The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

11/27/2017 12:04:56 PM

Chet Bodin

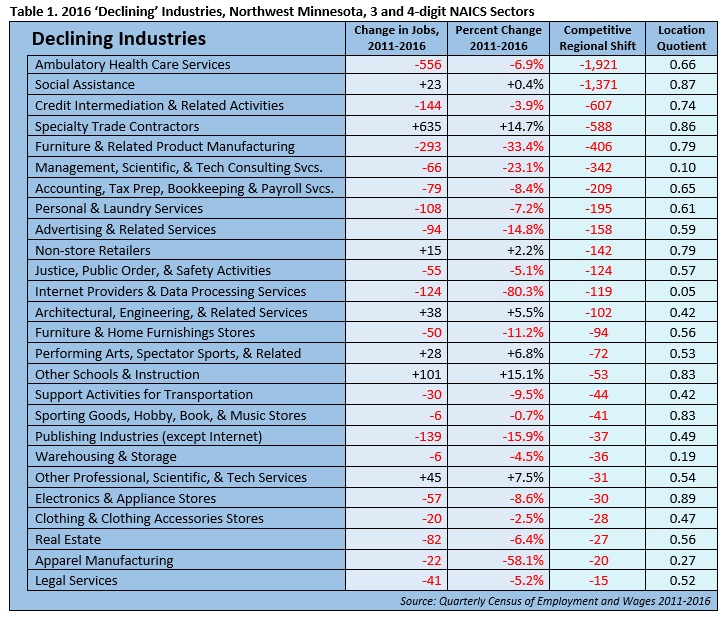

Following our recent analysis of industry clusters in Northwest Minnesota, this month’s blog post looks closer at ‘declining’ industries in our region. Unfortunately, a couple dozen industries have lost momentum in Northwest Minnesota, and some have fallen off the radar of public or private organizations working to develop the economy. Despite shedding almost 1,100 jobs since 2011, these ‘declining’ industries are still very important. In 2016 they accounted for over 16 percent of regional jobs, employing over 36,000 workers.

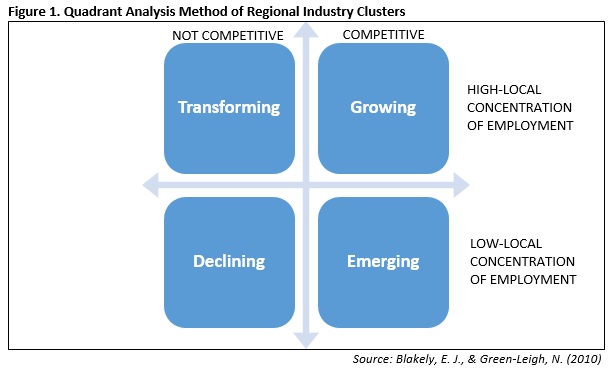

Determining industry clusters in a regional economy has been an important tool of regional planners and policy makers for decades. Regional industry clusters show communities the nuance of their economies, identify economic changes, and even suggest how a community might adapt to them. In particular, the Blakely and Green-Leigh quadrant method (Figure 1) clusters industry sectors by how well they withstand economic fluctuation. This method is unique in that it offers a matrix of sustainability, categorizing regional industries by their adaptation to economic change over time.

In this method, regional industries are grouped into four quadrants: transforming, growing, emerging, and declining, based on both the local concentration of, and competition for, employment from 2011-2016. The combined analysis of these two factors produces a more detailed approach to industry clusters, rather than those produced by supply chain models or employment concentration alone. For example, regional planners may be interested to know that larger employing industry sectors like social assistance, specialty trade contractors, and credit intermediation and related activities suffered through local factors that led to a lower concentration of jobs in the industry today than they provided five years ago, landing it in the ‘declining’ quadrant cluster.

As noted above, industries in this quadrant are less concentrated in the region than the state overall, and experienced locally-driven employment losses from 2011-2016. ‘Locally driven’ is determined by dissecting industrial employment change with shift-share analysis. In this case, regional employment changes are compared against those at the state level. In general, ‘declining’ industries are not large sources of regional employment, with 19 of these 26 sectors providing fewer than 1,000 jobs in the region; and the employment loss from 2011-2016 was often greater in the region than the state on average. Table 1 outlines the 3- and 4-digit NAICS sectors that meet this criteria.

However, that does not mean these industries are irrelevant in Northwest Minnesota. In some cases, the lack of competition may be an opportunity for startups to re-engage the market. In others, employment losses may be a result of non-economic factors having an effect. Ambulatory Health Care Services is a good example of a declining industry in Northwest Minnesota that remains essential. Much of the employment change was due to employment coding changes into the Hospitals subsector; and as a mostly rural area with an older population, health care in Northwest Minnesota is often provided by Critical Access Hospitals (CAH), which mostly offer the kind of outpatient services that ambulatory care represents. While the demand for these services remains high, hiring medical professionals has been increasingly more difficult in rural Minnesota as the labor market tightens. In addition, state and federal health care funding has fluctuated since 2011 and remains subject to change. Understanding its recent peril shows rural residents and lawmakers the current challenges in rural health care, particularly ambulatory health care services.

In other cases, the ‘declining’ industries were actually seeing employment growth, but not keeping pace with the rest of the state. For example, specialty trade contractors gained 635 net new jobs from 2011 to 2016, a 14.7 percent increase, but the state saw 28.3 percent growth in that sector. Six other industry sectors also saw job growth but were classified as ‘declining’ industries.

The industries that were seeing the biggest challenges included furniture and related product manufacturing (which includes kitchen cabinet manufacturing); credit intermediation and related activities (which includes banks, credit unions, and other mortgage and loan brokerages); and publishing industries, which all saw major job losses in the past five years.

Contact Chet Bodin.