The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

4/29/2021 9:00:00 AM

Erik White

With the release of Quarterly Census of Employment and Wages (QCEW) employment data for the fourth quarter of 2020, we now have the clearest picture yet of how the pandemic-induced recession impacted Northwest Minnesota's economy. As has been covered in past monthly updates, Northwest Minnesota has seen the strongest bounce back from the pandemic recession of the six planning regions in the state.

Looking at annual employment averaged over all four quarters of 2020, employment in the region was 5.6% lower in 2020 compared to 2019. While that was severe, Northwest Minnesota fared better than the state as a whole which finished the year down 6.7%.

By comparing first quarter to second quarter we can capture the initial impacts of the state shutdown in March of last year. In Northwest Minnesota, 13,943 jobs were lost between the first and second quarters, representing a -6.5% decline in employment. That was the smallest relative employment loss in the state, and nearly half the decline experienced in both Northeast and the Twin Cities metro area.

In the recovery that followed from the second quarter to the third quarter, Northwest regained 12,973 jobs, the highest share among planning regions. At that level, that covered 93% of the job losses; whereas the Twin Cities gained back only 33% of jobs lost, and other regions recovered between 40% and 60% of the jobs lost from first to second quarter. Then, even though Northwest was the only region that saw a job loss from the third to the fourth quarter of 2020, it was still closest to its pre-pandemic employment level (see Table 1) in the fourth quarter.

| Geography | Q1

2020 Jobs |

Q2

2020 Jobs |

Q1-Q2

Job Change |

Q3

2020 Jobs |

Q2-Q3

Job Change |

Q4

2020 Jobs |

Q3-Q4

Job Change |

Q1-Q4

Job Change |

Q4 % of

Q1 Emp. |

|---|---|---|---|---|---|---|---|---|---|

| Minnesota | 2,856,226 | 2,560,495 | -295,731 | 2,682,876 | +122,381 | 2,728,214 | +45,338 | -128,012 | 95.5% |

| Central | 272,300 | 250,935 | -21,365 | 263,625 | +12,690 | 265,808 | +2,183 | -6,492 | 97.6% |

| Northeast | 139,914 | 123,430 | -16,484 | 131,778 | +8,348 | 132,114 | +336 | -7,800 | 94.4% |

| Northwest | 215,170 | 201,227 | -13,943 | 214,200 | +12,973 | 212,363 | -1,837 | -2,807 | 98.7% |

| Twin Cities | 1,756,278 | 1,548,924 | -207,354 | 1,617,309 | +68,385 | 1,651,423 | +34,114 | -104,855 | 94.0% |

| Southeast | 243,210 | 221,059 | -22,151 | 232,602 | +11,543 | 235,500 | +2,898 | -7,710 | 96.8% |

| Southwest | 172,007 | 160,383 | -11,624 | 165,834 | +5,451 | 169,533 | +3,699 | -2,474 | 98.6% |

| Source: DEED Quarterly Census of Employment & Wages | |||||||||

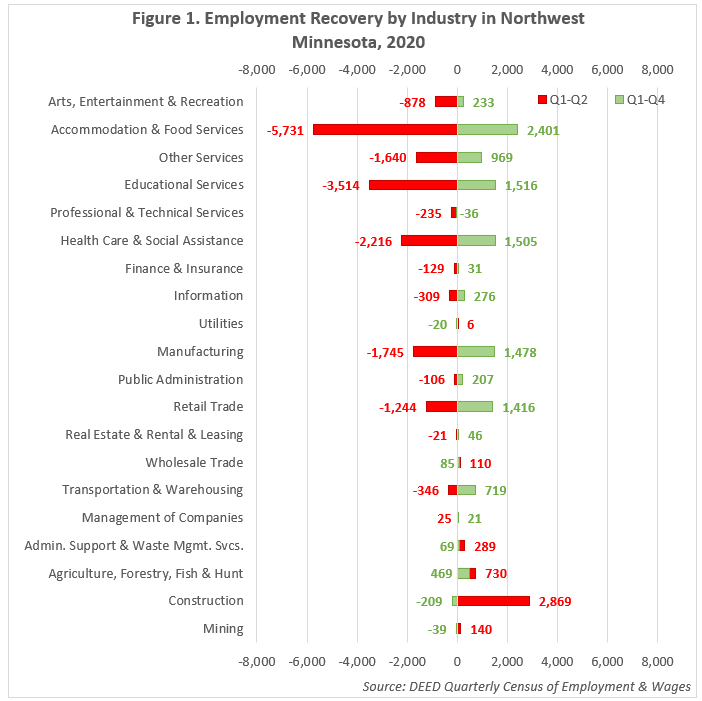

One trademark of the current recession is unequal impacts across industries. Good-producing sectors like Construction, Mining, and Manufacturing have fared much better than the Service-providing sectors like Accommodation & Food Services and Other Services. Northwest Minnesota may have benefited from having more employment concentrated in Goods-producing sectors, but also in those Service-providing sectors that were impacted least, such as Retail Trade and Public Administration.

Thirteen out of twenty industries lost employment between the 1st and 2nd quarters of 2020 (see Figure 1). Of those thirteen, the job losses in Accommodation & Food Services were by far the greatest, nearly reaching 6,000 over one quarter. The next greatest counts of job losses were in Educational Services (-3,514 jobs), Health Care & Social Assistance (-2,216 jobs), and Manufacturing (-1,745 jobs).

While Manufacturing saw significant job loss in the Q2, the bounce back was also swifter than in other industries. By the fourth quarter, nearly all of the lost jobs were recovered in the region. Retail Trade, Transportation & Warehousing, and Public Administration fared even better, even adding more jobs than were lost in the second quarter. Four industries gained jobs during both time periods, led by huge gains in the region in Agriculture, Forestry, Fishing & Hunting, as well as smaller gains in Administrative Support and Waste Management Services, Wholesale Trade, and Management of Companies.

Professional, Scientific, & Technical Services saw employment decline a further 15% in the second half of the year. However Professional, Scientific, & Technical Services is a relatively small industry and that loss represented 36 jobs. Of the larger industries, Arts, Entertainment, & Recreation and Accommodation & Food Services saw the smallest shares of jobs return. Educational Services also saw a smaller share of lost jobs return. The same industries that were hit the hardest initially had also recovered less fully by the end of 2020, indications of still-lingering impacts.

Contact Erik White.