job loss was less steep than nationwide, 5.8 percent compared to 6.3 percent, and job growth in the state was sustainably stronger in 2011 before cooling to just slightly behind the national pace last year (Figure 1).

A number of other indicators point toward Minnesota's economy and labor market having made more progress since the recession than the nation has (Table 1). Minnesota's unemployment rate had historically averaged 1.4 percentage points below the national rate but spiked to the national rate for most of 2007 and 2008. After reaching a 26-year high of 8.3 percent in 2009, the state's unemployment rate started to fall gradually while the U.S. rate continued to head upward before finally peaking at 10.0 percent. The national rate remained stuck above 9.0 percent for 16 months while Minnesota's rate slowly but gradually improved. Minnesota's unemployment rate has been running 2 percentage points or more below the U.S. rate for nearly four years now.

| Minnesota's Recovery vs. U.S. Recovery | |||

|---|---|---|---|

| Rate | Minnesota | U.S. | Source |

| Wage and Salary

Employment Rebound (as of May 2013) |

93 percent of jobs lost recaptured | 72 percent of jobs lost recaptured | Current Employment Statistics |

| Household Employment

(May 2007 - May 2013) |

2.3 percent higher than six years ago | 1.3 percent lower than six years ago | Local Area Unemployment Statistics |

| Unemployment Rate | Down 3.0 percentage points from 8.3 peak | Down 2.4 percentage points from 10.0 peak | Local Area Unemployment Statistics |

| Unemployed Workers

(May 2007 to May 2103) |

18 percent higher than six years ago | 78 percent higher than six years ago | Local Area Unemployment Statistics |

| Labor Force Growth

(May 2007 to May 2103) |

3 percent larger than six years ago | 2 percent larger than six years ago | Local Area Unemployment Statistics |

| Per Capita Income

(Pre-recession peak vs. 2012 level) |

0.3 percent less than pre-recession peak | 2.4 percent less than pre-recession peak | Bureau of Economic Analysis |

| Real GDP

(2007 level vs. 2012 level) |

6.1 percent larger than five years ago | 2.5 percent larger five years ago | Bureau of Economic Analysis |

Minnesota's unemployment rate has been 2 plus percentage points lower than the U.S. rate for an extended time period only one other time. That time period was right after the 1990-91 recession. Minnesota, unlike many other parts of the country, didn't experience a jobless recovery in 1992-94. Instead job growth rebounded much faster in Minnesota than nationwide helping to improve the state's rating across many economic statistics including per capita income and median household income.

Minnesota's first jobless recovery came after the 2001 recession when state's recovery lagged slightly behind the national rebound. This time the state is bouncing back faster than many parts of the country much like the 1991-94 period. Household employment, which includes the self-employed and agricultural employment, is 2.3 percent higher than six years ago in Minnesota but still down 1.3 percent nationwide. The number of unemployed workers in the U.S. is still a staggering 78 percent higher than six years ago while in Minnesota the jobless total is only 18 percent higher. GDP (Gross Domestic Product) and per capita income, two more comprehensive measures of economic well-being, have both improved in Minnesota relative to the U.S. over the last few years. Minnesota's per capita income was 8.3 percent above the U.S. level. That is the highest the state's per capita income has been compared to the U.S. since the record high 9.2 percent advantage in 2004.

Most leading indicators suggest that Minnesota's painfully slow job recovery will continue for the rest of the year with job spurts followed by periods of small declines or no growth. Initial claims for unemployment are near pre-recession levels. Online help-wanted ads for Minnesota jobs have slipped slightly over the last few months but still account for a higher percent of national help-wanted ads than is warranted by Minnesota's share of national employment. Minnesota's Purchasing Manager Index (PMI), a leading index similar to the national PMI, has been above the growth neutral reading of 50 for six straight months and has been outpacing the national level for most of that time.

