The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

5/2/2016 12:13:02 PM

Chet Bodin

Post-secondary education has always been an important factor in economic success, but the rising costs of college can be very concerning for job seekers who want to get the most out of their investment. Since 1985, the costs of higher education have surged more than 538 percent, according to Bloomberg News. This has many people asking what type of post-secondary education is right for them and how it will improve their lives. Many education paths can lead to a career, but understanding regional job prospects and the costs of education and living are vital to making post-secondary education work for you. To navigate this decision, DEED has several helpful tools.

The Graduate Employment Outcomes tool shows how well graduates fare after they’re done with school and join the workforce. Both statewide and regional data show that graduates from state colleges and universities with bachelor’s degrees are earning more than those with associate degrees after two years in the workforce. But for workers who relied on student loans to finance that education, two-year degree holders may have more financial breathing room up front. This month’s blog post will look at education and living costs and how they shake out for college graduates.

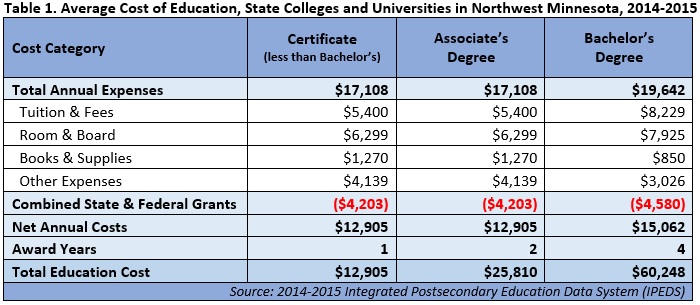

Table 1 itemizes education costs for students who use loans to pay all of their annual expenses, including tuition and fees, room and board, and other expenses. Of course, there are many options to lower the cost of education during and after attaining an education. Working while in school is becoming a more popular option, and working students tend to borrow less than those who do not work, according to a Georgetown study in 2015. Costs are also likely to depend on school location, cost of living before and after graduating, personal savings, and household income. For starters though, this analysis just looks at average costs regardless of how they are paid by students.

Annual costs of education at four-year universities exceed those at two-year colleges, but not by as much as one might think. According to the National Center for Education Statistics, Tuition & Fees and Room & Board cost more at regional state universities (such as Bemidji State and Minnesota State University-Moorhead), but Other Expenses such as transportation and personal expenses are less. Universities are more likely to offer on-campus room and board options like dorms and apartments, compared to the regional state colleges (including Alexandria, Bemidji, Brainerd, Detroit Lakes, Fergus Falls, Moorhead, Thief River Falls and Wadena), which rarely do. Therefore, these students tend to live off-campus and drive to school, which may help explain these differences; though the total cost of room and board and other expenses varied by only about $500 between colleges and universities.

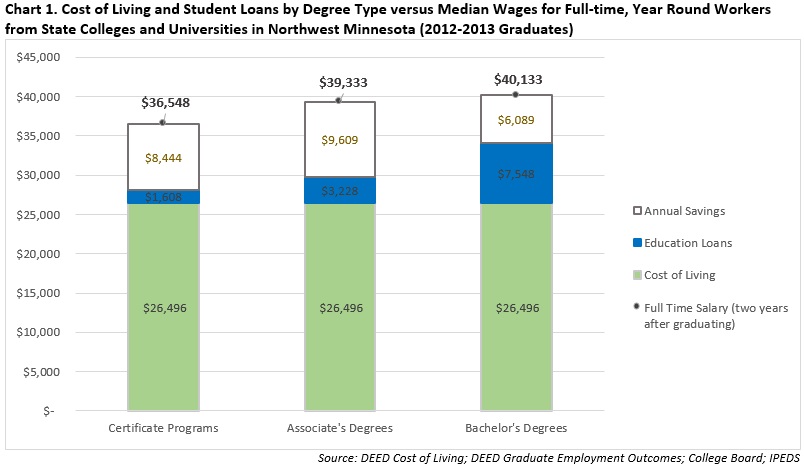

The greater difference comes from the accumulated costs of multi-year programs, and the additional interest on what is borrowed to complete a degree. Borrowers have several options to cover these costs, including private loans from banks and credit unions. However most first-year, full-time students are eligible for federally-subsidized loans at 4.66 percent interest. Based on that, certificate completers paying off $12,905 in student loans over a 10-year period would need to pay $1,608 per year. Associate degree holders who compiled $25,810 in loans would need to pay $3,228 per year for 10 years; and students who loaned $60,248 to earn a bachelor’s degree would have annual payments of $7,548 over 10 years.

After graduating and joining the labor force, in addition to student loans, these workers often start accumulating regular expenses like housing, food, insurance, transportation and more. According to DEED’s Cost of Living tool, the basic needs budget for a single person with no children in Northwest Minnesota is $26,496 – regardless of educational attainment. Though the data show that not all graduates are able to find full-time, year-round employment immediately after graduating, that is often the goal for these students.

Looking at wages of graduates from the public colleges and universities in Northwest Minnesota (see above), DEED’s Graduate Employment Outcomes shows that the median earnings for full-time, year-round workers with one- and two-year degrees made just slightly less in their second year after graduating, but because of their lower loan payments these graduates had more net income than four-year degree holders who found full-time, year-round work after joining the workforce (Chart 1).

Given these income margins, a certificate holder would have nearly $2,400 more in financial freedom than a four-year degree holder in 2015, and a two-year graduate would have $3,500 more in-pocket. If salaries remain equidistant by degree in the next couple years, those extra savings could quickly exceed $5,000-$10,000. The resulting debt-to-income ratio could help anyone just starting out in their life and career or readjusting halfway through. If one- and two-year degree holders choose to pay their loans off faster with the extra income, they could also save significant amounts of loan interest.

Contact Chet Bodin.