The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

10/2/2017 12:04:56 PM

Chet Bodin

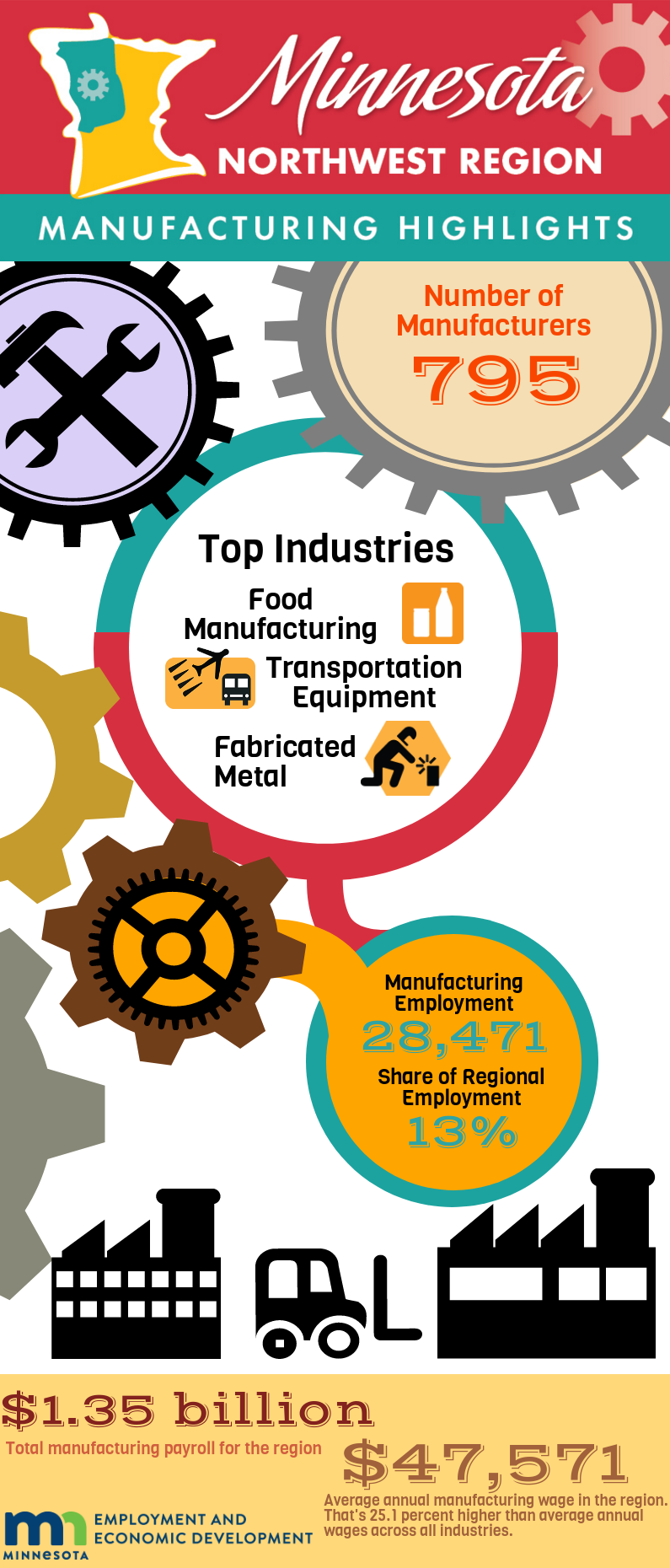

In Northwest Minnesota, the manufacturing industry provided 28,471 jobs at 795 business establishments, making it the second largest industry in the region in terms of employment, behind only health care and social assistance. Manufacturing accounted for 13 percent of total employment in Northwest Minnesota, compared to 11.3 percent for the state as a whole.

In Northwest Minnesota, the manufacturing industry provided 28,471 jobs at 795 business establishments, making it the second largest industry in the region in terms of employment, behind only health care and social assistance. Manufacturing accounted for 13 percent of total employment in Northwest Minnesota, compared to 11.3 percent for the state as a whole.

From 2011 to 2016, manufacturers in Northwest Minnesota added over 2,000 net new jobs, an increase of 7.6 percent. That made it the largest growing industry in the region, accounting for almost one-fifth (18.5 percent) of the region's total job growth from 2011 to 2016. Manufacturing gained over 700 more jobs than the next largest growing industry in the region, construction.

With just over 5,700 jobs, food manufacturing is the largest manufacturing subsector in Northwest Minnesota, but the region also has significant operations in transportation equipment manufacturing (4,244 jobs), fabricated metal products (3,899 jobs), machinery manufacturing (3,677 jobs), and wood product manufacturing (3,444 jobs). These five sectors accounted for almost 74 percent of the manufacturing jobs in the region.

Manufacturing is one of the highest paying industries in the region. Total payroll in manufacturing was approximately $1.35 billion in 2016, accounting for 16.2 percent of total wages paid in Northwest Minnesota. Average annual wages in manufacturing in the region were $47,571 in 2016. That was 25.1 percent higher than average annual wages across all industries in the region.