Perhaps most important is the pickup in Minnesota's home-building industry. After several false starts over the last three or four years, home construction finally looks to be on a sustainable recovery path. Job growth from a rebounding housing industry will spur more than just stepped-up construction hiring. Higher hiring in other construction-related industries will be generated by an acceleration in home-building activity.

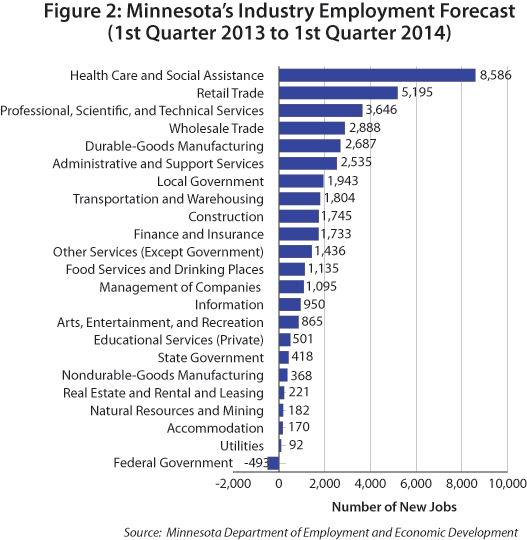

Minnesota's expected job gains over the next year will again be led by the Health Care and Social Assistance and the Retail Trade sectors. These two sectors accounted for 37 percent of payroll expansion last year and will generate 35 percent of the new jobs in 2013. Every other sector except for Federal Government will add jobs in 2013. Last year all sectors except Federal Government, Educational Services, and Accommodations increased their workforce numbers. The expanding sectors will add around 41,200 jobs, but the federal employment cuts will bring net job growth down to 39,700.

Job growth across most sectors is expected to be down slightly from last year, but five sectors will be adding more jobs this year than in 2012. Educational Services, Accommodation, and State Government will experience the largest pickup in hiring over the next 12 months. Forecasts for job growth across 23 Minnesota sectors between the first quarter of 2013 and first quarter of 2014 are displayed in Figure 2.

Employment in Natural Resources and Mining cooled last year, increasing less than half as fast as in 2011. Worldwide steel demand plunged during the Great Recession, forcing large layoffs on the Iron Range four years ago. Taconite employment rebounded with the 2011 recovery in the world steel market, but less growth is expected this year as the global economic growth slows. New mining developments are planned for the Iron Range, but the anticipated job boost is still a couple of years away. Frac sand mining will add some jobs in Minnesota this year, but the pace will continue to trail Wisconsin's booming frac sand mining operations. A small gain in logging-related jobs is expected in 2013 as the industry benefits from a moderate rebound in home-building.

Construction employment will record its third straight year of growth in 2013 following six years of decline from 2006 to 2010. Home-building activity will continue to improve during 2013 helping to boost demand for construction workers. Commercial and Industrial Construction is showing signs off taking off, but a sustained recovery is still probably a year or two away. The 2,700 new construction jobs predicted by 2014 will push construction employment up to roughly 75 percent of its peak workforce during the housing boom years of 2005-06.

Payroll numbers at Minnesota's Durable-Goods Manufacturers will increase again in 2013, extending job growth for the third year in a row. A slowdown in U.S. exports will limit any significant pickup in hiring. Employment growth will end up being similar to last year's growth with around 2,700 jobs added. Fabricated metal products and machinery manufacturing hiring will offset layoffs in computer and electronic products.

Nondurable Goods Manufacturing employment will also see its third straight year of expansion. This sector hasn't seen three consecutive years of job growth since the mid-1990s. Job growth this year will be 0.3 percent, a slight improvement over last year's 0.1 percent gain. Small workforce expansion in Food, Chemical, and Plastic and in Rubber Products Manufacturing will offset more losses in Printing.

Wholesale trade payrolls spiked last year with more than 5,000 workers added. Hiring will slow this year but the sector will still add nearly 3,000 jobs. The job growth will be split almost evenly between durable and nondurable wholesalers. This sector's workforce is on track to top its pre-recession total in late 2014 or early 2015.

