by Dave Senf

July 2013

Note: All data except for Minnesota's PMI have been seasonally adjusted. See the feature article in the Minnesota Employment Review, May 2010, for more information on the Minnesota Index.

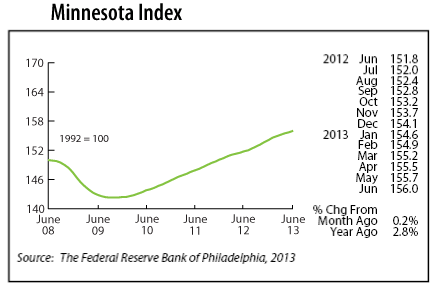

The Minnesota Index advanced for the 48th straight month in June, increasing 0.2 percent. The index was recalibrated this month using revised Gross State Product (GSP) data that included the first estimate of Minnesota's 2012 GDP. Job growth was flat along with factory hours, but unemployment inched down, and wage and salary payments were up modestly. The index has been growing 0.2 percent for most of the first half of 2013, slightly slower than the 0.3 percent monthly rate at the end of last year. The index is a proxy measure of the state's GDP providing a real-time monthly measure of the state's economic production.

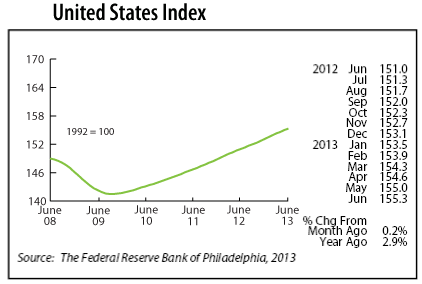

The recalibrated indices show that Minnesota's economy has pretty much matched the national path. Minnesota's index dropped 5.3 percent from the pre-recession peak to the recession trough. The U.S. drop was 5.1 percent. Since reaching bottom in the fall of 2009, the Minnesota index has advanced 9.6 percent while the U.S. index is up by 9.8 percent.

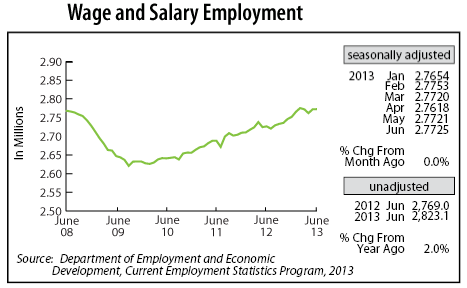

Minnesota's Wage and Salary Employment barely changed in June with only 400 jobs added. Job growth was strong in Professional and Business Services, in Trade, Transportation, and Utilities, and in Leisure and Hospitality. Government, Financial Activities, Construction, and Manufacturing cut the most jobs.

Over-the-year job growth, using unadjusted employment numbers for Minnesota, jumped to 2.0 percent, the highest pace since February. The comparable national rate was 1.7 percent. Private sector job growth over the year was 2.1 percent in Minnesota and 2.0 percent nationally. Public sector employment cuts dragged down total job growth both in Minnesota and nationally.

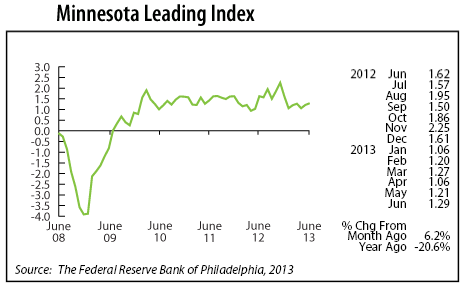

The Minnesota Leading Index, designed to predict the pace of economic growth in Minnesota six months down the road, was also recalibrated this month. The revised index forecasts that Minnesota's economic activity will increase 1.3 percent over the next six months. That's roughly 2.6 percent on an annual basis.

