Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Most of the manufacturing base centers on mining and forest products industries. More than half of the sector's employment is in paper and machinery manufacturing.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

8/3/2020 9:00:00 AM

Carson Gorecki

With over $350 million in loans leading to the retention of nearly 60,000 jobs in the region in just over three months, the Paycheck Protection Program (PPP) has been a vital source of aid for thousands of Northeast businesses during the COVID-19 pandemic.

Since March, trillions of dollars of pandemic-related aid have flowed from the federal government. This aid took many forms including direct unemployment payments to workers and grants and loans to businesses. While the impact of additional federal unemployment benefits has been written about extensively, less documented is the impact of emergency aid on local small businesses. A recent release of data by the U.S. Treasury Department provides a vital look into the effects of the PPP in Northeast Minnesota.

The PPP is a component of the Coronavirus Aid, Relief, and Economic Security (CARES) Act passed in late March. The PPP provides small businesses forgivable loans to cover up to eight weeks of payroll and other costs. The initial round of loans went quickly due to extremely high demand. The extraordinary circumstances under which the CARES ACT and PPP were created necessitated a prioritization of speed over specificity to get money out to businesses and workers in need. Recent data from the U.S. Treasury Department detail how funds were dispersed in the first two rounds of the PPP. These data are at the loan level and include amounts, business types, locations, demographics, and importantly, the number of jobs retained. With this information we can assess the impact of the PPP on Northeast Minnesota businesses and jobs.

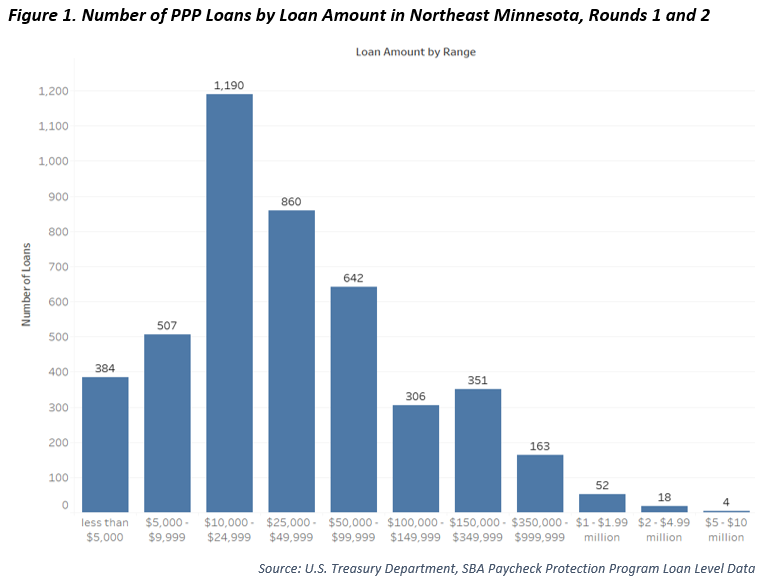

From March through the end of June, 4,477 businesses applied for and received PPP loans in Northeast Minnesota. The exact dollar amount is difficult to discern because loans over $150,000 are lumped into wide ranges. ($150,000 - $349,999, $350,000 - $999,999, $1 million - $1.99 million, $2 million - $4.99 million, and $5 million to $10 million). However, for the 3,889 loans under $150,000, the total lent to regional businesses equaled $138,112,340. Assuming the minimum of each range for loans greater than $150,000, the amount lent to Northeast businesses was at least $355,812,340. Of the 588 loans greater than $150,000, almost 60% were in the $150,000 to $349,999 range and more than 27% were between $350,000 to $999,999. Only four loans in the region were made at the highest level of $5 - $10 million (see Figure 1).

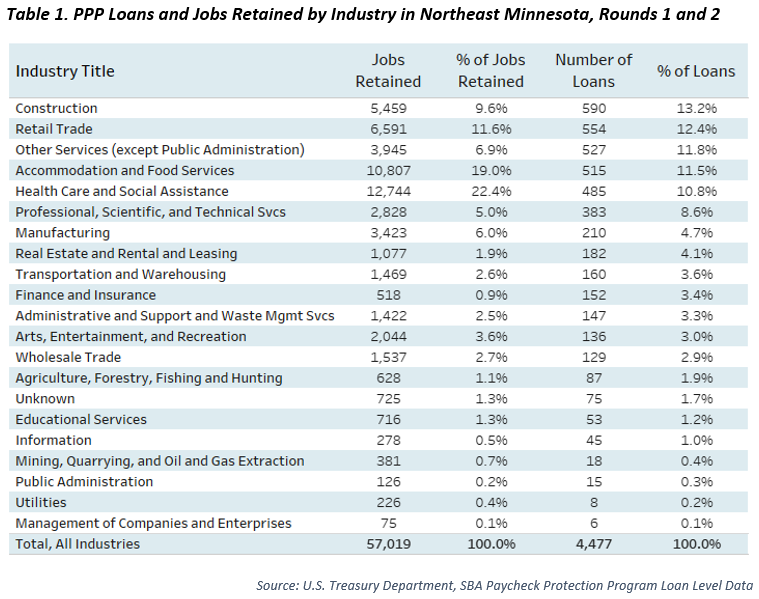

According to QCEW data, the top three industries in the region by employment are health care and social assistance, retail trade, and accommodation and food services, accounting for over 46.6% of all jobs in the region. These three industries however, represented only 34.7% of PPP loans. Instead, construction and other services accounted for a quarter of loans but employ only 8.4% of the region's workers. In fact, construction businesses were the recipients of the greatest number of loans in the region, at 590.

The primary stated objective of the PPP is to help businesses keep workers on their payrolls. In that sense, a good measure of a loan's impact is the number of jobs that were retained. And by that measure, the distribution of jobs retained through the loans better reflects the distribution of employment by industry than the number of loans by industry. Indeed, health care and social assistance accounted for the greatest share of jobs retained (22.4%) through the program. as. The 515 loans provided to businesses in food service and accommodation – the industry hit hardest initially by the pandemic – represented 19% of all retained jobs. Loans to retail trade and construction establishments made up 11.6% and 9.6% of retained jobs (see Table 1).

As of mid-July, a third round of PPP is open to businesses with fewer than 100 employees.

NOTE: In a previous blog, I wrote about the initial impact of Federal Pandemic Unemployment Compensation (FPUC) in Northeast Minnesota. The FPUC provided a temporary additional $600/week to those eligible for regular unemployment benefits or Pandemic Unemployment Assistance (PUA). FPUC was intended to provide aid directly to impacted workers and was another passed under the CARES Act.

Contact Northeast Minnesota Labor Market Analyst Carson Gorecki at 218-302-8413.