by Jerry Brown

April 2013

Monthly analysis is based on seasonally adjusted employment data.

Yearly analysis is based on unadjusted employment data.*

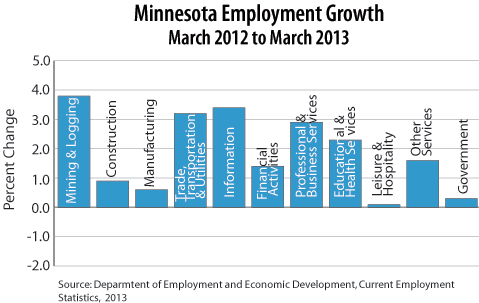

The trend of strong employment growth which held in recent months experienced a hiccup in March as the state lost an estimated 5,200 jobs. February employment was also revised downward by 4,600 to post a still robust final February gain of 9,000. The loss in March was the first decline since July 2012. Although the estimates showed a very weak month in terms of job growth, it is important not to read too much into a single, although sizeable, loss. Further, it is common for at least some offsetting adjustment to occur in the month following a large change such as we experienced in February. Often such large changes are related to an alteration of normal seasonal patterns which are then at least partly balanced by later developments. The weather has been relatively cold and is likely dampening some job growth. In March there were six supersectors that posted a loss for the month with substantial declines in Educational and Health Services, down 2,900, Leisure and Hospitality, down 2,100, and Government, down 1,500. There were three supersectors that added employment: Trade, Transportation, and Utilities, Construction, and Professional and Business Services with gains of 1,400, 800, and 400, respectively. Mining and Logging and Information showed no change. The weak monthly results caused the annual rate of growth to drop to 1.7 percent in March, down five tenths of a percentage point from February. Despite the drop, Minnesota's annual growth was still slightly better than the 1.5 percent gain for the U.S. Every supersector showed a gain over the past year with Trade, Transportation, and Utilities estimated to have the largest gain at 15,600 and also the third highest rate of growth at 3.2 percent.

There was no change in employment in March following increases the three previous months. Over the past year the supersector added 300 jobs.

Construction industries added 800 jobs over the past month despite less than stellar weather conditions. Although modest, this increase was the third consecutive and the fifth in the last six months. Specialty Trade Contractors and Construction of Buildings showed fairly strong growth for the month but Heavy and Civil Engineering Construction lagged. It seems clear that Construction is set for expansion in 2013 with permitting for new units improving, prices of existing homes up, and the volume of homes for sale at much lower levels. This will likely be negatively impacted by the increased income tax rate and sequestration, but adding Construction as another source of economic growth is an important step forward. Over the past year Construction was up 0.9 percent, with essentially all of the increase coming in Specialty Trade Contractors where employment increased1.2 percent.

Manufacturing saw a second consecutive month of decline with a loss of 400 in March. The loss was entirely caused by a fall of 1,200 in Nondurable Goods Manufacturing where there was modest weakness in all of the estimated component industries. Durable Goods Manufacturing showed an increase of 800, snapping back after losses were posted in January and February. Wood Product and Fabricated Metal Product Manufacturing experienced strong monthly growth to account for a large portion of the monthly change. The weakness the past two months was not wholly unexpected as the Minnesota Business Conditions Index, a leading indicator, spent several months in negative territory last fall. This index has turned positive once again indicating conditions have improved and making better manufacturing job growth more likely in coming months. Compared to last year the supersector was up only 0.6 percent with all of the growth coming in Durable Goods Manufacturing.

Estimates showed a job gain of 1,400 in Trade, Transportation, and Utilities for the month. This gain came despite a loss of 2,100 in Retail Trade. The loss in Retail Trade was the first since July and nearly erased February's gain. General Merchandise Stores and Building Materials and Garden Equipment Stores fared poorly for the month. These losses were outweighed by gains of 1,900 in Transportation, Warehousing, and Utilities and 1,600 in Wholesale Trade. Nationally, the pace of consumer spending has slowed and the full impact of the tax increase combined with sequestration has yet to be felt. This may prove a challenge to Retail growth for the year. Over the past 12 months the supersector added 15,600 jobs with healthy growth in the three major components including the addition of 6,000 jobs in Retail Trade. The majority of this growth occurred since last August.

The Information supersector showed no change to its estimated employment total in March with only slight countervailing changes in its two estimated components. Over the past year Information employment was up 3.4 percent, with all of the increase coming from outside of traditional Publishing and Telecommunications industries.

