The Minneapolis-St. Paul metropolitan area is a national leader in finance, advanced manufacturing, agriculture and retailing.

The Minneapolis-St. Paul metropolitan area is a national leader in finance, advanced manufacturing, agriculture and retailing.

Medical devices, electronics and processed foods are strong suits recognized globally.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

8/9/2021 9:00:00 AM

Tim O'Neill

Last month we looked at how employment has trended in the Minneapolis-St. Paul Metropolitan Statistical Area (MSA). The monthly employment data used for that analysis came from the Department of Employment and Economic Development's (DEED) Current Employment Statistics (CES) tool. While data from CES's survey of businesses does get updated monthly, it only filters down to MSAs, and has limited industry-level detail. New data from DEED's Quarterly Census of Employment and Wages (QCEW) allows us to see how employment is trending for smaller geographies, including planning areas, economic development regions, counties, and cities.

Before we get into the latest QCEW data, one should know one more major difference between the monthly-released CES data and the quarterly QCEW data. As previously hinted at, the CES data is survey-based. The Minnesota sample each month consists of approximately 2,400 businesses covering roughly 9,000 worksites. Meanwhile, QCEW includes all establishments covered under the Unemployment Insurance Program. For more on the differences between these data sources, check out this article titled Variations in Employment in the CES and QCEW Programs. Now let's see how employment is trending in the Seven-County Metro Area through the first quarter of 2021.

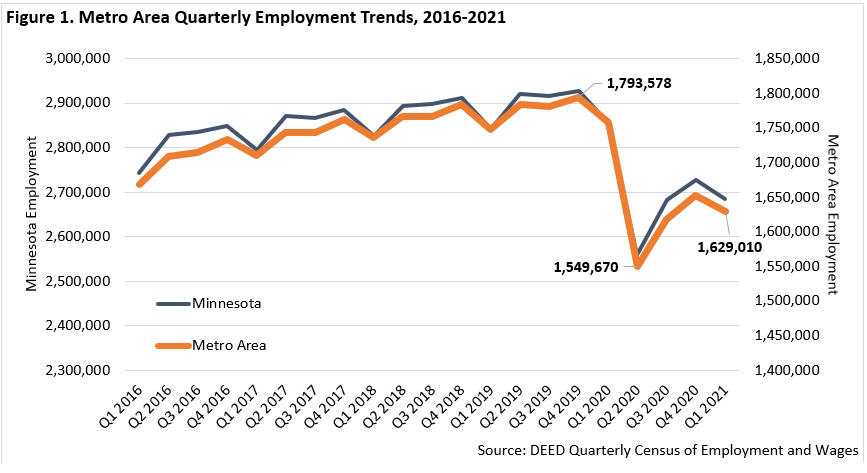

According to DEED's QCEW data, the Seven-County Metro Area had 89,336 establishments supplying 1,629,010 covered jobs during the first quarter of 2021. This was down 164,568 jobs (9.2%) from the region's peak employment before COVID-19 in the fourth quarter of 2019, but is up 79,340 jobs (5.1%) from the nadir of pandemic-induced employment losses during the second quarter of 2020 (Figure 1). The 1.6 million jobs during the first quarter of 2021 represents the lowest first-quarter employment level in the Metro Area since 2014.

Figure 1 shows that the Metro Area did lose jobs between the fourth quarter of 2020 and the first quarter of 2021. While this does represent a snag in employment recovery from the losses caused by COVID-19, it should be noted that the region typically loses jobs during this period. This is largely due to seasonal losses in industries like Administrative and Support Services, Construction, Retail Trade, and Wholesale Trade. Over the past 15 years, the Metro Area has shed an average of 36,000 jobs between quarter four and quarter one. This equates to an average employment loss of -2.2%. Between the fourth quarter of 2020 and the first quarter of 2021, however, the region lost just over 23,800 jobs (-1.4%). So, while the region still experienced seasonal employment loss during this time, it was not as severe as the historical average. Typical seasonal losses in 2021 were offset by employment growth in Accommodation and Food Services; Manufacturing; Arts, Entertainment and Recreation; Wholesale Trade; and Professional, Scientific, and Technical Services.

