The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

3/17/2017 12:04:56 PM

Chet Bodin

As the weather warms up, many workers are ready to trade winter hats and boots for hard hats and tool belts. Once spring starts, so does construction season – and construction employers have a major impact in Northwest Minnesota.

Data from DEED’s Quarterly Census of Employment & Wages program shows that construction industry hiring in Northwest Minnesota is extremely seasonal, fluctuating between a low of 8,500 jobs in the first quarter to a recent peak of almost 12,700 jobs in the third quarter of the past year.

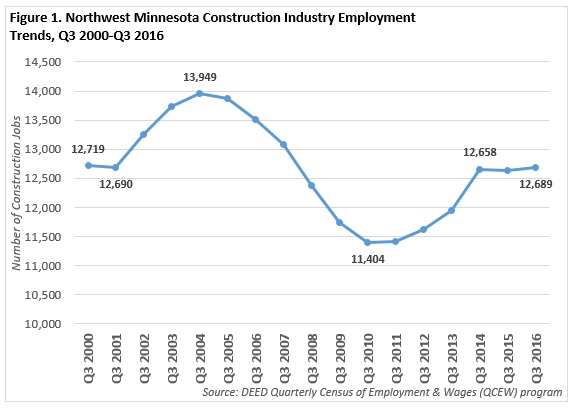

In addition to seasonal ups and downs, construction employers have also weathered some serious annual ebbs and flows over the past 15 years. Payrolls built up quickly from 2001 to 2004 as the regional housing market was red hot, then started to decline with the housing bubble that burst in 2006. Construction employment fell to a low point in 2010 as the economy struggled to recover from the Great Recession.

The region has seemingly returned to a point of stability now, with construction employers recording just over 12,600 employees in the third quarter in each of the past three years. Interestingly, the 12,689 jobs reported in the third quarter of 2016 was nearly identical to the number of jobs posted in the third quarter of 2001, before the housing bubble build-up (Figure 1).

With an annual average of about 10,800 jobs at about 2,100 establishments in 2015, construction was the eighth largest industry in Northwest Minnesota, but also had the second largest number of employers, behind only retail trade. Most construction employers are small businesses, averaging about five employees per establishment, compared to about 13 employees per business across all industries.

In addition, the region was home to 6,130 self-employed construction workers, according to data from the U.S. Census Bureau’s Nonemployer Statistics program. These nonemployers reported sales of nearly $360 million in 2014. However, like covered employment, the number of self-employed construction workers in the region also declined over the past decade, falling from 7,349 nonemployers in 2004.

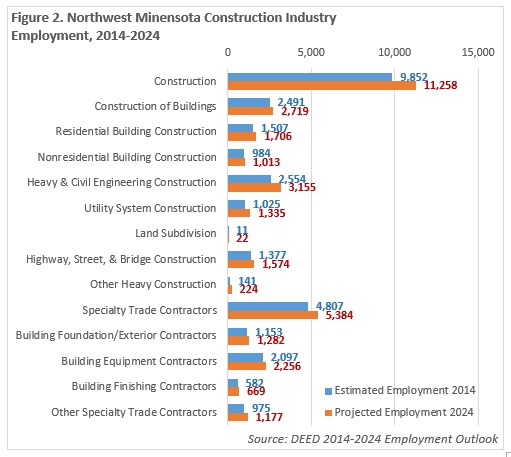

The region’s recent economic recovery has led to positive projections for the construction industry. Construction is projected to be the third fastest and third largest growing sector in Northwest Minnesota over the next decade, with only health care and social assistance ranking ahead of it in both categories of growth.

If these projections remain accurate, the construction industry may add just over 1,400 new jobs in the next decade, a 14 percent growth rate that is more than three times faster than the regional projected growth rate across all industries. Job gains are expected to be spread across the various construction subsectors, with the biggest expansion occurring in heavy and civil engineering construction, followed by specialty trade contractors, with the smallest gain logged in construction of buildings.

Part 2 of Hard Hats Ahead will look at the occupations in demand in the construction industry in Northwest Minnesota, many of which are high paying and expected to be fast growing.

Contact Chet Bodin at chet.bodin@state.mn.us.