Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Most of the manufacturing base centers on mining and forest products industries. More than half of the sector's employment is in paper and machinery manufacturing.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

10/7/2020 9:00:00 AM

Carson Gorecki

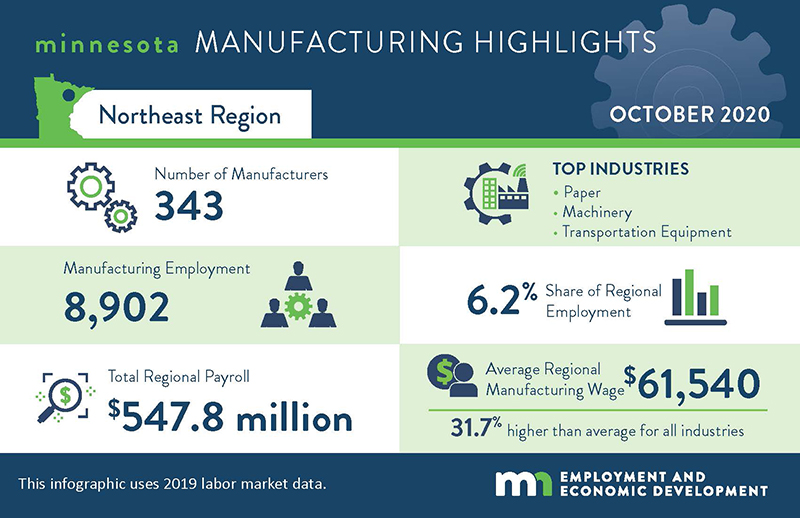

The Manufacturing industry in Northeast Minnesota may not have as large a footprint as it does in other regions, but it plays an important role in the local economy, nonetheless. From more traditional manufacturing – such as Food and Fabricated Metal Manufacturing – to activities more unique to the region such as Transportation Equipment and Paper Manufacturing, the industry is a diverse one.

The Quarterly Census of Employment and Wages (QCEW) shows that, in the first quarter of 2020, there were 8,740 Manufacturing jobs at 345 firms in Northeast Minnesota, accounting for 6.3% of all jobs, making it the sixth-largest industry. That is the smallest number and lowest concentration of any region in the state (see Table 1).

| Table 1. Manufacturing Industry Employment by Region, First Quarter, 2020 | ||||||

|---|---|---|---|---|---|---|

| Region | Total Jobs, All Industries | Manufacturing Firms | Total Jobs, Manufacturing | Percent of Area Jobs | Percent of Area Payroll | Manufacturing Average Annual Wage |

| Northeast | 139,829 | 345 | 8,740 | 6.3% | 8.6% | $65,000 |

| Northwest | 214,935 | 833 | 28,583 | 13.3% | 17.5% | $55,900 |

| Central | 271,812 | 1,193 | 41,210 | 15.2% | 18.3% | $55,536 |

| Twin Cities Metro | 1,756,143 | 4,121 | 172,008 | 9.8% | 11.1% | $82,264 |

| Southeast | 242,760 | 672 | 37,903 | 15.6% | 18.2% | $62,244 |

| Southwest | 171,369 | 616 | 30,434 | 17.8% | 22.6% | $55,692 |

| Minnesota | 2,854,080 | 8,419 | 319,376 | 11.2% | 12.4% | $71,188 |

| Source: DEED Quarterly Census of Employment and Wages | ||||||

Like virtually every industry, Manufacturing has been negatively impacted by the COVID-19 pandemic. Initially, the Manufacturing industry in the Duluth MN-WI metro area saw a peak loss of an estimated 853 jobs between March and April, equivalent to just over 10% of regional Manufacturing employment, according to Current Employment Statistics (CES). Since April, the industry experienced two months of modest job growth before levelling out into August. Manufacturing employment in August was still 6.4% lower than it was a year previously.

Up or down, large anchor employers often play important roles in local economies. With an average of 25.7 employees per site, the Manufacturing industry had the third most employees per firm in Northeast Minnesota, behind Education and Health Services (33.9) and Natural Resources and Mining (30.6).

The largest manufacturing establishments in the Northeast region are Paper Manufacturers, with an average of 252 workers per firm. In June of this year, the indefinite closure of the Verso paper mill in Duluth resulted in the layoff of an estimated 225 workers, representing about 13% of Paper Manufacturing jobs. Paper mills in Cloquet and Grand Rapids also laid off portions of their workforces at least temporarily during the COVID crisis.

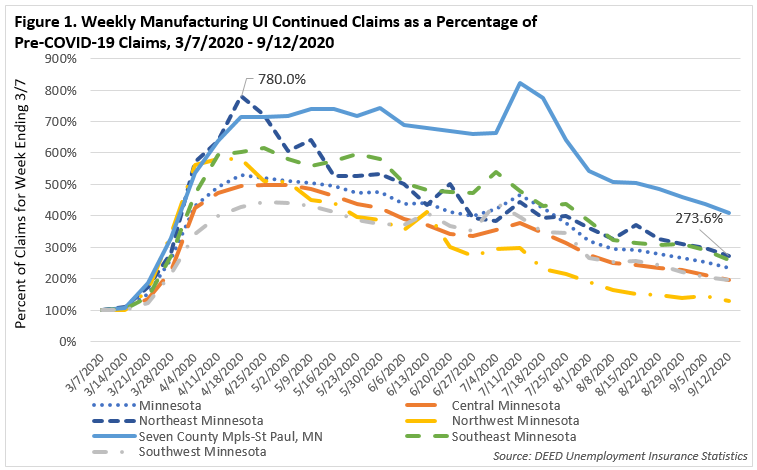

Despite some large, institutional closures, the trend since mid-to-late April has been a decline in unemployment insurance claims across the state as workers were called back. In Northeast Minnesota, large layoffs such as those at Verso likely contributed significantly to the slower relative decline of Manufacturing UI claims and slower recovery of employment over the past four months. After the Minneapolis-St. Paul metro, Northeast Minnesota has seen the slowest decline in the number of continued UI claims, an indication of longer-term unemployment for some Manufacturing workers.

Earlier in the pandemic, Manufacturing claims in Northeast Minnesota were the highest relative to the total number of claims just prior to the implementation of the first stay-at-home order in March. As of the week ending September 5, Manufacturing claims were still up 274% from the week ending March 7, but down 65% from the peak in mid-April (see Figure 1).

The closure of paper mills is significant for many reasons in addition to the number of jobs lost directly. The Paper Manufacturing sector pays high wages and is a large consumer of local forest products harvested by the Logging industry. The average annual wage for Paper Manufacturing jobs is over $86,000, nearly double the average for all industries. Logging typically transports its products to buyers located within 100 miles, so the closure of a large consumer such as a paper mill could have large impacts on the Logging industry and workforce as well, according to Bud Stone, president of the Grand Rapids Chamber of Commerce.

Strong local connections between industries helps to build resilience in our regional economies. Much like a forest regenerates after fire, a diversified economy will sprout new opportunities from the ashes of the old. Local leaders and businesses will need to find creative and innovative solutions in order to plant those new seeds of industry. Regional manufacturers will continue to play an important role in building the Northeast regional economy of the future.

Contact Northeast Minnesota Labor Market Analyst Carson Gorecki at 218-302-8413.