Retail Trade employment dropped three straight years between 2008 and 2010 before beginning to rebound in 2011. Consumer spending will continue to increase gradually in Minnesota this year as the improving labor market leads to modest wage growth. The advance in consumer spending will generate roughly 5,200 retail jobs over the next 12 months. That's down slightly from last year but about the same as in 2011. About half of the Retail Trade jobs lost during the Great Recession will have been recaptured by 2014.

Minnesota's utilities added 130 jobs last year and will add another 100 this year. Utilities have added on average 50 new positions per year during the last decade, so the predicted hiring this year will be a notch above average.

The deep economic downturn drove Transportation and Warehousing payroll numbers down nearly 7,000 jobs between the first quarter of 2008 and the first quarter of 2010. Since then the sector has regained roughly 5,000 of the lost jobs. Another 1,800 jobs are expected to be added in 2013 bringing the sector's employment base close to its 2008 total of 95,000. That is still way below the sector's peak payroll total of 103,000 workers achieved in 2000. Minnesota lost a ton of Air Transportation jobs ten years ago that will take at least another decade to top through employment growth in other transportation industries like Trucking.

The Information sector broke an 11-year string of job declines last year, adding 2,000 jobs. Employment growth is expected to be about half as large this year. Job loss in Publishing and Telecommunications is expected again this year, but cutbacks are expected to be lower than in previous years. Job growth has been accelerating in Other Information Services.

Minnesota's Finance and Insurance workforce came out of the financial crisis four years ago in much better shape that the sector did nationally. Minnesota's finance and insurance companies reduced payrolls by roughly 5.5 percent between 2007 and 2010 while nationally the sector lost 7.5 percent of its workforce. Minnesota finance and insurance employment has grown by 3 percent compared to 2 percent nationwide. The state will add jobs in this sector for the third consecutive year with about 1,700 new jobs anticipated in 2013.

Real Estate and Rental and Leasing employment has been on the upswing since 2010 after having declined by more than 7 percent between 2008 and 2010. The trend is expected to continue this year, but job growth will be down from last year, declining to about 200 new jobs this year from 600 new jobs last year.

Job expansion in Professional, Scientific, and Technical Service companies was one of the most promising developments in Minnesota's job picture last year. The sector added 4,700 positions in 2012 after having expanded by 3,100 jobs in 2011. Another 3,600 jobs in this high-paying sector are anticipated this year. Last year was the first year in a long time that Minnesota's job growth in this sector exceeded the national pace.

This sector is composed of employment at corporate, subsidiary, and regional headquarters offices and holding companies. Since 2006 employment in this sector has declined only in 2010. More growth is anticipated over the next 12 months with another 1,100 jobs added by 2014.

Employment in the Administration and Support sector nosedived by 13 percent during the Great Recession but has come roaring back since. Temporary employees are included in this sector and accounted for a large share of the decline and the rebound. An additional 2,500 new jobs are expected this year pushing this sector to its all-time employment high for the second year in a row.

Private Educational Services payrolls slipped for the first time in 14 years last year. Employment is expected to rebound partially this year, increasing by 500 jobs - about half of the 1,100 jobs lost last year. Most of the job reduction was in post-secondary institutions.

Employment growth in the huge Health Care and Social Assistance sector lost some steam around the recession but has accelerated sharply over the last two years. After adding nearly 9,000 jobs in 2011, the sector picked up hiring in 2012, adding another 12,000 workers. The sector's hiring pace is expected to slow this year, but another 8,600 jobs will be added.

Employment in Arts, Entertainment, and Recreation dipped between 2008 and 2010 but has bounced back over the last two years. Total employment reached a record high last year, and the sector will add to its workforce again in 2013 with nearly 900 new jobs expected.

