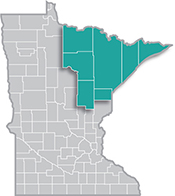

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Most of the manufacturing base centers on mining and forest products industries. More than half of the sector's employment is in paper and machinery manufacturing.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

1/11/2023 9:00:00 AM

Carson Gorecki

Despite a tough couple of years, Health Care & Social Assistance remains the largest sector in Northeast Minnesota by a fair margin, employing nearly one out of every four workers. That share is down only slightly from a peak in 2020, and the percent employment losses from 2019 to the first half of 2022 were smaller in Health Care & Social Assistance (-6.6%) than for the total of all industries (-7.8%).

Employment losses were concentrated in Nursing & Residential Care Facilities and Ambulatory Healthcare Services, which deals primarily with outpatient and clinic activities. And while Health Care job losses slowed somewhat from 2020 into 2022, they accelerated for Nursing & Residential Care Facilities for which burnout and retention have been major concerns. After rebounding into 2021, Ambulatory Healthcare Services employment declined again into the first half of 2022. As a result, both industries remain more than 8% below their 2019 pre-pandemic employment levels (see Table 1).

| Table 1. Northeast Minnesota Healthcare Employment and Wage Trends, 2019-2022* | |||||||

|---|---|---|---|---|---|---|---|

| Measure | Industry Title | 2021 Average | 2022* Average | Percent Change | |||

| 2019-2020 | 2020-2021 | 2021-2022* | 2019-2022* | ||||

| Employment | Nursing & Residential Care Facilities | 9,739 | 9,169 | -1.7% | -5.3% | -5.9% | -12.4% |

| Ambulatory Healthcare Services | 5,177 | 5,078 | -7.0% | 0.1% | -1.9% | -8.7% | |

| Hospitals | 13,212 | 13,248 | -4.1% | 0.1% | 0.3% | -3.7% | |

| Social Assistance | 4,681 | 4,803 | -7.6% | 5.4% | 2.6% | 0.0% | |

| Health Care & Social Assistance | 32,810 | 32,299 | -4.3% | -0.9% | -1.6% | -6.6% | |

| Total, All Industries | 132,143 | 132,546 | -8.6% | 0.6% | 0.3% | -7.8% | |

| Wages | Nursing & Residential Care Facilities | $34,528 | $35,276 | 10.0% | 6.2% | 2.2% | 19.4% |

| Ambulatory Healthcare Services | $89,856 | $88,480 | 4.9% | 5.8% | -1.5% | 9.4% | |

| Hospitals | $71,032 | $73,494 | 2.6% | 6.1% | 3.5% | 12.6% | |

| Social Assistance | $30,992 | $32,021 | 10.3% | 3.1% | 3.3% | 17.5% | |

| Health Care & Social Assistance | $57,460 | $58,829 | 4.7% | 6.1% | 2.4% | 13.8% | |

| Total, All Industries | $52,312 | $53,284 | 6.0% | 5.7% | 1.9% | 14.1% | |

| *Avg. of Q1 and Q2. Source: DEED Quarterly Census of Employment and Wages | |||||||

By contrast, Hospitals and Social Assistance – the other two industries that make up the Health Care sector – fared better over the past two years. Hospital employment declined only -4.1% from 2019 to 2020, the smallest among Health Care industries and a reflection of the crucial roles those facilities played early in the pandemic. And while Hospitals started to chip away at initial employment losses, the deficit remains just above -4%. Social Assistance employment, while declining 7.6% in the first year of the pandemic, has recovered each year since. As of the first half of 2022, Social Assistance employment had regained pre-pandemic levels. These employment gains may have been buoyed by the infusion of public assistance for programs supporting youth and families.

As employment fell under the impacts of COVID, wages tracked strongly upward as demand and inflation increased. Overall, wages were up 14.1% from 2019 to the first half of this year. Health Care & Social Assistance wages were up just slightly less, however Health Care wages remained higher on average. Within the sector, the industries with the lowest average wages saw the largest percent growth. Social Assistance and Nursing & Residential Care Facilities saw wage growth over 17.5%, several percentage points above the sector average. The nearly 20% growth in Nursing & Residential Care Facilities wages likely reflects the extremely high demand for workers in that industry. Health Care wage growth peaked from 2020 to 2021 and has since tapered off in each industry except for Social Assistance. Ambulatory Healthcare Services, which has the highest average wages, even saw wages fall over the last year.

| Table 2. Duluth Metro Health Care Job Switchers Staying in Health Care by Year | ||

| Year | Number of Switchers | Share of Switchers |

| 2021 | 741 | 65.8% |

| 2020 | 599 | 66.1% |

| 2019 | 1,006 | 64.8% |

| 2018 | 960 | 61.0% |

| 2017 | 897 | 61.3% |

| Source: U.S. Census Job-to-Job Flows | ||

With the well-documented trends of staffing shortages and burnout in the Health Care sector, people may assume that workers are opting for jobs in other, non-Health Care sectors, or opting to leave the labor market altogether. While we are not exploring data specific to Health Care labor market exits here, data from the U.S. Census Bureau show that Health Care job switchers in the Duluth area were actually more likely to find another job in Health Care than they were before the pandemic (Table 2). However, the share and number of switchers from non-Health Care sectors into the Health Care sector have also declined since the onset of the pandemic. From 2017 to 2019, switchers into Health Care from other sectors represented an average of 11.7% of all job switchers. After jumping to 12.2% in 2020, the share was down to 10.7% in 2021. All of these numbers add up to a Health Care sector currently in flux, yet resilient in the face of historically tight labor market conditions.

Contact Carson Gorecki, Labor Market Analyst, at carson.gorecki@state.mn.us