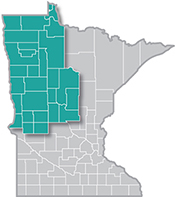

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

8/10/2021 9:00:00 AM

Carson Gorecki

The end of July brought us the latest data from DEED's Quarterly Census of Employment and Wages (QCEW) program. The first quarter 2021 data provide our most up-to-date and detailed look into the economic recovery statewide as well as here in Northwest Minnesota. The employment component of the QCEW program showed that the overall number of jobs remained down -3.2% compared to the first quarter of 2020, the final quarter before the impacts of the pandemic rippled across the U.S. economy. That was the smallest deficit of the 6 planning regions and the smallest over-the year loss across the past four quarters. Despite having fewer absolute jobs than in both the 3rd and 4th quarter, regional employment is relatively closer to what it was a year previously. By comparison, second quarter 2020 employment was -11.2% below second quarter 2019.

| Industry Title | 2021 Q1 Employment | Change of Employment | Percent Change of Employment | Average Weekly Wage | Percent Change in Average Weekly Wage |

|---|---|---|---|---|---|

| Arts, Entertainment, and Recreation | 2,447 | -581 | -19.2% | $422 | +15.0% |

| Accommodation and Food Services | 16,406 | -3,373 | -17.1% | $334 | +1.2% |

| Educational Services | 21,991 | -2,238 | -9.2% | $871 | +5.6% |

| Management of Companies | 562 | -54 | -8.8% | $1,984 | +2.5% |

| Other Services (except Public Admin.) | 5,960 | -536 | -8.3% | $507 | +11.4% |

| Mining | 106 | -8 | -7.0% | $723 | -10.6% |

| Public Administration | 15,260 | -731 | -4.6% | $971 | -0.6% |

| Total, All Industries | 208,348 | -6,963 | -3.2% | $883 | +7.9% |

| Health Care and Social Assistance | 38,162 | -1,036 | -2.6% | $884 | +1.6% |

| Retail Trade | 26,391 | -672 | -2.5% | $561 | +6.5% |

| Real Estate Rental and Leasing | 1,453 | -35 | -2.4% | $824 | +16.7% |

| Finance and Insurance | 5,869 | -123 | -2.1% | $1,271 | +8.0% |

| Utilities | 1,232 | -25 | -2.0% | $1,878 | +0.1% |

| Professional, Scientific, and Technical Svcs. | 4,705 | -92 | -1.9% | $1,087 | +6.9% |

| Agriculture, Forestry, Fishing and Hunting | 4,457 | -78 | -1.7% | $859 | +3.6% |

| Manufacturing | 28,212 | -369 | -1.3% | $1,145 | +6.5% |

| Information | 2,504 | -32 | -1.3% | $1,002 | +10.0% |

| Transportation and Warehousing | 6,250 | +127 | +2.1% | $835 | +3.7% |

| Wholesale Trade | 11,096 | +240 | +2.2% | $1,168 | +3.8% |

| Admin Support and Waste Mgmt Services | 3,597 | +117 | +3.4% | $616 | +0.8% |

| Construction | 11,683 | +2,535 | +27.7% | $1,346 | +37.6% |

| Source: DEED Quarterly Census of Employment and Wages | |||||

While most sectors lost jobs between the first quarter of 2020 and the first quarter of 2021, there was one very notable exception. The Construction sector added over 2,500 jobs, expanding an astounding 27.7% (see Table 1). The next largest relative employment growth was in Administrative Support and Waste Management Services, a 3.4% increase.

In addition to the number of jobs added, the rate of pay also increased, both within Construction as well as across all industries. The average wage for the total of all industries increased 7.9%, from $818 to $883 per week. Wages in the Construction sector grew faster than employment, ballooning nearly 38% over the year – more than double the next largest wage increase which occurred in Real Estate, Rental and Leasing. Lastly, total quarterly payroll in Construction increased by a whopping 75.7% while the average for all industries was up just 4.5%. Without the Construction sector, over-the-year overall employment change drops from -3.2% to -4.6%, average weekly wage growth falls from 7.9% to 5.5%, and total payroll decreases from 4.5% to 0.7%.

| Industry Title | 2020 Q1 Employment | 2021 Q1 Employment | Employment Change | Percent Change of Employment |

|---|---|---|---|---|

| Construction | 9,148 | 11,683 | +2,535 | +27.7% |

| Construction of Buildings (236) | 2,141 | 2,265 | +124 | +5.8% |

| Residential Building Construction (2361) | 1,372 | 1,367 | -5 | -0.4% |

| Nonresidential Building Construction (2362) | 769 | 898 | +129 | +16.8% |

| Heavy and Civil Engineering Construction (237) | 2,528 | 4,844 | +2,316 | +91.6% |

| Utility System Construction (2371) | 794 | 3,129 | +2,335 | +294.1% |

| Land Subdivision (2372) | 9 | 10 | +1 | +11.1% |

| Highway, Street, and Bridge Construction (2373) | 1,671 | 1,617 | -54 | -3.2% |

| Other Heavy and Civil Engineering Construction (2379) | 53 | 88 | +35 | +66.0% |

| Specialty Trade Contractors (238) | 4,478 | 4,573 | +95 | +2.1% |

| Foundation, Structure, and Building Exterior Contractors (2381) | 736 | 794 | +58 | +7.9% |

| Building Equipment Contractors (2382) | 2,440 | 2,430 | -10 | -0.4% |

| Building Finishing Contractors (2383) | 697 | 709 | +12 | +1.7% |

| Other Specialty Trade Contractors (2389) | 604 | 639 | +35 | +5.8% |

|

Source: DEED Quarterly Census of Employment and Wages |

||||

We can be confident that most of the growth in the Construction sector was attributable to large projects such as the construction of the Line 3 pipeline. The large job growth was driven by gains in Heavy and Civil Engineering Construction, specifically Utility System Construction and Other Heavy and Civil Engineering Construction. In fact, Utility System Construction employment nearly quadrupled. By comparison, the other two subsectors – Construction of Buildings and Specialty Trade Contractors – added only a combined 219 jobs over the year (see Table 2).

The increase also appears to have buoyed Construction employment during the typical seasonal low point. Construction jobs in the first quarter of 2021 were actually lower than during the previous three quarters, but as the first quarter employment is typically just under 80% of the annual average, the first quarter levels actually appear as significant growth. As other projects slowed down the work on the pipeline forged ahead, keeping many Construction workers employed when they otherwise may have been laid off at least temporarily.

Among other industries, Transportation and Warehousing (2.1%) and Wholesale Trade (2.2%) also experienced employment growth over the year. The largest losses belonged to Arts, Entertainment, and Recreation (-19.2%) and Accommodation and Food Services (-17.1%), as two of the hardest hit industries throughout the pandemic continued to lag. Those two industries also had the lowest average weekly wages, supporting the finding that it was primarily low-wage workers that lost jobs, especially early on in the pandemic shutdown.

More recently, there were stories of rising wages in industries struggling to hire, including those in Leisure & Hospitality. However, while the average weekly wage in Arts, Entertainment, and Recreation grew 15%, it expanded only 1.2% for workers in Accommodation and Food Services jobs. These trends point toward a choppy and incomplete recovery that differs by industry. Most industries have not had the benefit of a large, generational project upon which to sustain themselves.

Contact Carson Gorecki at 218-333-8253.