The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

2/14/2023 9:00:00 AM

Anthony Schaffhauser

As the economy recovers from the pandemic recession, the two biggest economic topics are the tight labor market and inflation. While the tight labor market pulls wages up, inflation pulls down the purchasing power of those increased wages. Which is winning out, wage growth or inflation?

My esteemed colleagues at DEED conclude that for the entire state of Minnesota, wage growth over the last three years is less than inflation. The statewide analysis is based on Current Employment Statistics (CES) data. These data are survey-based and applicable for the U.S., states, and to a more limited extent, metropolitan statistical areas. The benefit to this analysis is that CES data is timely, with each month's data released in the middle of the following month.

But for a longer-term look, we have Quarterly Census of Employment and Wages (QCEW) from unemployment insurance wage records that is available for all areas of Minnesota, and is not hampered by survey error. In my opinion, that is well worth the four to six month time lag. QCEW is less current, but is more accurate.

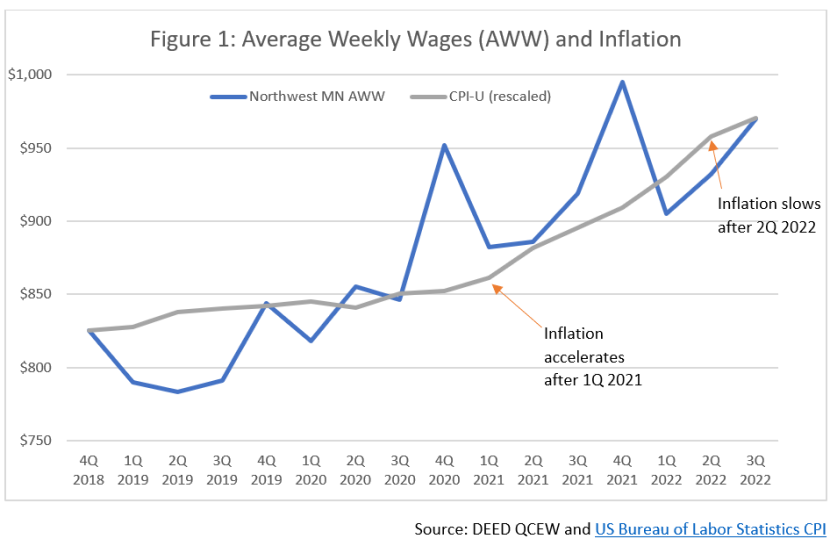

According to QCEW, average weekly wages (AWW) in Northwest Minnesota are keeping up with inflation. To visualize this, I shift the consumer price index (CPI) up on the vertical axis of Figure 1 to start at the same level as AWW for fourth quarter 2018, showing the growth of each on the same scale.

Quarter-to quarter variation in AWW is striking, and peaks each fourth quarter reflecting year-end bonuses and profit sharing. To that end, this is not showing a rate of pay like an hourly wage, as was used in the CES analysis. Instead, AWW is the average weekly paychecks of workers for the quarter, calculated by dividing the total industry payroll by the number of workers and the number of weeks in the quarter. This comparison tells us how average worker pay compares to inflation without regard to hours worked. Perhaps workers are putting in more hours to get bigger paychecks rather than receiving wage increases; we don't know for sure from this data.

Also visually apparent (perhaps due to the orange arrow and text) is the first quarter 2021 inflection point for inflation. From that point inflation advances at a steeper slope. Also note slowing inflation after second quarter 2022. The CPI peaked at 9.1% over-the-year in June 2022 and has steadily declined, ending 2022 at 6.5%. So, if wages have pulled harder than inflation through the last three months of 2022, they will be winning this tug-of-war.

With the quarter-to-quarter variation in AWW, it helps to see annual data. However, since the latest QCEW is third quarter, we can't use a calendar year. Hence, Table 1 has twelve months ending in September.

| Table 1: Average Weekly Wages and Inflation | ||||||||

|---|---|---|---|---|---|---|---|---|

| - | 12 Months Ending September | Over-the-Year Change | 3-Year Change | |||||

| - | 2019 | 2020 | 2021 | 2022 | 2019-2020 | 2020-2021 | 2021-2022 | 2019-2022 |

| Northwest | $798 | $841 | $910 | $951 | 5.5% | 8.2% | 4.5% | 19.3% |

| Minnesota | $1,137 | $1,197 | $1,275 | $1,345 | 5.3% | 6.5% | 5.5% | 18.3% |

| CPI-U | 254.38 | 258.01 | 266.62 | 287.72 | 1.4% | 3.3% | 7.9% | 13.1% |

| Source: DEED QCEW and US Bureau of Labor Statistics CPI | ||||||||

This shows that lumping all paychecks together and taking an average, wages in Northwest have grown more than inflation since before the pandemic. The fact that this differs from the statewide analysis with CES (cited above), suggests that workers in Northwest may be working more hours to afford higher prices. And in this tight labor market, businesses can use the extra help.

Contact Anthony Schaffhauser at anthony.schaffhauser@state.mn.us.