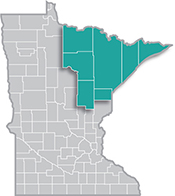

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Most of the manufacturing base centers on mining and forest products industries. More than half of the sector's employment is in paper and machinery manufacturing.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

8/9/2021 9:00:00 AM

Carson Gorecki

The end of July brought us the latest data from DEED's Quarterly Census of Employment and Wages (QCEW) program. The first quarter 2021 data provide our most up-to-date and detailed look into the economic recovery statewide as well as here in Northeast Minnesota. The employment component of the QCEW program showed that the overall number of jobs remained down 7.8% compared to the first quarter of 2020, the final quarter before the impacts of the pandemic rippled across the U.S. economy. The 7.8% deficit may seem disheartening – it certainly indicates that there is a ways to go for full recovery – but it also represents the smallest over-the-year loss of the past four quarters. Despite having fewer absolute jobs than in both the 3rd and 4th quarter, employment is relatively closer to what it was a year previously. By comparison, second quarter 2020 employment was 15.2% below second quarter 2019.

While employment remained down, wages for all industries rose almost 4% over the year. As the economy recovered, stories of rising wages in industries struggling to hire became more common. Many of these industries were the same that suffered the largest employment losses early in 2020. Yet, the wage trends in Northeast Minnesota appear much more mixed. Some of the lower-paying industries such as Arts, Entertainment, and Recreation, Administrative Support, and Retail Trade did see above average bumps in their weekly wages. However, others such as Accommodation and Food Services and Other Services, two of the lowest paying and hardest hit industries during the pandemic, actually saw wages fall (see Table 1). To further muddy the waters, among the two highest-paying industries, Mining experienced the largest wage growth while Utilities saw the second largest wage decline.

| Industry Title | 2021 Q1 Employment | Change of Employment | Percent Change in Employment | Average Weekly Wage | Percent Change in Average Weekly Wage |

|---|---|---|---|---|---|

| Arts, Entertainment, & Recreation | 2,619 | -798 | -23.4% | $514 | +6.9% |

| Accommodation & Food Services | 11,015 | -2,833 | -20.5% | $321 | -0.3% |

| Other Services | 4,125 | -859 | -17.2% | $561 | -0.9% |

| Information | 1,064 | -211 | -16.5% | $978 | +4.0% |

| Admin Support & Waste Mgmt Services | 2,636 | -503 | -16.0% | $595 | +6.3% |

| Transportation & Warehousing | 3,595 | -506 | -12.3% | $1,016 | +4.5% |

| Agriculture, Forestry, Fishing & Hunting | 570 | -67 | -10.5% | $964 | +0.6% |

| Management of Companies | 694 | -76 | -9.9% | $1,524 | -3.1% |

| Real Estate & Rental & Leasing | 1,045 | -107 | -9.3% | $669 | +5.5% |

| Educational Services | 11,582 | -1,110 | -8.7% | $878 | +1.3% |

| Total, All Industries | 129,020 | -10,903 | -7.8% | $937 | +3.7% |

| Manufacturing | 8,122 | -627 | -7.2% | $1,218 | -2.3% |

| Wholesale Trade | 2,716 | -188 | -6.5% | $1,190 | -3.8% |

| Finance & Insurance | 3,928 | -213 | -5.1% | $1,310 | +6.5% |

| Health Care & Social Assistance | 32,925 | -1,751 | -5.0% | $984 | +2.3% |

| Construction | 5,368 | -237 | -4.2% | $1,233 | +1.9% |

| Public Administration | 10,528 | -388 | -3.6% | $1,047 | -1.0% |

| Mining | 4,148 | -129 | -3.0% | $2,126 | +7.5% |

| Retail Trade | 16,220 | -478 | -2.9% | $546 | +4.2% |

| Utilities | 1,427 | -15 | -1.0% | $2,050 | -3.4% |

| Professional, Scientific, & Technical Svcs | 4,686 | +195 | +4.3% | $1,283 | +5.3% |

| Source: DEED Quarterly Census of Employment & Wages | |||||

If it was primarily the lower wage workers that lost their jobs while higher wage workers were kept on, it follows that the average wages for industries with higher concentrations of low wage workers would increase. Yet again, this does not appear to be the case. To delve deeper, we can utilize Quarterly Employment Demographics (QED) data to factor in the number of hours worked.

The median number of quarterly hours worked barely changed for all industries but decreased over the year in the third quarter of 2020 by -3.8% for Arts, Entertainment, and Recreation, and -5.4% for Accommodation and Food Services. We know that employment was down in these industries so even the workers that kept their jobs saw their hours decrease. Importantly, wages also increased from third quarter 2019 to third quarter 2020 for most industries, including 6.3% for Arts, Entertainment, and Recreation and 5.3% for Accommodation and Food Services. Employment declined, hours fell, and yet median compensation increased, pointing toward more job losses among the lower-paid workers in these industries, at least as of the third quarter last year.

However, is what we observed in third quarter of last year still applicable? Is the wage growth in the first quarter of 2021 attributable to more prevalent job losses at the low end of industry wage scales or is there something else at play, such as increased competition among employers for workers? The answer to that question is important because the former points to lingering disproportionate impacts among workers in low-wage occupations and industries while the latter indicates increased worker power. More likely, the answer lies somewhere in between and is dynamic, changing with the evolving recovery. Yet one thing remains certain, and that is the complexity that must be embraced when studying recent wage and employment trends. An endeavor served well by the data available on DEED's Data Tools Page.

Contact Northeast Minnesota Labor Market Analyst Carson Gorecki at 218-302-8413.