However, this was the lowest average annual wage in manufacturing of the six planning areas in the state, and over $16,000 less per year than the average annual wages for the manufacturing industry statewide. This is partly due to a slower wage growth in Northwest Minnesota manufacturing since 2013. Average annual wages in manufacturing grew at 7.1 percent statewide since 2013, compared to 5.3 percent in the Northwest.

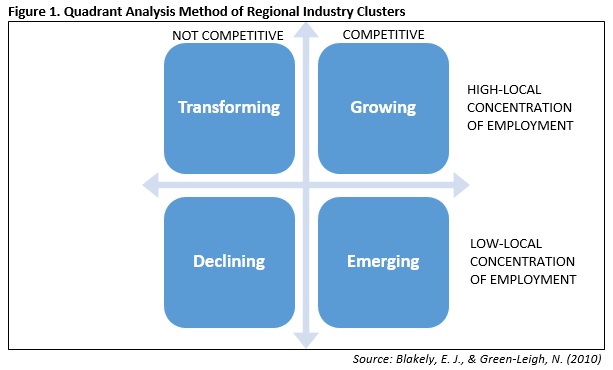

In the Northwest planning area, manufacturing accounted for 13 percent of total employment, and over 16 percent of the total wages paid, in 2016. But, economic changes over the past decade have had varying effects on different parts of the manufacturing industry – some subsectors have thrived while others have needed to adjust. These effects can be seen statistically by applying the Blakely and Green-Leigh quadrant method (see Figure 1). This method is unique; it offers a matrix of sustainability and categorizes regional industries by their response to economic fluctuations over time.

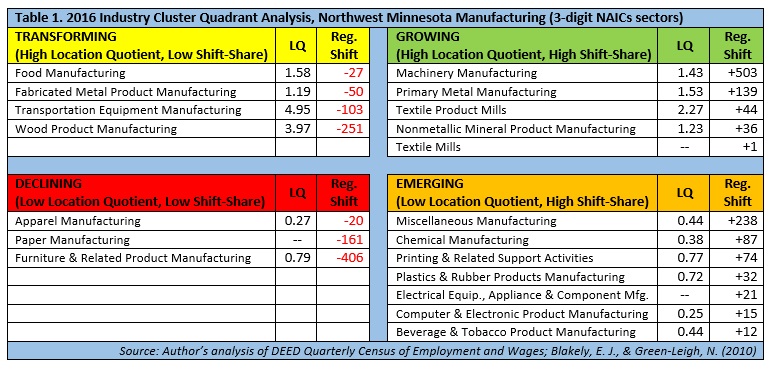

Blakely and Green-Leigh cluster industries into four quadrants: transforming, growing, emerging and declining. Placement is based on both the local concentration of, and competition for, employment from 2011 to 2016. For example, despite a low concentration of jobs in Northwest Minnesota, the chemical manufacturing subsector has had significant locally driven employment gains since 2011, landing it in the "emerging" quadrant cluster.

"Locally competitive" is determined by dissecting employment growth with shift-share analysis. In our breakdown, regional employment changes are compared against those at the state level. Manufacturing subsectors with positive regional shift-share growth land in both the "growing" and "emerging" quadrants, depending on their local concentration. As opposed to emerging subsectors with low regional concentration, like chemical manufacturing, "growing" industries are highly concentrated in regional employment. These manufacturing sectors are major pillars of the regional economy and continue to develop employment locally. They include such sectors as machinery manufacturing, primary metal manufacturing, textile product mills and nonmetallic mineral product manufacturing (see Table 1).

Industries with high employment concentrations that slowed hiring from 2011 to 2016 are considered "transforming" industry subsectors. There could be a variety of reasons these industries are in a state of transformation. But given their relative size in Northwest Minnesota, their response to economic change is very important to the regional economy overall and, for whatever reasons, they have been forced to slow and adapt.

In Northwest Minnesota, there are four manufacturing subsectors with location quotients greater than 1.00 that had no locally driven employment gains from 2011 to 2016. Among them, transportation equipment manufacturing had the third highest location quotient in 2016 of any three-digit NAICS sector in the region. The subsector showed a regional concentration of jobs five times higher than the industry statewide, thanks in part to major regional employers such as Arctic Cat and Polaris. However, regional employment growth from 2011 to 2016 was only 1.9 percent – less than half the rate statewide. During the same period, transportation equipment manufacturing employment grew 4.4 percent statewide, signaling that the industry has not been as competitive in Northwest Minnesota recently.

Finally, some manufacturing subsectors have had negative regional shift-share, or no locally-driven employment growth, and also have low regional concentrations of employment. Employment in furniture and related product manufacturing fell by 293 jobs from 2011 to 2016, but it still has maintained some regional presence with 877 jobs remaining. After losing 22 jobs over the past five years, apparel manufacturing had just 16 jobs left in the region. These industries are facing significant challenges in today's economy, particularly in Northwest Minnesota.

Given that the manufacturing industry can be subject to economic shifts, changes in the industry are inevitable. Regional industry clusters show the nuance of local economies, identify economic changes, and even suggest how a community might adapt to them. Ideally, gauging how different sectors respond to economic change over time will give employers and policymakers the insight to respond appropriately.

Contact Chet Bodin at chet.bodin@state.mn.us.