Financial Activities posted a loss of 800 for the month to post its first loss since last October. Finance and Insurance showed a loss of 400 with nearly all the decline coming from very weak results in Insurance Carriers. An additional loss of 400 in Real Estate and Rental and Leasing was probably at least partly from the lingering winter weather as home sales activity usually increases as spring arrives. Over the past 12 months Financial Activities added 2,400 jobs with all but about 600 of this gain coming in Credit Intermediation. The improvement in Real Estate will be beneficial to this supersector but Mortgage Refinancing has slowed.

Professional and Business Services employment increased 400 for the month as small gains in Professional and Technical Services and Management of Companies outweighed a loss of 700 in Administrative and Support Services. This was the fifth consecutive increase for the supersector, with the most consistent growth coming from Professional and Technical Services. Following two months of very strong growth, Administrative and Support declined with weak outcomes in both the Services to Buildings and the Employment Services industry groupings. Annual growth was estimated to be a healthy 2.9 percent with all three major component groups showing good rates of growth over the past year.

The loss of 2,900 in Educational and Health Services was the largest monthly loss since September 2009. Education showed a drop of 1,600 marking the second large decline for Private Education in three months. To some extent the loss is probably associated with the difficulty of adjusting for the impact of spring break in the seasonal adjustment process. There was also a rare loss in Health Care and Social Assistance which fell for the first time since July 2011 and the largest loss since July 2010. Much of the monthly loss came in Nursing and Residential Care Facilities. On an annual basis the supersector added 10,900 jobs with 7,700 of these additions in Ambulatory Health Care Services. Social Assistance employment growth has slowed with only an estimated gain of 300 for the past year.

After five consecutive months of employment growth, Leisure and Hospitality reversed ground to lose an estimated 2,100 jobs in March. The colder and wetter than usual weather associated with March is likely to have had a negative impact on seasonal hiring in these industries. Accommodation and Full Service Restaurants seem to have been particularly impacted by this leading to a loss of 1,500 in Accommodation and Food Services. Arts, Entertainment, and Recreation also contributed a loss of 400. The estimates showed that Leisure and Hospitality was barely in positive territory compared to last year, with an estimated gain of only 200 over the past year. This is an area where Minnesota is lagging the U.S. substantially with a gain of 2.3 percent estimated for the nation as a whole. Accommodation and Full- Service Restaurants both showed losses, largely negating the modest annual increases in Limited-Service Restaurants and in Arts, Entertainment, and Recreation.

Similar to February, March saw a miniscule loss of 100 in Other Services. This resulted from a slight weakness in Religious, Grantmaking, Civic, Professional, and Similar Organizations. Annual growth totaled 1,900, equal to 1.6 percent. Repair and Maintenance and Religious, Grantmaking, Civic, Professional, and Similar Organizations showed gains of 2.2 and 2.1 percent, respectively.

Government employment fell by 1,500 in March as there were substantial losses in Local Government and to a lesser extent Federal Government. The loss in Local Government was fairly equally distributed among education and non-education units of government. The reduction in Federal Government were distributed fairly equally between postal locations and other federal offices. Over the past year there was a gain of 1,400 estimated with this gain coming largely in Local Government Education.

| Minnesota Seasonally Adjusted Nonagricultural Wage and Salary Employment (in thousands) | |||

|---|---|---|---|

| March 2013 | February 2013 | January 2013 | |

| Total Nonfarm | 2,770.1 | 2,775.3 | 2,765.4 |

| Goods Producing | 411.0 | 410.6 | 410.1 |

| Mining and Logging | 7.3 | 7.3 | 7.2 |

| Construction | 97.3 | 96.5 | 95.0 |

| Manufacturing | 306.4 | 306.8 | 307.9 |

| Service-Providing | 2,359.1 | 2,364.7 | 2,355.3 |

| Trade, Transportation, and Utilities | 517.4 | 516.0 | 514.5 |

| Information | 54.7 | 54.7 | 54.8 |

| Financial Activities | 178.5 | 179.3 | 177.8 |

| Professional and Business Services | 345.5 | 345.1 | 338.9 |

| Educational and Health Services | 485.0 | 487.9 | 486.9 |

| Leisure and Hospitality | 249.0 | 251.1 | 248.8 |

| Other Services | 116.6 | 116.7 | 116.9 |

| Government | 412.4 | 413.9 | 416.7 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2013. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.