Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Most of the manufacturing base centers on mining and forest products industries. More than half of the sector's employment is in paper and machinery manufacturing.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

4/24/2023 9:00:00 AM

Carson Gorecki

There were an estimated 12,388 job vacancies in Northeast Minnesota in 2022, across all industries and occupations. Overall vacancies were up slightly (+0.6%) from 2021 into 2022, indicating continued high demand for workers across the region. That compared to a slight decline of openings statewide.

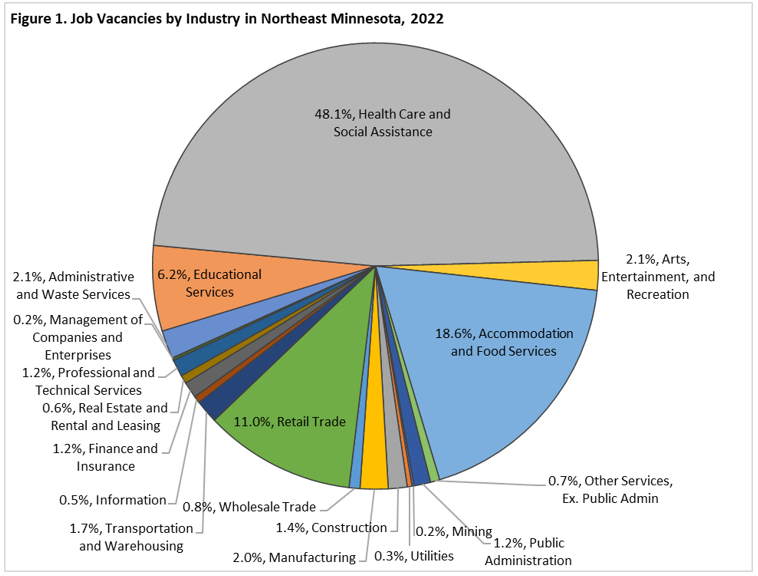

Over the year, Educational Services, Manufacturing, Health Care & Social Assistance, and Finance & Insurance saw the largest growth in openings in Northeast Minnesota. Other Services, Real Estate, Wholesale Trade, Public Administration, and Mining saw declines in the number of vacancies.

The growth in Health Care & Social Assistance openings meant that in 2022 they accounted for nearly half of all vacancies in the region. The next largest shares of openings belonged to Accommodation & Food Services (18.6%) and Retail Trade (11%). Those three industries were also the top three-employing industries in the region, but while they represent 47% of filled jobs, they accounted for almost 78% of vacancies (see Figure 1).

The Job Vacancy Survey also calculates a job vacancy rate, which is the number of vacancies divided by the sum of filled jobs. The vacancy rate is a measure of demand for workers and may also reflect on overall turnover in each industry and occupation. Accordingly, vacancy rates were highest in Health Care & Social Assistance (18.2%), Accommodation & Food Services (17.3%), and Administrative Support & Waste Management Services (10.8%).

For context, Administrative Support and Accommodation & Food Services also had some of the highest vacancy rates prior to the pandemic, indicating continued difficulty in filling positions. The vacancy rate in Health Care & Social Assistance, however, was more in line with the regional average in 2019 (5.7%), before more than tripling over the next three years due to demand during the pandemic and an increase in the number of Health Care & Social Assistance employees leaving the field.

Only Utilities, a much smaller industry, saw a larger increase in vacancy rates over the same period.

Digging into the Health Care & Social Assistance occupations a bit more, the high vacancy rates are spread across various types of jobs in Healthcare Support as well as Practitioner and Technical occupations. Of occupations with at least 10 vacancies, the highest vacancy rates occurred for Psychiatrists, Cardiovascular Techs, LPNs, Psychiatric Techs, General Internal Medicine Physicians, and Dental Assistants, all with rates exceeding 40%. In general, vacancy rates were higher for Healthcare Support occupations. These are jobs that typically pay lower wages and have lower educational requirements.

