Southeast Minnesota is a health care and agricultural powerhouse. The region is home to the renowned Mayo Clinic and some of the world's most recognized food companies and brands.

Southeast Minnesota is a health care and agricultural powerhouse. The region is home to the renowned Mayo Clinic and some of the world's most recognized food companies and brands.

Advanced manufacturing is especially strong here, with machinery, chemicals, and electronics among the top products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

1/30/2018 9:47:04 AM

In many cases, post-secondary education pays off with higher wages and potential for promotion, but post-secondary education is not always required to get a high-paying job, nor does it guarantee one. For example, DEED's Occupations in Demand data for Southeast Minnesota shows that food batchmakers, a job which requires a high school diploma or equivalent, make a median wage of $44,458 annually while veterinary technologists and technicians, requiring an associate degree, currently earn a median wage of $30,755. Still, many choose to further their education by earning a post-secondary credential ranging from an additional certificate or license all the way up to a doctoral degree.

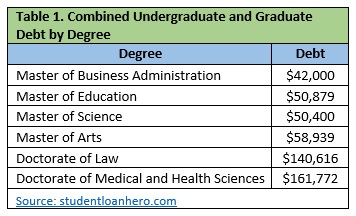

Often though, additional post-secondary education is accompanied by student loan debt. According to USA Today, the average student loan debt in Minnesota is $31,526, and both CNBC and LendEDU.com show that Minnesota is ranked sixth highest for student loan debt in the nation. Tack on additional loans for graduate school, which currently account for 40 percent of the $1 trillion of the total student loan debt in the nation, according to studentloanhero.com, and this can become quite financially crippling (Table 1).

Student loan debt can impact the lives of those who owe in many ways. According to a study by American Student Assistance, over half of those who owe student loans worry about repayment – 26 percent stated "all of the time" and 30 percent said "often". Additionally, 40 percent felt that their health was affected by their worrying about their student loan debt. This study also illustrated the financial strain that individuals with student debt face, including over 50 percent who report having to delay saving for retirement to focus on paying off student loans and 61 percent who considered working a second job to help pay back their loans.

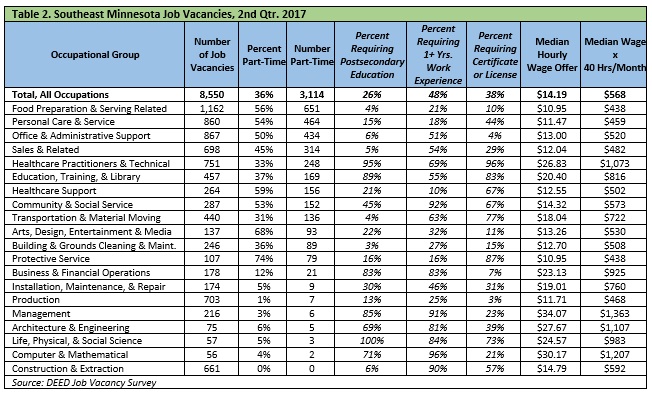

For those in Southeast Minnesota, many part-time vacancies can provide a second source of income to help make monthly school loan payments. Over one-third of the current vacancies across all industries are characterized as being part-time, equaling 3,114 openings in the region (Table 2). Some of these part-time jobs may require post-secondary education, such as those for life, physical and social science occupations, healthcare practitioners and technical; education, training, and library occupations, and management.

However, there are also plenty of part-time vacancies where very few of the openings require post-secondary education, such as food preparation and serving-related (651), personal care and service (464), and office and administrative support occupations (434).

The potential additional income from some of these part-time jobs could be very helpful in paying off student loan debt. For example, an individual who works 40 hours per month, or an average of 10 additional hours per week, in a sales job (which has a median wage offer of $12.04 in the region) would earn an additional $482 a month. This may be enough to handle an entire monthly school loan payment with money left over to pay additional bills or afford other activities, such as going out to eat or attending a movie in the theater (with popcorn!).

While working a second job on top of full-time employment may not be the most appealing option, many with student loans find this to be their reality. Fortunately, Southeast Minnesota residents who are paying off their education have plenty of opportunities for part-time employment to make life with student loans a bit less stressful.

Contact Mark Schultz.