by Amanda Rohrer

February 2013

Monthly analysis is based on seasonally adjusted employment data.

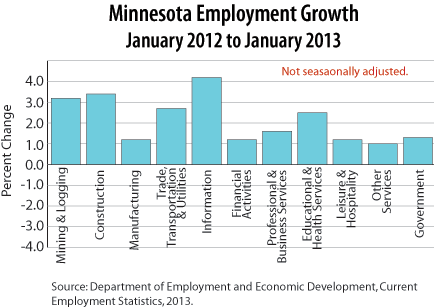

Yearly analysis is based on unadjusted employment data.*

Following December's job gains of 5,800 (0.2 percent), January employment climbed 12,100 (0.4 percent) for the month. This is the sixth consecutive growth month, but gains continue to be tepid.

Specific industries are faring better - Mining and Logging has been growing rapidly and has surpassed pre-recession levels. Construction gains were encouraging, but the larger trend is still toward only slow growth.

Falling between holiday hiring and spring hiring, January is often a month where we see little or no employment growth. Coming months will be better indicators of what to expect in 2013.

Employment in Natural Resources and Mining increased 100 over the month, a 1.4 percent gain. The industry hasn't been very volatile this year, with no changes of greater magnitude and only one decline. The employment level is now 7,200, the highest the industry has seen since February 2001. Given developments in mining technology and the businesses that have benefited, this rapid growth is expected, but nonetheless welcome.

Construction employment gained 2,600 jobs (2.8 percent) over the month. Although growth has been inconsistent, this is stronger than in employment overall. However, Construction is a highly seasonal industry and has a large January adjustment; this indicates much slower employment declines than typical, not an adding of jobs.

Manufacturing employment increased 600 (0.2 percent), the third straight monthly increase. Durable Goods Manufacturing fell 0.3 percent (500), while Non-Durable Goods Manufacturing increased 1.0 percent (1,100). Over the year, employment for all three industry groups is up - Durable is up 1.6 percent, Non-Durable 0.3 percent, and Manufacturing overall is up 1.2 percent, none seasonally adjusted. Although Manufacturing employment is growing, recent growth has been inconsistent and slow.

Employment in Trade, Transportation, and Utilities increased 4,100 (0.8 percent). Wholesale Trade fared better, growing 1.5 percent (1,900) while Retail Trade was a little weaker, growing only 0.4 percent (1,200). Transportation, Warehousing, and Utilities increased 1.1 percent (1,000). Growth in these industries has been weak over the last few years, with the most significant improvement coming from the recent holiday season. Year over year, employment in Trade, Transportation, and Utilities was up 2.7 percent (13,338), not seasonally adjusted.

Employment in Information grew 400 (0.7 percent) over the month. Employment in the industry has remained between 52,000 and 55,000 since early 2009 and has seen balancing declines and gains during that whole time. The current level, 55,000, is comfortably within that range. There has been little obvious trend in the industry's employment.

Financial Activities employment declined 0.1 percent (100). Its component industries were competing, with Finance and Insurance employment falling 0.3 percent (400) and Real Estate and Rental and Leasing gaining 0.8 percent (300). Growth in these industries has been tepid and inconsistent on a monthly basis, but over-the-year Financial Activities employment is up 1.2 percent (2,131).

Professional and Business Services employment was fairly flat for the month, increasing 0.1 percent (200), but growth was unevenly distributed between its component industries. Professional and Technical Services fell 1.5 percent (2,000) over the month, reversing two months' worth of gains. Management of Companies and Enterprises gained 1.1 percent (800), bringing it to a post-recession high of 75,700, and Administrative and Support Services grew 1.1 percent (1,400). In seven of the last eight months Administrative and Support Services saw declines, so January's comparatively strong performance is a hopeful sign.

Educational and Health Services employment grew 700 (0.1 percent) over the month, following more than a year of near-perfectly consistent gains. Over the year, employment is up 11,748 (2.5 percent). The weakness comes from Private Education, which fell 1,100 (1.7 percent) over the month, while the other component industry, Health Care and Social Assistance, increased 1,800 (0.4 percent) and hasn't seen a monthly seasonally adjusted decline since July 2011.

Employment in Leisure and Hospitality increased 1,700 (0.7 percent) over the month. After a weak summer for employment, this is the fourth straight month of increase, and over-the-year employment is up 1.2 percent (1,986). Over the month the gains were unevenly divided between Arts, Entertainment, and Recreation (up 2.7 percent, 1,100) and Accommodation and Food Services (up 0.3 percent, 600). Over the year the strength of the industries was reversed, with 1.0 percent growth and 1.3 percent growth, respectively. Arts, Entertainment, and Recreation is the much smaller piece of the Leisure and Hospitality industry.

Employment grew 900 (0.8 percent) over the month. The industry has seen equal numbers of gains and losses over the last couple of years. Since it includes as varied industries as Repair and Maintenance, Laundry and Personal Services, and Religious and Grantmaking employment, it's difficult to draw conclusions about overall health of the industries.

Employment increased 900 (0.2 percent). Federal Government saw the only decline, falling 1.3 percent (400), while State Government employment grew 0.4 percent (400), and Local Government employment grew 0.3 percent (900). Recent federal government budget problems likely contribute to the declines.

| Seasonally Adjusted Nonfarm Employment | |||

|---|---|---|---|

| January 2013 | December 2012 | November 2012 | |

| Total Nonfarm | 2,764.0 | 2,751.9 | 2,746.1 |

| Goods-Producing | 410.2 | 406.9 | 407.0 |

| Mining and Logging | 7.2 | 7.1 | 7.0 |

| Construction | 95.1 | 92.5 | 94.2 |

| Manufacturing | 307.9 | 307.3 | 305.8 |

| Service-Providing | 2,353.8 | 2,345.0 | 2,339.1 |

| Trade, Transportation, and Utilities | 514.1 | 510.0 | 507.1 |

| Information | 55.0 | 54.6 | 54.5 |

| Financial Activities | 177.7 | 177.8 | 177.6 |

| Professional and Business Services | 338.1 | 337.9 | 337.7 |

| Educational and Health Services | 487.3 | 486.6 | 483.9 |

| Leisure and Hospitality | 248.6 | 246.9 | 245.7 |

| Other Services | 116.7 | 115.8 | 116.6 |

| Government | 416.3 | 415.4 | 416.0 |

| Source: Department of Employment and Economic Development, Current Employment Statistics, 2013. | |||

*Over-the-year data are not seasonally adjusted because of small changes in seasonal adjustment factors from year to year. Also, there is no seasonality in over-the-year changes.