The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

11/27/2023 9:00:00 AM

Anthony Schaffhauser

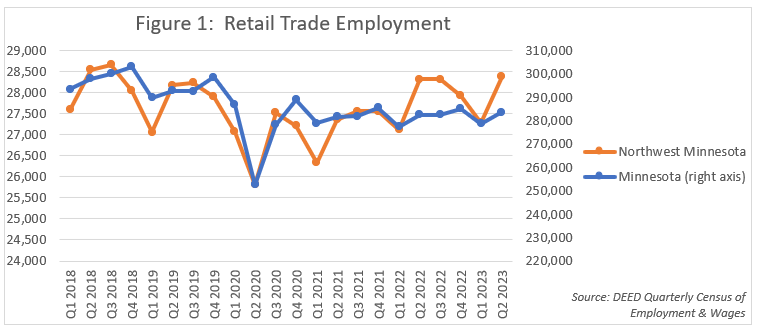

As the holiday season approaches, shopping comes to mind for many people. Minnesota's Retail Trade employment also follows the seasons. It increases from its seasonal low in the second quarter as spring gets people out to shop and hits its annual peak in the fourth quarter with winter holidays. However, Northwest Minnesota's seasonal fluctuation is more about summer than Santa, hitting a peak in third quarter and dropping into the fourth quarter. This seasonal pattern is displayed in Figure 1, apart from the Pandemic Recession in second quarter 2020.

Northwest Minnesota retail employment peaks earlier than statewide as tourism drops off and seasonal residents migrate south. That drop in demand more than offsets holiday-inspired shopping. Not only is Northwest Minnesota's seasonal effect earlier, it is also more pronounced than statewide. Disregarding 2020, retail employment typically jumped between 3.5% and 4.5% from the first to second quarters in Northwest, compared to a 1% to 2% rise statewide. That 1% to 2% statewide expansion is essentially the same as the jump between the third and fourth quarters. While holiday hiring is important, summer is clearly more critical to Northwest retail employment.

Figure 1 also shows Northwest Minnesota retail employment exceeded 2019 levels in 2022, comparing corresponding quarters, and is higher yet for the first and second quarters of 2023. In contrast, statewide retail employment is still slightly below 2019 levels. More specifically, Northwest retail employment is 0.7% higher in second quarter 2023 compared to second quarter 2019, while statewide retail employment is 3.1% lower.

Both in the Northwest and statewide, total employment for all industries peaked in 2019 while retail employment peaked in 2016. Annual average retail employment was down 1.7% from 2016 to 2019 statewide, and down 2.2% in the Northwest. By 2022, the Northwest was still 2.0% below 2016 job levels, while Minnesota was down 5.6%.

A major factor for retail employment both before the pandemic and since is the challenge to hire and retain workers. This challenge is demonstrated by Retail Trade job vacancy rates. A job vacancy rate is the number of job openings relative to the number of filled jobs, and a higher job vacancy rate signals a greater need for workers. When at peak employment in 2016, the job vacancy rate for Retail Trade was 4.1% for Minnesota and 3.3% in the Northwest. As retail employment dropped, the job vacancy rate increased. In 2019 it was 7.5% statewide and 8.0% in the Northwest; then in 2022, it jumped to 10.2% for Minnesota and 19.2% for the Northwest.

A lack of workers, not a lack of jobs, is holding back retail employment growth. Statewide there were 28,477 retail trade job vacancies, the second largest of any industry sector behind Health Care & Social Assistance. In the Northwest, Retail Trade had 5,269 job vacancies, the most of any industry and over a quarter of all job vacancies in the region. If many of these vacancies had been filled, we would see higher employment and lower job vacancy rates, more similar to 2016. Hopefully employment will hold through fourth quarter rather than its typical drop in Northwest Minnesota, so we can get our holiday shopping done.

Contact Anthony Schaffhauser at anthony.schaffhauser@state.mn.us.