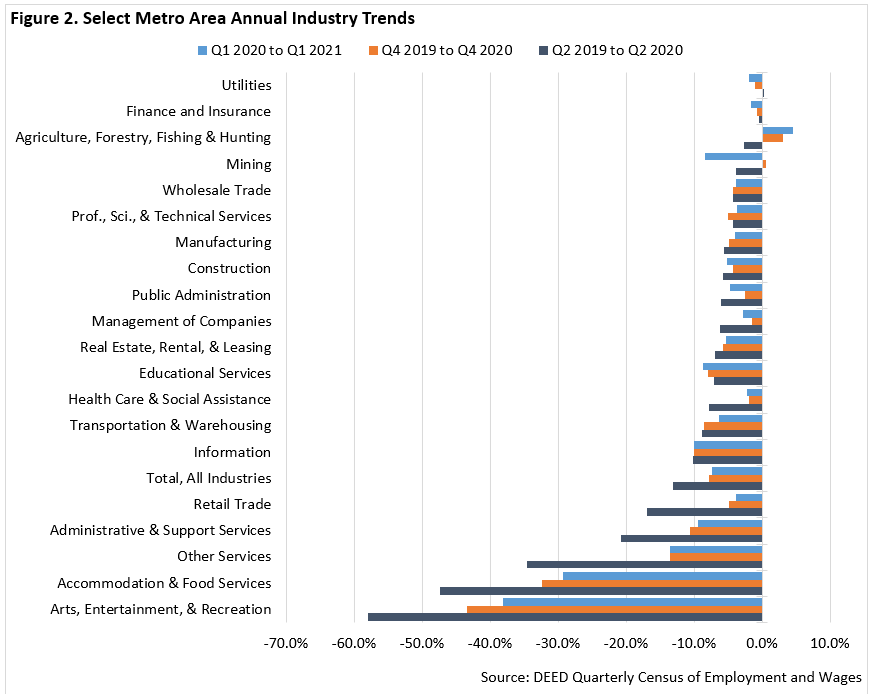

To provide a fairer analysis of employment trends, let's look at annual changes. Figure 2 highlights three select annual trends: between the second quarters of 2019 and 2020, between the fourth quarters of 2019 and 2020, and between the first quarters of 2020 and 2021. Our first trend, between the second quarters of 2019 and 2020, reveals the steepest annual employment losses during the pandemic. Over that time, the Metro Area's total employment dropped by 233,777 jobs (-13.1%). Steepest losses were experienced in Accommodation and Food Services (-67,446 jobs; -47.4%); Retail Trade (-27,857 jobs; -17.0%); Health Care and Social Assistance (-21,893 jobs; -7.9%); Arts, Entertainment, and Recreation (-21,826 jobs; -57.9%); Administrative and Support Services (-20,315 jobs; -20.7%); and Other Services (-19,987 jobs; -34.6%).

By the fourth quarter of 2020, the employment situation in the Metro Area had improved significantly. Between the second and fourth quarters of 2020, the Metro Area regained 103,154 jobs (+6.7%). Over the year, between the fourth quarters of 2019 and 2020, the region was still down 140,754 jobs. This 7.8% decline over-the-year, however, was markedly improved from 13.1% loss between the second quarters of 2019 and 2020. At this time, annual employment losses were steepest for Accommodation and Food Services (-45,374 jobs); Arts, Entertainment, and Recreation (-15,259 jobs); Educational Services (-11,307 jobs); and Administrative and Support Services (-10,519 jobs).

We once again return to the most recent annual employment trends in the Metro Area. Already noting typical seasonal losses during this quarter, the region still managed to improve upon previous annual trends. To summarize, the Metro Area experienced the following annual employment trends during the COVID-19 pandemic:

Continue to check back with DEED's QCEW data tool to see how the Metro Area's industry employment continues to recover from COVID-19.

Contact Tim O'Neill, Labor Market Analyst.