Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Most of the manufacturing base centers on mining and forest products industries. More than half of the sector's employment is in paper and machinery manufacturing.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

12/11/2017 12:04:56 PM

Erik White

Minnesota's Department of Employment and Economic Development (DEED) has released a new data tool: the Quarterly Employment Demographics (QED). Created from an inter-agency agreement between DEED and the Minnesota Department of Public Safety, the program links age and gender data with administrative records from Minnesota's Unemployment Insurance program. This dataset provides a wealth of new information including: job distribution statistics, median hourly wage, and median hours per quarter broken down by gender and age, available by industry and geography.

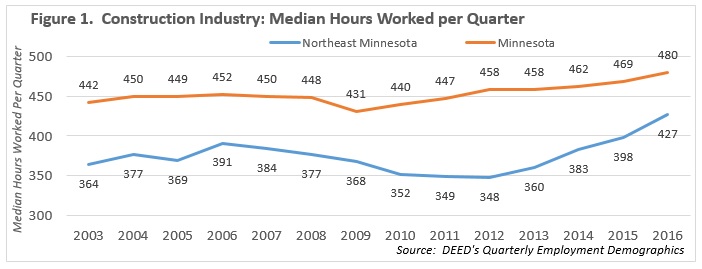

Utilizing this dataset to analyze Northeast Minnesota's construction industry, we find that this sector was greatly affected by the recession but has rebounded since. The median hours worked per quarter in Northeast Minnesota dropped to an annual average of about 350 hours worked per quarter for the few years following the recession, down from a pre-recession peak of 391 hours worked per quarter in 2006. For 2016, the median hours worked has jumped to 427 hours, a 22 percent increase from the post-recession low, and a 36-hour increase from the pre-recession peak median, indicating that the industry is being put back to work (see Figure 1).

Compared to the state overall, Northeast Minnesota's construction industry has consistently averaged less hours worked per quarter, however. After the 2009 recession, the difference in median hours worked between the state and Northeast Minnesota was about 100 hours per quarter for 2011, 2012, and 2013. In 2016, the region's construction industry has narrowed the gap to 53 hours, but it still lags behind considerably (see Figure 1).

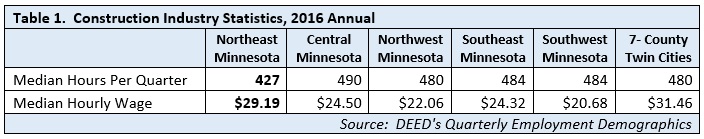

In fact, the Northeast region had the fewest median hours worked per quarter of the 5 other planning areas in the state for every year of the QED data, going back to 2003. But it did have higher median hourly wages than all but one of the planning areas, other than 7-County Twin Cities region, signifying the strength of union participation in the construction trades in the region (see Table 1).

No doubt that the winters of Northeast Minnesota and its small (compared to other planning areas) and non-increasing population have a big impact on the amount and type of construction work being done in the region. But another concern for this industry, as well as the region's overall economy, is the aging of its workforce.

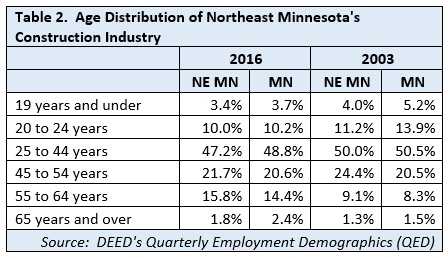

In Northeast Minnesota, 17.6 percent of jobholders in the construction industry were 55 years and older in 2016, suggesting there may be considerable hiring demand in the near future to replace those workers that will retire out of the field. Interestingly, the percentage of older workers in the Arrowhead construction industry nearly matches the state's 16.8 percentage of 55 year and older workers, indicating an industry-wide dilemma and not just a localized issue. Historical data shows that the industry saw a significant demographic shift compared to 2003, when only about 10 percent of the region's construction workers were 55 years or older. Meanwhile, the percentage of workers that are 24 and younger in the industry hovers between 13 and 14 percent for the Northeast region and the state of Minnesota (see Table 2).

Construction in Northeast Minnesota was greatly affected by the recession in terms of the number of hours worked but has recently showed signs of momentum, according to DEED's new QED dataset. However, the aging of the workforce could cause potential disruption to this industry going forward at a region and state level. As people retire, it creates demand for new workers in tight labor market conditions where other industries are also looking to hire from the limited supply of workers. Reaching out to under-represented populations such as women and minorities may hold the answer to forthcoming workforce challenges. And datasets like QED help us better understand these industry challenges, as well as their responses.

Contact Erik White at 218-302-8413.