After declining by a combined 10 percent in 2008 and 2009, employment in Minnesota's lodging sector appeared ready to bounce back after climbing by 2 percent in 2010. Instead, employment in the sector has been nearly flat over the last two years. The picture is expected to improve only marginally in 2013 with job growth predicted to increase by 0.7 percent or about 170 jobs.

After 17 years of adding employees, Food Services and Drinking Places firms reduced their payrolls between 2008 and 2010 as Minnesotans cut back on dining out when personal income dropped during the recession. As personal income started to rebound in 2011, the restaurant business started to rebound, and job growth returned to the sector. Job growth was 1,500 last year and is predicted to be 1,100 this year. This year's job growth may be enough to push Food Services and Drinking Places employment above the pre-recession peak.

Jobs in the All Other Services sector declined in five out of the seven years between 2004 and 2010 before recording growth over the last three years. This positive trend is expected to continue in 2013 with more than 1,400 new jobs anticipated. This year's job growth will bring Other Services employment up to 117,000 or about 2,000 jobs short of the record high of 119,000 reported in 2003.

Minnesota's improving fiscal picture will translate into Local and State Government job growth, but Federal Government jobs will continue to shrink in 2013. Federal Government employment in Minnesota will decline for the fourth straight year in 2013 with almost 500 jobs expected to be cut. Local Government payrolls dropped for four years between 2008 and 2011 before bouncing back strongly in 2012. Payroll numbers at the local level are expected to jump again in 2013 increasing by 1,900. The additional jobs will leave Local Government employment two to three thousand jobs short of the all-time high of 292,000 employed in 2002. State Government employment is expected to add around 400 positions in 2013 after changing little last year and dropping by 1,300 positions in 2011. State Government job growth is expected to be split evenly between higher education institutions and all other state government agencies.

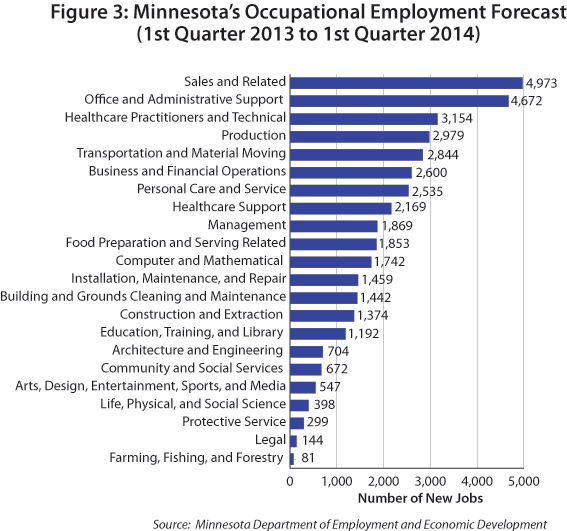

The 39,700 new jobs expected between the first quarters of 2103 and 2104 will be spread across all major occupational groups as job growth spills across most industries during the fourth year of Minnesota's economic recovery. During the Great Recession years only a handful of the 22 major occupational groups experienced employment growth since most industries reduced their workforce. Only occupations concentrated in industries that for the most part avoided the worse of the Great Recession managed to grow between 2008 and 2010. Healthcare practitioners and technical occupations are prime examples of occupations that continued to add positions through the recession years.

Employment climbed in 18 occupational groups over the last two years as the job market gradually strengthened. Payroll numbers will even start to expand this year in three major occupational groups - in business and financial, in education, training, and library, and in farming, fishing, and forestry - that have shrunk during the previous three years.

Eight occupational groups are expected to add more than 2,000 jobs each the next 12 months (Figure 3), and 12 of the groups are expected to grow faster than overall job growth. The fastest growing major groups are expected be healthcare support and personal care and services. Employment in education, training, and library occupations and protective service occupations will be the slowest growing.

More than 85 percent of Minnesota's 786 occupations are expected to experience employment growth over the next 12 months. Most of the increasing occupations, 575 to be precise, will see employment gains of less than 100 jobs. These occupations combined accounted for roughly 34 percent of jobs in 2013 and are predicted to account for 29 percent of employment growth.