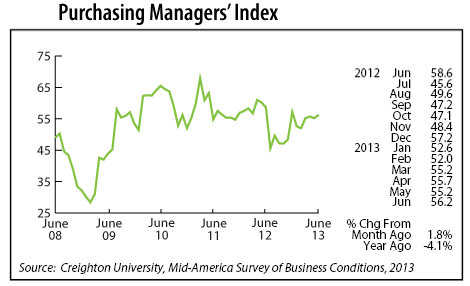

Minnesota's Purchasing Managers' Index (PMI) inched up in June to its highest reading of the year. June's 56.2 level suggests that Minnesota's economy should continue to expand at a moderate rate through the rest of 2013. The index has been running significantly higher since the beginning of the year compared to the last half of 2012. This suggests that Minnesota's job growth in 2013 will easily surpass the 1.4 percent achieved in 2012.

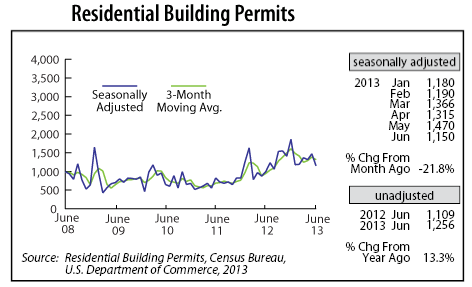

Adjusted Residential Building Permits hit a pothole in June with permit numbers falling to 1,150, the lowest monthly level since last August. Other housing market indicators, however, continue to suggest that Minnesota's residential construction activity will continue its two-year comeback.

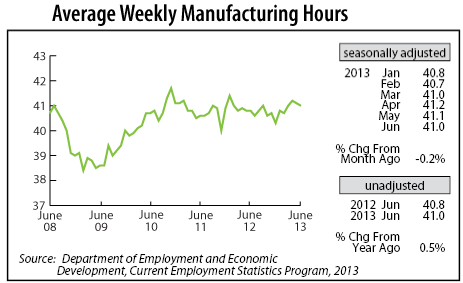

Adjusted Manufacturing Hours slipped slightly in June, dropping to 41.0. However, the factory workweek has been 41 hours or more for three straight months which hasn't occurred since late 2010, early 2011. Manufacturers have cut 2,600 jobs since the beginning of the year even though the workweek has been high. Ramped up factory hours are usually associated with increased hiring. Manufacturers may be using workers from temporary help agencies at a higher rate than in the past.

Adjusted Manufacturing Earnings spiked to their highest level in two and a half years, increasing to $826.16. Average manufacturing earnings, after adjusting for inflation, were 4.7 percent higher than a year ago. That is the highest real pay bump in three years.

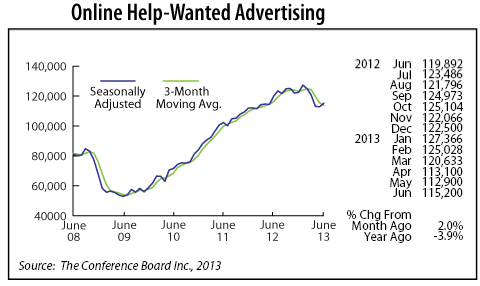

Minnesota's adjusted online Help-Wanted Ads rose for the first time in five months, climbing 2.0 percent in June. National online advertising increased 1.1 percent. Help-wanted ads in the state are down 6.0 percent from the start of the year while nationally ads are up 0.1 percent for the year. Minnesota's share of help-wanted ads however remains higher than its share of jobs implying that labor demand in Minnesota continues to be stronger than nationally. The stronger-than-national labor market, as measured by the larger share of online help-wanted advertising, is consistent with Minnesota's unemployment rate being significantly below the national rate.

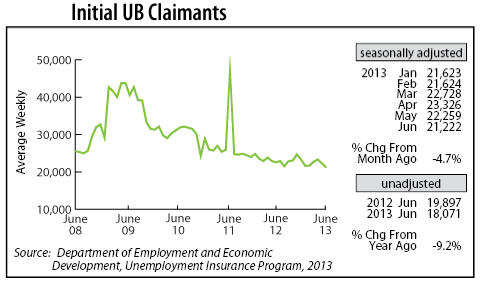

Adjusted Initial Claims for Unemployment Benefits (UB) fell for the second month in a row, dipping to the lowest total since March 2008. Monthly initial claims as a percent of monthly wage and salary employment is on track to fall to 0.8. That would be the lowest rate since the glory job growth years of 1992 - 2000. Job growth averaged 2.5 percent during that time period while initial claims averaged 0.7 percent of the employment total.