Among all occupations, the highest vacancy rate occurred in Community and Social Service jobs and was driven, as it appeared to be in health care, by demand for mental health professionals. Mental Health Counselors and Social & Human Service Assistants combined to account for 87% of openings in the occupational group.

The Job Vacancy Survey also asks some additional questions about the nature of openings such as whether they are full or part-time, and whether they require postsecondary education, specific experience, or some other sort of credential. Among these attributes there have been some noticeable trends. Since 2019, the share of openings listed as part-time has declined nearly 15 percentage points. At the same time, the share requiring at least one year of experience rose, as did the share requiring postsecondary education and the share requiring a certificate or license. It is probably no surprise then, that these trends, in combination with rising inflation, have contributed to rising wage offers as well.

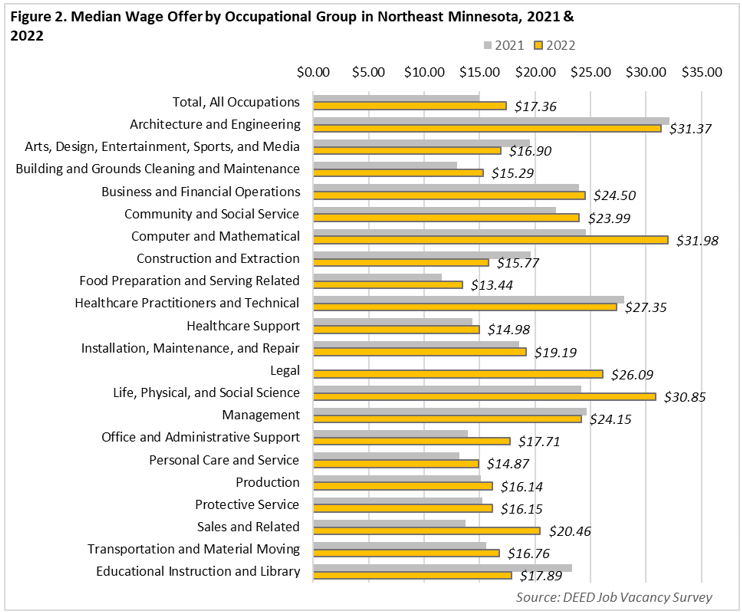

The median wage offer for all vacancies in the region sat at $17.36 in 2022 (see Figure 2). That wage represented a 27% increase from 2019 and a 16% rise from 2021, outpacing inflation over both periods. The highest wage offers were in Architecture & Engineering, Computer & Mathematical, and Life, Physical & Social Science occupations which all had median offers above $30 per hour. At the low end of the spectrum were Food Preparation & Serving Related, Personal Care & Service, and Health Care Support occupations, all with median wage offers below $15 per hour.

Between 2021 and 2022, the largest percent wage offer growth occurred in Sales & Related occupations (+49.3%), which was in the bottom five occupational groups (out of 23) for wage offers in 2021 but moved into the top 10 in 2022. Related to this growth was the significant decline in the number of vacancies in the lower-wage occupations such as Cashiers and Retail Salespersons. Office & Administrative Support and Building & Grounds Cleaning & Maintenance, two other low-paying occupational groups, also made above average gains in wage offers from 2021 to 2022.

The Computer & Mathematical and Life, Physical & Social Sciences occupational groups, which were the two groups with the highest median wage offers in 2022, also saw above average wage offer growth. In contrast, wage offers declined over the year for six occupational groups, most notably for Educational Instruction & Library, Construction & Extraction, and Arts, Design, Entertainment, Sports, & Media occupations.

New job vacancy data show that demand for workers remains high in Northeast Minnesota, especially for certain health care, hospitality, and other service-oriented jobs. Likewise, recent wage offer growth has been strong, even outpacing inflation in some cases, but concentrated in relatively few industries and occupational groups.

Contact Carson Gorecki, Labor Market Analyst, at carson.gorecki@state.mn.us.