Approximately 8 percent of occupations are expected to see little change in employment totals over the next year. These occupations are concentrated in industries predicted to show little job growth in the short-term. Only 50 occupations will shrink over the next 12 months. Job losses in these occupations will add up to roughly 700 positions. Postal service mail sorter and postal service clerk jobs are expected to shrink the most as the Post Office continues to reduce its workforce.

The fastest growing occupations will add employees at a rate two or three times faster than the 1.5 percent total employment expansion. Biomedical engineers, chiropractors, and veterinary technologists are expected to be the frontrunners among occupations growing the fastest (Table 2). The 20 fastest growing occupations combined will account for just more than 4,000 new jobs or roughly 10 percent of forecasted job growth.

| Top 20 Fastest Growing Occupations | Estimated 1st Quarter 2013 Employment | Forecast 1st Quarter 2014 Employment | Forecast Percent Change | Forecast Numerical Change |

|---|---|---|---|---|

| Biomedical Engineers | 996 | 1,053 | 5.7 | 57 |

| Chiropractors | 987 | 1,034 | 4.8 | 47 |

| Veterinary Technologists and Technicians | 2,019 | 2,108 | 4.4 | 89 |

| Veterinarians | 1,363 | 1,423 | 4.4 | 60 |

| Helpers--Carpenters | 536 | 559 | 4.3 | 23 |

| Tree Trimmers and Pruners | 718 | 747 | 4.0 | 29 |

| Massage Therapists | 1,963 | 2,042 | 4.0 | 79 |

| Veterinary Assistants and Laboratory Animal Caretakers | 998 | 1,036 | 3.8 | 38 |

| Meeting and Convention Planners | 1,572 | 1,631 | 3.8 | 59 |

| Nonfarm Animal Caretakers | 2,245 | 2,329 | 3.7 | 84 |

| Dispensing Opticians | 1,528 | 1,585 | 3.7 | 57 |

| Cabinetmakers and Bench Carpenters | 2,355 | 2,439 | 3.6 | 84 |

| Personal and Home Care Aides | 46,464 | 48,105 | 3.5 | 1,641 |

| Multi-Media Artists and Animators | 776 | 803 | 3.5 | 27 |

| Home Health Aides | 37,888 | 39,179 | 3.4 | 1,291 |

| Brickmasons and Blockmasons | 940 | 972 | 3.4 | 32 |

| Demonstrators and Product Promoters | 1,066 | 1,102 | 3.4 | 36 |

| Market Research Analysts and Marketing Specialists | 9,711 | 10,033 | 3.3 | 322 |

| Actuaries | 695 | 718 | 3.3 | 23 |

| Marriage and Family Therapists | 1,004 | 1,037 | 3.3 | 33 |

| Source: Minnesota Department of Employment and Economic Development | ||||

Many of the occupations that are expected to add the most jobs are familiar, having made the top 20 list in past years (Table 2). These occupations are either concentrated in industries that are expanding rapidly or are large-sized occupations that add workers even when the economy is growing only moderately. Personal and home care aides, home health aides, and registered nurses are examples of occupations adding significant levels of new workers as a result of strong Health Care and Social Assistance sector employment growth. General office clerks, cashiers, and truck drivers are large-size occupations that add significant number of jobs as the economy expands. Almost 40 percent of all the new jobs that are expected to be created between the first quarter of 2013 and first quarter of 2014 will be in one of the 20 occupations listed in Table 3.

| Top 20 Occupations Adding the Most Jobs | Estimated 1st Quarter 2013 Employment | Forecast 1st Quarter 2014 Employment | Forecast Percent Change | Forecast Numerical Change |

|---|---|---|---|---|

| Retail Salespersons | 81,796 | 83,868 | 2.5 | 2,072 |

| Personal and Home Care Aides | 46,464 | 48,105 | 3.5 | 1,641 |

| Home Health Aides | 37,888 | 39,179 | 3.4 | 1,291 |

| Combined Food Preparation and Serving Workers | 53,544 | 54,776 | 2.3 | 1,232 |

| Registered Nurses | 56,449 | 57,632 | 2.1 | 1,183 |

| General Office Clerks | 60,530 | 61,379 | 1.4 | 849 |

| Cashiers | 58,701 | 59,477 | 1.3 | 776 |

| Truck Drivers, Heavy and Tractor-Trailer | 30,689 | 31,420 | 2.4 | 731 |

| Janitors and Cleaners | 42,475 | 43,159 | 1.6 | 684 |

| Customer Service Representatives | 43,643 | 44,268 | 1.4 | 625 |

| Sales Representatives, Wholesale and Manufacturing | 27,378 | 27,917 | 2.0 | 539 |

| Laborers and Freight, Stock, and Material Movers, Hand | 30,705 | 31,229 | 1.7 | 524 |

| Bookkeeping, Accounting, and Auditing Clerks | 35,940 | 36,452 | 1.4 | 512 |

| Business Operations Specialists, All Other | 39,150 | 39,645 | 1.3 | 495 |

| Supervisors/Managers of Retail Sales Workers | 22,729 | 23,198 | 2.1 | 469 |

| Landscaping and Groundskeeping Workers | 12,694 | 13,067 | 2.9 | 373 |

| Nursing Aides, Orderlies, and Attendants | 31,511 | 31,870 | 1.1 | 359 |

| Software Developers, Applications | 15,373 | 15,726 | 2.3 | 353 |

| Receptionists and Information Clerks | 20,749 | 21,094 | 1.7 | 345 |

| Supervisors/Managers of Office/Administrative Support Workers | 24,510 | 24,844 | 1.4 | 334 |

| Source: Minnesota Department of Employment and Economic Development | ||||

Job openings related to employment growth, while an important component of the job market, account for a small slice of all job openings available to job seekers. Most openings are created by employee turnover, which occurs for a variety of reasons. A nurse working at a hospital job hops over to a health clinic for better hours. An engineer switches careers, becoming a high school math teacher. A 25-year-old housekeeper earns her degree in accounting and leaves for a job in her field. Or a 60-year old machinist retires from his manufacturing firm after working there for 30 years.

While data limitations preclude reliable estimates of job openings arising from workers switching employers but still working in the same occupation, census data on occupational changes by workers can be used to estimate 'replacement' openings. Replacement openings arise as workers leave occupations, not just change employers. Some workers switch occupations, other workers retire, return to school, or quit a job for health reasons or to assume household responsibilities.

While individuals already in the workforce will fill many of the replacement openings, some job openings will remain vacant since some workers have left the workforce. The openings not filled by workers already in the workforce are 'net replacement openings.' New workforce entrants and individuals reentering the workforce are more likely to land jobs in occupations where employment is growing or has high net replacement needs.

An estimated 62,000 job openings will be generated by replacement needs over the next 12 months. Total job openings will top 104,000 when job openings from replacement needs are combined with job openings arising from employment growth. Almost all occupations will have some job openings from the need for replacements including occupations expected to decline over the year. For example, the number of workers employed as waiters and waitresses is expected to be down slightly in 2014, but 2,400 net replacement openings are anticipated next year in this occupation. Table 4 lists the Top 20 occupations when ranked by 'total job openings'. The occupations expected to have the most total job openings over the next year tend to be occupations that already employ a large number of workers and have high turnover rates.

Source: Minnesota Department of Employment and Economic Development| Rank | Top Occupations with Most Total Job Openings | Estimated 1st Quarter 2013 Employment | Forecast 1st Quarter 2014 Employment | Forecast Percent Change | Forecast Numerical Change | Forecast Total Job Openings |

|---|---|---|---|---|---|---|

| 1 | Retail Salespersons | 81,796 | 83,868 | 2.5 | 2,072 | 4,589 |

| 2 | Cashiers | 58,701 | 59,477 | 1.3 | 776 | 4,202 |

| 3 | Combined Food Preparation and Serving Workers | 53,544 | 54,776 | 2.3 | 1,232 | 2,985 |

| 4 | Waiters and Waitresses | 45,968 | 45,962 | 0.0 | -6 | 2,439 |

| 5 | Registered Nurses | 56,449 | 57,632 | 2.1 | 1,183 | 2,041 |

| 6 | Personal and Home Care Aides | 46,464 | 48,105 | 3.5 | 1,641 | 1,932 |

| 7 | Office Clerks, General | 60,530 | 61,379 | 1.4 | 849 | 1,871 |

| 8 | Customer Service Representatives | 43,643 | 44,268 | 1.4 | 625 | 1,822 |

| 9 | Home Health Aides | 37,888 | 39,179 | 3.4 | 1,291 | 1,718 |

| 10 | Laborers and Freight, Stock, and Material Movers, Hand | 30,705 | 31,229 | 1.7 | 524 | 1,523 |

| 11 | Janitors and Cleaners | 42,475 | 43,159 | 1.6 | 684 | 1,417 |

| 12 | Counter Attendants, Cafeteria and Food Concession | 10,306 | 10,430 | 1.2 | 124 | 1,312 |

| 13 | Truck Drivers, Heavy and Tractor-Trailer | 30,689 | 31,420 | 2.4 | 731 | 1,298 |

| 14 | Business Operations Specialists, All Other, | 39,150 | 39,645 | 1.3 | 495 | 1,168 |

| 15 | Sales Reps, Except Technical and Scientific Products | 27,378 | 27,917 | 2.0 | 539 | 1,162 |

| 16 | Stock Clerks and Order Fillers | 35,185 | 35,356 | 0.5 | 171 | 1,066 |

| 17 | Receptionists and Information Clerks | 20,749 | 21,094 | 1.7 | 345 | 1,006 |

| 18 | Supervisors/Managers of Retail Sales Workers | 22,729 | 23,198 | 2.1 | 469 | 975 |

| 19 | Supervisors/Managers of Office/Administrative

Support Workers |

24,510 | 24,844 | 1.4 | 334 | 958 |

| 20 | Bookkeeping, Accounting, and Auditing Clerks | 35,940 | 36,452 | 1.4 | 512 | 904 |

NOTESThe Minnesota Department of Employment and Economic Development (DEED) produces two sets of employment projections or forecasts. One set, long-term employment projections, looks 10 years into the future and is aimed at young adults planning a career or older workers considering a career change. Others job seekers, such as dislocated workers or labor force re-entrants, need information on what the job market will look like next month or nine months down the road. Short-term forecasts strive to fill that need. This report provides a forecast for the state's job market from the first quarter of 2013 to the first quarter of 2014. Short-term forecasts are updated each quarter to account for recent economic developments. These short-term job forecasts, combined with DEED's Job Vacancy Survey and Occupations in Demand (OID), help job seekers identify occupations that are currently in demand as well as occupations that will be in demand over the next year. Short-term forecasts of industry-based employment are based on monthly Current Employment Statistics (CES) employment data from January 1990 through March 2013. CES employment data cover only wage and salary employment or about 92 percent of total jobs in Minnesota. Estimates and forecasts of agricultural jobs, self-employed farmers, self-employed nonagricultural workers, and domestic workers employed by households are not included in CES data. Employment forecasts are carried out for 70 industries, mostly at the 2-digit North American Industry Classification System (NAICS) level, using five alternative statistical methodologies. National and Minnesota leading indicators are incorporated in the models. Projected industrial employment is converted to occupational employment forecasts using occupational staffing data from the Occupational Employment Statistics (OES) survey. Net replacement and total replacement opening estimates are based on national rates of job separation and net movement of new and experienced workers into and out of occupations. The replacement rates are developed by the Bureau of Labor Statistics using Current Population Survey data. |